Buying and holding solid companies capable of delivering healthy long-term growth is one of the best ways to make money in the stock market, especially if the company operates in a disruptive industry.

Artificial intelligence (AI) is emerging as a disruptive technology, capable of significantly enhancing productivity, and is expected to make substantial contributions to the global economy in the future. Not surprisingly, many companies involved in the rollout of AI technology have witnessed a terrific increase in their share prices in recent years. As a result, most of the companies in this sector are trading at expensive valuations.

However, there's one name that's not only growing rapidly, but can also be bought at a really attractive valuation right now: Marvell Technology (MRVL +0.55%). Let's look at the reasons why it would be a good idea to invest $1,000 of your investible cash in this semiconductor stock.

Image source: Getty Images.

Marvell stock underperformed last year, but that's a blessing in disguise

Marvell Technology stock dropped about 22% in 2025. Meanwhile, the PHLX Semiconductor Sector index shot up almost 46% during the year, powered by the AI-fueled demand for chips.

Marvell's underperformance is a result of heightened expectations from investors and analysts, as well as a recent analyst downgrade that pointed out that the company may have lost a contract with a key customer. However, what's worth noting is that Marvell's results have been solid enough in recent quarters, and they don't justify the stock's underperformance.

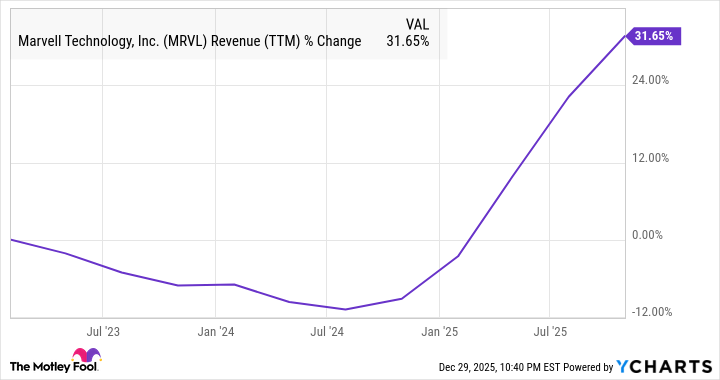

MRVL Revenue (TTM) data by YCharts

The company has been benefiting from the fast-growing demand for AI-specific application-specific integrated circuits (ASICs) being deployed in data centers to tackle AI workloads more efficiently. ASICs are known for offering higher computing speeds and power efficiency when carrying out tasks for which they are designed, when compared to general-purpose computing chips such as graphics processing units (GPUs).

As a result, hyperscalers and AI companies have been turning toward ASIC designers such as Marvell to make in-house chips. Demand for ASICs is so strong that their shipments are expected to grow by 45% in 2026, as compared to the 16% estimated jump in GPU shipments, according to TrendForce. Marvell is in a solid position to capitalize on this growth in 2026 as it counts the likes of Alphabet, Amazon, and Microsoft among its customers.

These customers are set to witness an increase in the deployment of their in-house AI chips, as recent developments indicate. Alphabet, for instance, is reportedly going to deploy its custom chips for the likes of Anthropic and Meta Platforms. These contracts reportedly will run into the tens of billions of dollars.

NASDAQ: MRVL

Key Data Points

What's more, Marvell's relationship with Alphabet could open a massive long-term opportunity for the former. That's because the tech giant could be looking at a potential $900 billion revenue opportunity in the long run if it decides to start selling its in-house AI chips to third parties, according to DA Davidson analyst Gil Luria.

Additionally, Marvell management pointed out in June 2025 that it is also working on custom designs for emerging hyperscalers, apart from the four big ones. In all, the company sees a lifetime revenue potential of $75 billion in the data center business, which is an impressive figure, considering its trailing-12-month revenue is just under $8 billion.

So, Marvell's underperformance shouldn't last for long. That's exactly the reason why its drop in 2025 is a buying opportunity for investors.

The valuation makes the stock a no-brainer buy right now

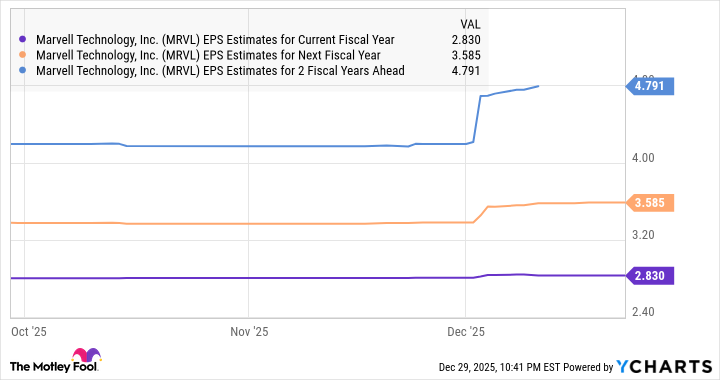

Marvell's revenue in the ongoing fiscal 2026 year is on track to jump by 42% to $8.2 billion. Earnings growth, on the other hand, is likely to be much stronger at 80% to $2.83 per share, thanks to its improving margin profile. Even better, analysts are forecasting an acceleration in Marvell's growth over the next couple of fiscal years.

MRVL EPS Estimates for Current Fiscal Year data by YCharts

If the company indeed achieves $4.79 per share in earnings after a few years and trades at 33 times earnings at that time (in line with the tech-laden Nasdaq-100 index's earnings multiple), its stock could jump to $158. That points toward a potential upside of 84% from current levels.

Marvell is currently trading at 30 times earnings, a discount to the Nasdaq-100 index's average. So, investors are getting a great deal on this AI stock right now, which they may not want to miss as the acceleration in its growth could send it soaring in the future.