Data centers are arguably the hottest growth trend right now. Companies are spending tens of billions, if not hundreds of billions, of dollars to build data centers and populate them with chips and other hardware to train and operate artificial intelligence (AI) models.

Applied Digital (APLD +8.49%) is riding the wave. The data center specialist's growth has taken off since its pivot from blockchain to AI workloads. The stock is up by 1,200% since the beginning of 2023. Analysts expect another banner year for the company in 2026, with current estimates predicting $552 million in revenue, a substantial 86% increase from its full-year 2025 estimate of $297 million.

Should investors buy the stock now? Here is what you need to know.

Image source: Getty Images.

A lucrative pivot from blockchain to AI

Applied Digital designs, builds, and operates high-performance data centers. They accommodate heavy GPU (graphics processing unit) workloads, which have demanding power and cooling requirements. The company then leases the computing output from its data centers to customers.

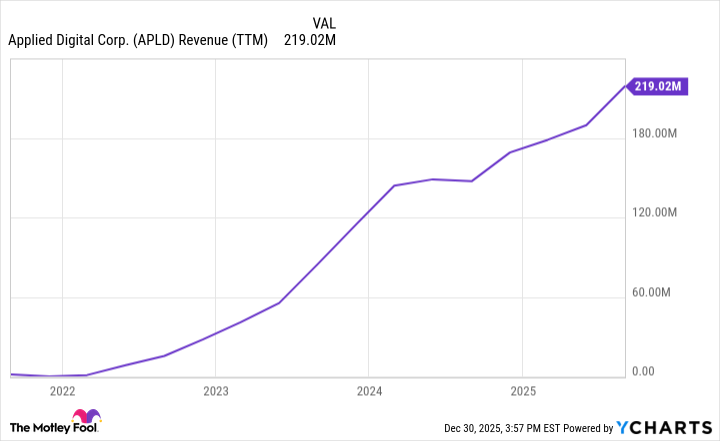

It launched its first data center in 2021, initially focusing on blockchain applications as its primary market. However, the company pivoted to capitalize on AI opportunities in 2023. You can see how Applied Digital's revenue caught fire once it shifted its focus to AI. Applied Digital is riding a massive and ongoing boom in data center spending.

APLD Revenue (TTM) data by YCharts

Leading AI hyperscalers, including several "Magnificent Seven" companies, OpenAI, Oracle, and others, are investing more than $350 billion in AI capital expenditures in 2025 alone. The U.S. government recently initiated the Genesis Mission to develop AI for national security, which is likely to remain a tailwind for AI investment.

In all, Applied Digital cites research estimates that total data center capacity demand will surge by nearly 300% from current levels by 2030.

Deep in the hole with capital expenditures

Wall Street analysts estimate that Applied Digital will end 2025 with $297 million in revenue, followed by an increase to $552 million in 2026. Explosive revenue growth often means higher stock prices, and the stock has clearly performed well.

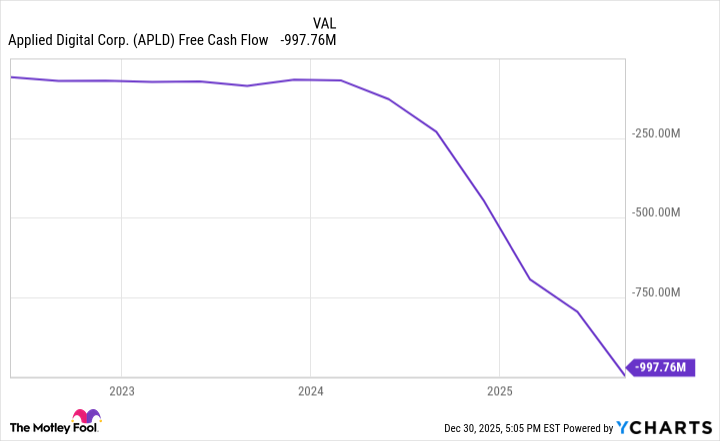

That said, the company is essentially building out data centers for its clients. It's costly, and you can see how Applied Digital is spending cash at an accelerating rate.

APLD Free Cash Flow data by YCharts

Applied Digital will begin recouping that money as revenue from its leases, but it's fair to question what the long-term profit margins might look like. How big must Applied Digital become to operate profitably if it must continuously spend money to replace old chips and hardware, or to build new data centers to increase its capacity for growth?

For now, the company is funding its data center projects by issuing new stock and taking on debt. Applied Digital's share count has increased by 196% over the past three years, and the company has approximately $700 million in long-term debt on its balance sheet.

A rising share count can diminish a stock's investment potential through share dilution, and too much debt is bad news for obvious reasons.

Is Applied Digital Corporation a buy now?

NASDAQ: APLD

Key Data Points

Buying the stock now involves taking a leap of faith that Applied Digital will generate meaningful cash flow within the next few years. Or, at least enough to fund itself and service its debt.

That's a pretty sizable risk, and the stock's valuation isn't offering investors much of a margin of safety to take that risk. Applied Digital's current $7 billion market cap values the stock at a price-to-sales ratio of nearly 13 times 2026 revenue estimates.

The stock feels quite expensive here. Remember, this is a hardware business that is currently incinerating cash. It doesn't make sense to value it like software companies, or most other AI hyperscalers, which often have existing profitable businesses to help fund their AI investments.

Investors should keep an eye on Applied Digital, but it isn't easy to see much value in buying the stock now.