Does your portfolio need reliable dividends, but you don't want to pay too much for too little yield? That's a tall order these days. The rapid rise of artificial intelligence (AI) stocks has lifted lots of tickers to unusually high valuations, dialing back their relative dividend payouts.

Not every name has suffered this phenomenon, though. If you're willing to give up a little bit of growth potential and a lot of excitement, there's a handful of reliable "forever" dividend payers you can step into today at a fantastic price. And one of the best of the best of these tickers right now is Procter & Gamble (PG +1.17%).

Image source: Getty Images.

A challenging environment for consumer goods stocks

You've certainly heard of the company. What you may not realize is the breadth and depth of its presence within the consumer goods space. P&G is the name behind Tide laundry detergent, Gillette razors, Dawn dishwashing liquid, Crest toothpaste, Pampers diapers, Bounty paper towels, and many more. It's not just the world's biggest consumer staples name as measured by revenue and market cap, reporting a top line of $84.3 billion for the fiscal year ending in June. Several of its products dominate their respective categories. And it's much easier to remain in the lead of a particular market than it is to dethrone a market leader.

Sheer size can also work against a company, of course. Not only does more size generally mean more corporate complexity, but it also creates bigger year-over-year comparisons that make growth look a little less meaningful.

That's arguably one of the chief reasons P&G shares have performed so poorly since November 2024, falling 20% from that peak -- the company's been forced to maneuver rather aggressively in an inflation-riddled environment where consumers are doing more price-conscious shopping (not to mention an environment that now offers them more accessible choices). This, in turn, has led to a few more quarterly revenue and profit shortfalls, and done so for far longer than might have been expected when the headwind first began blowing.

NYSE: PG

Key Data Points

The thing is, this cyclical headwind is likely to be nearer its end than not. In the meantime, Procter & Gamble's dividend was never in any real jeopardy. That's why the stock's prolonged weakness is most definitely a buying opportunity for true long-term income investors.

A light at the end of the tunnel for P&G

P&G's foreseeable future could remain tricky to navigate. Now more than a year into the proverbial gauntlet, however, management has clearly figured out how to do so.

In the meantime, the underlying inflation that's been so problematic for P&G finally appears to be abating at the same time economic growth is perking up. The Federal Reserve is forecasting that the United States' annualized inflation rate will cool from last year's figure of around 3% to just above 2% for 2027, and stay there in 2028. And, following the third quarter's surprisingly strong growth estimate of 4.3%, the Fed's governors expect the country's GDP growth rate to improve from 2025's average in the ballpark of 1.7% to growth of around 2.2% this year, where it should remain next year. As for outside of the U.S. (where Procter & Gamble does about half of its business), the World Bank is calling for global GDP growth of 2.6% in 2026 (roughly in line with last year's progress), helped by well-tempered inflation.

These seemingly small numbers are actually a pretty big deal for P&G's price-sensitive customers.

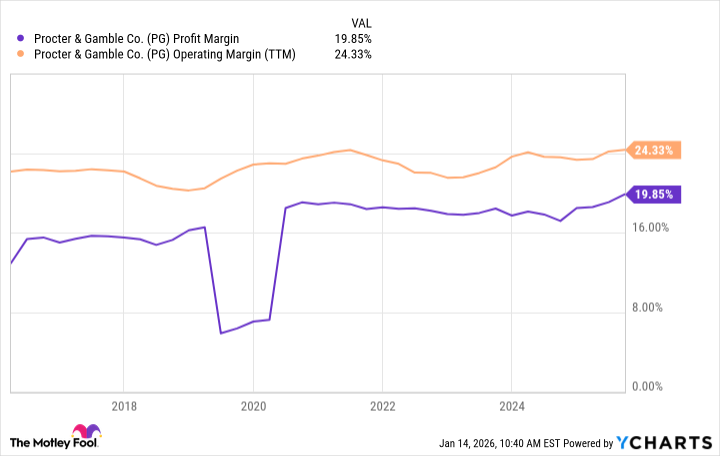

The irony? While Procter & Gamble may have reported a few disappointing quarterly results of late, the company's actually managed to find a way to widen its profit margins during this turbulent period.

Data by YCharts.

Perhaps more important to income-minded investors, all of this dynamic lends support to Procter & Gamble's already well-supported dividend payment. Of last fiscal year's per-share earnings of $6.51, only $4.08 (or 63%) of that bottom line was distributed in the form of dividends. Indeed, the company's not only paid a dividend like clockwork for 135 years now, but has been able to raise its annual dividend payout every year for the past 69 years. And by more than a little. It's grown by nearly 5% per year over the course of the past decade, handily outpacing inflation during this stretch. There's no end in sight to either streak.

A short-term window of long-term opportunity is open

Given the company's stature, along with the stock's current above-average forward-looking yield of 3%, it's surprising that Procter & Gamble shares have been allowed to sink for as long and as far as they have. On the other hand, it's also possible that slower-growing value stocks like this one have simply fallen out of favor in an environment where investors can't seem to get enough exposure to faster-growing artificial intelligence stocks.

Both dynamics set the stage for a better performance from P&G shares from here, however.

This ticker is much more than a mere way of capitalizing on a short-term shift back to longer-term norms. Procter & Gamble has a long history of solid, risk-adjusted performance that's ultimately rooted in the nature of its products and its dominance of several consumer goods categories. The entry opportunity is a temporary one because it's so unusual to see this stock down this much for so long.

Don't overthink it, even if we don't know if P&G's stock has hit its ultimate low just yet. This is more than enough of a discount to dive into it here and now.