Dividend stocks are the backbone of a well-diversified portfolio. They fill in the gaps when stocks are down and provide the stability and passive income that allow investors to buy excellent growth stocks.

They may not always outperform the market, but they often do when the market is down. And for investors who need the passive income, like retirees, the dividend and the safety can be much more important than market outperformance from riskier stocks. Plus, because dividend payers are predominantly established, solid companies, you can hold them forever.

One of the best ways to benefit from investing in dividend stocks is to buy exchange-traded funds (ETF) that are concentrated in dividend stocks. These provide broad exposure to many dividend stocks in various categories and can protect your portfolio under almost any circumstances.

The Schwab U.S. Dividend Equity ETF (SCHD +0.24%) and the Vanguard Dividend Appreciation ETF (VIG +0.17%) are two fabulous choices if you have $500 to invest today.

Image source: Getty Images.

1. The Schwab U.S. Dividend Equity ETF

The Schwab dividend ETF is a passive index fund that tracks the Dow Jones U.S. Dividend 100 Index. As that implies, it owns about 100 stocks at any given time, although as of this writing, it's 102. That's fair diversification among many sectors, including financials, healthcare, and industrials.

Its five largest holdings include Bristol-Myers Squibb, Merck, ConocoPhillips, Lockheed Martin, and Chevron, which each account for about 4% of the total portfolio. These are stable industry giants that are reliable for dividend growth.

If you invest in dividend stocks, one of the most important features you want to see is the dividend yield. That tells you how much you're making on your investment in passive income. The Schwab ETF is well-known for its high yield, which is 3.7% today. The fund comes with an expense ratio of 0.06%, which is a low price to pay for access to the ETF.

NYSEMKT: SCHD

Key Data Points

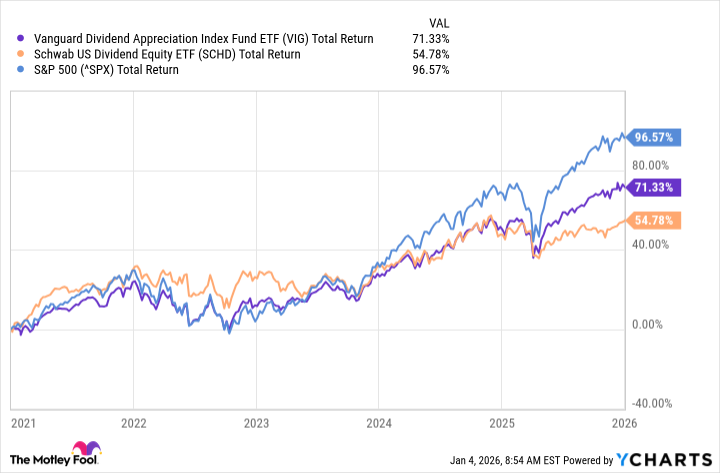

The ETF's components aren't high-growth stocks, and the ETF doesn't usually beat the market. It's up 55% over the past five year, while the S&P 500 has nearly doubled. But the ETF provides excellent protection in challenging times and strong long-term value for investors who prize security.

Each share, which trades on an open market, costs only $28, so you can get quite a few if you have $500 available to invest today.

2. The Vanguard Dividend Appreciation ETF

The Vanguard Dividend ETF is similar to the Schwab offering, with a few different features. It also tracks an index, in this case, the S&P U.S. Dividend Growers Index. This has many more stocks than the Schwab ETf; 338 right now, which is much more diversified, and its components are much more varied and include many tech stocks.

NYSEMKT: VIG

Key Data Points

Its five largest holdings are Broadcom, Microsoft, Apple, JPMorgan Chase, and Eli Lilly. While Broadcom accounts for 7.6% of the portfolio, the other four are on average are about 4%, while the remaining components are all small positions.

This is a much larger mixture of stocks that still provides safety but also comes with higher growth. That's why this ETF has gained much more than the Schwab version over the past five years (and longer).

VIG Total Return Level data by YCharts

However, the dividend yield is much lower, at 1.6%. There's often the trade-off of growth vs. dividend yield, and the Vanguard ETF offers higher growth over the long term, while still providing reliability.

As with all Vanguard ETFs, the Dividend ETF comes with a low expense ratio of 0.05%, allowing you to keep more of the gains while you benefit from long-term growth and the stability of great dividend stocks. The market price is about $220 today, so you can get about two shares if you have $500 available to invest.