Rocket Lab (RKLB +2.13%) stock continues to soar to new heights. The company, which serves as an end-to-end space company by providing launch services, is seeking to fill an important void, as the U.S. space program and other governments continue to outsource projects to commercial companies.

Shares of Rocket Lab stock jumped a whopping 360% in 2024 and then climbed another 174% in 2025. The stock is currently trading near all-time highs on the heels of an $816 million contract to design and build missile-tracking satellites for the U.S. Space Development Agency.

Can Rocket Lab maintain its impressive performance, or is this the year the company slows down? Here's what investors need to know.

About Rocket Lab

Rocket Lab, which is based in California, provides rockets and launch services, as well as spacecraft and satellite components that can be blasted into space on other companies' rockets. Its technology supports space solar power systems, advanced composite structures, flight software, and more.

It has three launch pads -- two located in New Zealand and one in Virginia -- and its technology has been used by more than 1,700 satellites. The company is responsible for launching 245 satellites with its Electron two-stage orbital launch vehicle.

The company made 21 separate launches in 2025, according to its website, with customers including the U.S. Space Force, the U.S.-based company BlackSky, Japanese companies Synspective and iQPS, Japan's national space agency, and some undisclosed customers.

The most recent Electron mission, launched Dec. 21 for iQPS, will help provide near-real-time images from 12 different orbits for iQPS customers. It was the 79th overall mission for Electron. "Electron makes frequent and reliable launch look easy as it outpaces all other American small-lift orbital rockets, year after year," said Sir Peter Beck, Rocket Lab's CEO.

Rocket Lab is also supporting NASA missions to the moon and to Mars -- its spacecraft are being used in NASA's Escapade mission to Mars that launched aboard Blue Origin rockets from Cape Canaveral on Nov. 13. The mission will study how the impact of solar wind on the planet's atmosphere.

The company is also working to finalize its reusable Neutron launch vehicle, which is designed for deep space missions and human spaceflight. Management hopes to move the rocket to a launch platform in the first quarter of this year.

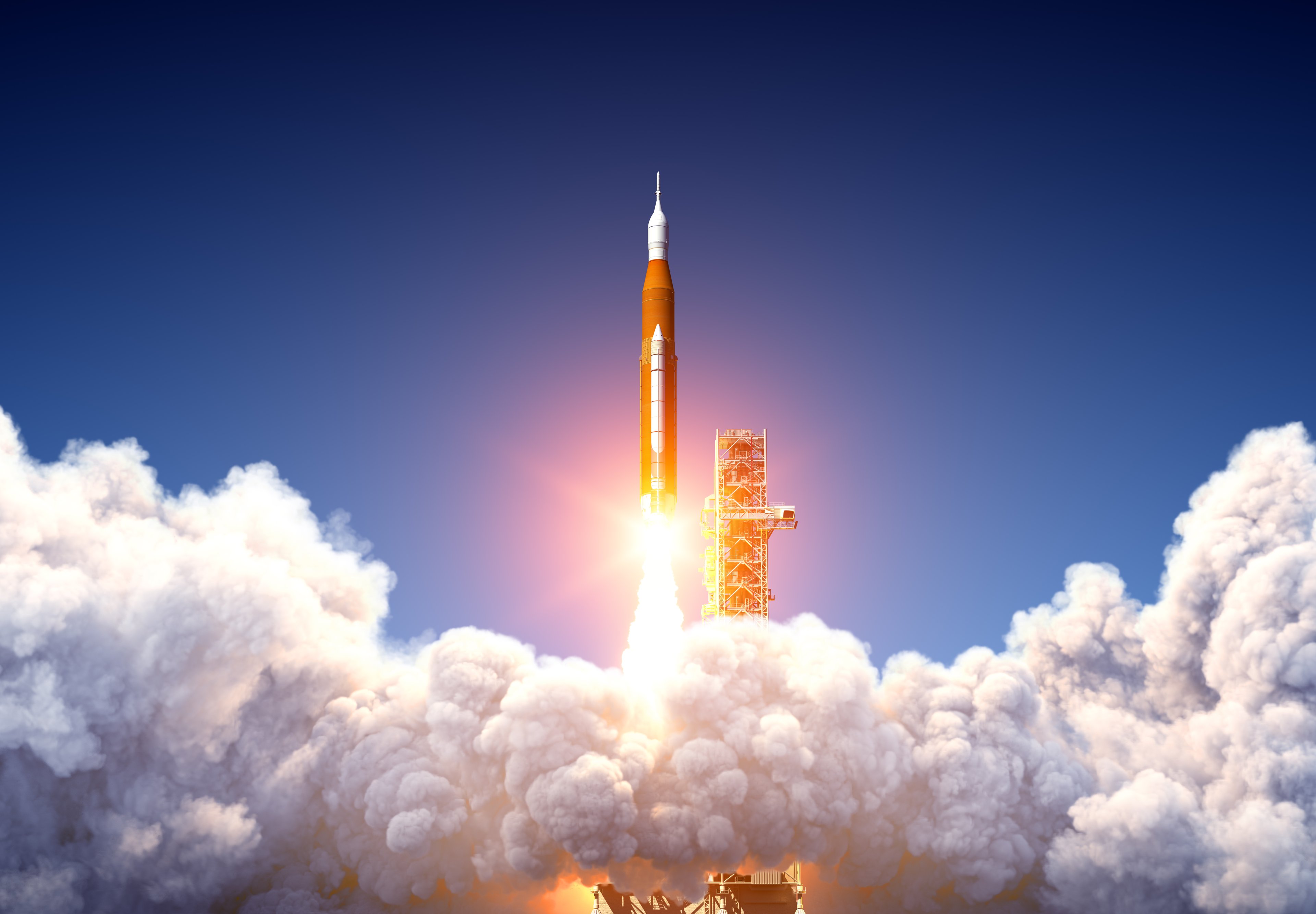

Image source: Getty Images.

The stock has been a solid winner

Rocket Lab has plenty of momentum, and that's reflected in the company's most recent earnings reports. Revenue in the third quarter was $155 million, a record high for the company, representing a 48% increase from the same period last year. The company's gross profit was $57.3 million, up from $28 million a year ago, but operating expenses of $116.2 million resulted in an operating loss for the quarter of $58.9 million. The net loss of $18.25 million and $0.03 per share was greatly improved from a year ago, when the company lost $51.93 million and $0.10 per share.

Meanwhile, the company recorded its highest gross margins, at 37%, and succeeded in gathering its largest launch backlog, with 49 on contract. Rocket Lab closed its $325 million acquisition of Geost, a manufacturer of electro-optical and infrared sensors, which will enable it to provide end-to-end capabilities for launches involving U.S. national security. It's also finalizing the acquisition of Mynaric, a German laser communications company.

Rocket Lab ended the quarter with more than $1 billion in liquidity, providing it with additional resources for expansion and potential mergers. Beck said in a news release:

With progress across our major space systems programs, record backlog of contracts for our launch services business, and well-timed, strategic M&A in growth areas that are well-aligned with next-generation defense programs like Golden Dome and the Space Development Agency's future constellations, our momentum is strong, and we're poised to deliver long-term exciting growth.

NASDAQ: RKLB

Key Data Points

Is Rocket Lab a buy now?

Any company that isn't profitable is a risk, and firing rockets into outer space is an expensive business. But Rocket Lab is making strong strides toward profitability, and its backlog of launches indicates that it will increase its launch velocity in 2026. The company may not match its 174% gain from 2025, but for risk-tolerant investors, this stock is a strong buy in 2026.