When I began my investment journey nearly a decade ago, the prospect of investing in Bitcoin (BTC 0.77%) was nearly the same as tossing your hard-earned money on the ground and simply walking away. In its early days, cryptocurrency was often referenced as a mechanism for money laundering or seen as the investment equivalent of gambling or playing the lottery.

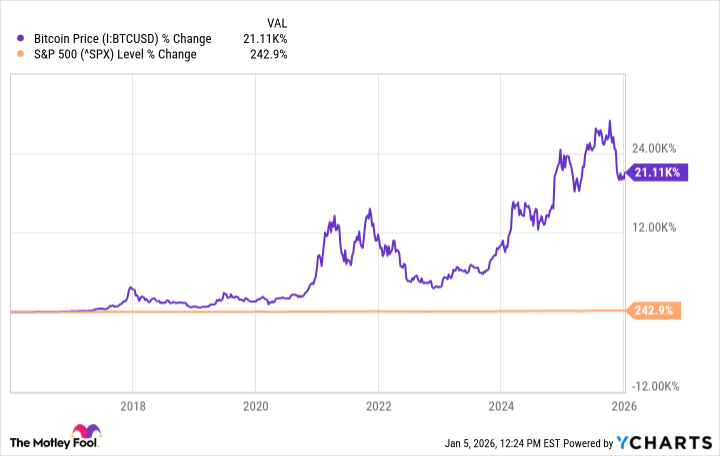

Nevertheless, retail investors in particular took a liking to the cryptocurrency opportunity. Through a combination of optimism and curiosity, those who invested in Bitcoin 10 years ago and held through today have beaten the S&P 500 by almost 100 times.

Bitcoin Price data by YCharts.

Unsurprisingly, investors are now scouring to find the next Bitcoin. One cryptocurrency that has risen in popularity in recent years is XRP (XRP 1.65%) -- a coin distributed by financial services firm, Ripple.

With a price of about $2, could XRP some day reach a six-figure price point as Bitcoin has? Let's assess the differences between XRP and Bitcoin and explore if the token could emerge as the next breakout candidate in the cryptocurrency landscape.

Will XRP rally in 2026?

There are both macro-oriented and token-specific tailwinds that could fuel XRP's price throughout 2026.

While the Federal Reserve has begun cutting interest rates, Moody's Analytics Chief Economist Mark Zandi thinks further easing of monetary policy is on the horizon. Zandi cites "fragile" economic growth. He forecasts 2% gross domestic product (GDP) as well as a weak job market that could inspire the Fed to cut rates at least twice this year.

Broadly speaking, a lower interest rate environment can influence investors to at least consider allocating some of their capital toward more speculative assets such as cryptocurrency. Under these conditions, inflows directed toward smaller tokens like XRP could be in store.

Another tailwind for XRP could be rising adoption of spot exchange-traded funds (ETFs). These are passive funds that track the price of XRP without requiring investors to own the coin outright, bypassing much of the administrative nuances of buying cryptocurrency on exchanges and storing them in a crypto wallet. Some of the more popular spot XRP ETFs include the Grayscale XRP Trust ETF, Franklin XRP ETF, and Canary XRP ETF.

Another potential tailwind for XRP revolves around its primary use case as a bridge currency. Ripple's payments infrastructure is both faster and more cost efficient than incumbent protocols -- namely, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) system.

Businesses that rely on Ripple have the option to denominate their transactions in XRP as opposed to fiat currency, providing a clever way to bypass foreign exchange fees in cross-border payments. If Ripple acquires more market share in the cross-border payments industry, it could lead to wider adoption of XRP in the long run.

Lastly, Ripple has outlined a robust plan to expand beyond payments applications. Specifically, the company's ecosystem is beginning to explore additional decentralized finance (DeFi) utilities across lending, stablecoins, compliance, and real world asset tokenization in which ownership of assets such as stocks and bonds is converted into tradeable crypto.

While Ripple's ambitions to disrupt the payments industry will take years to bear fruit, XRP could witness renewed buying activity if a rising number of investors begin to collectively buy into the idea that the coin will play a central role in Ripple's long-term adoption.

CRYPTO: XRP

Key Data Points

Despite the potential upside, XRP is fundamentally different from Bitcoin

Given the details above, XRP's upside trajectory looks compelling. The question is: Could XRP experience a rally similar to that of Bitcoin?

In order to answer this, investors must understand what fueled Bitcoin's rise to begin with. After all, it's not like Bitcoin has overtaken fiat currency as a means of payment at global scale. All things considered, Bitcoin's utility is still relatively niche.

Right now, nearly 20 million Bitcoins have been mined and are in circulation. Interestingly, Bitcoin boasts a total supply base of 21 million coins.

At its core, Bitcoin is viewed in a similar fashion to alternative assets like gold, artwork, or rare collectibles. In other words, there is an inherent scarcity mindset when it comes to investing in Bitcoin; it's capped supply makes it desirable despite the speculation that comes with owning it.

XRP, despite its current utility and potential to evolve into a more multifaceted player in the payments world, is structurally different from Bitcoin. I like to think of XRP as more of a business -- or at least an extension of a business (Ripple) -- whereas Bitcoin is more of a store of value.

Against this backdrop, owning XRP versus Bitcoin requires two totally different investment theses.

Image source: Getty Images.

Should you buy XRP right now?

Choosing to invest in XRP boils down to your appetite for risk. If you're only interested in XRP because you're hoping it will experience an explosive rise akin to Bitcoin, then you're likely to be disappointed.

On the other hand, if you are seeking some exposure to cryptocurrency and are willing to sit through periods of outsized momentum, then XRP could potentially become a multibagger in the long run.

Still, I would only encourage investing in XRP if you can stomach a high degree of speculation. There is no guarantee that Ripple -- and by extension XRP -- will be widely adopted by banks and corporations in the long run.