At the end of 2025, Warren Buffett ended his stint as CEO of Berkshire Hathaway after leading the conglomerate for 60 years. In that time, Buffett and his managers grew Berkshire Hathaway into a trillion-dollar company that has routinely outperformed the S&P 500.

Because of Berkshire's success, its holdings have become a go-to guide for investors looking for inspiration on investments they should make. Although Buffett is no longer in charge, the company still holds many of the investments he ushered in or that follow his philosophy.

If you have $1,000 to invest, the following two companies are great options to consider.

Image source: Getty Images.

1. Amazon

Amazon (AMZN 4.36%) is a stock that Buffett was hesitant about at first, but it has turned out to be one of Berkshire's better investments in recent memory. Unfortunately, the past year hasn't been the best for Amazon. It finished 2025 up only around 5%, underperforming the S&P 500 and every one of its other "Magnificent Seven" stocks.

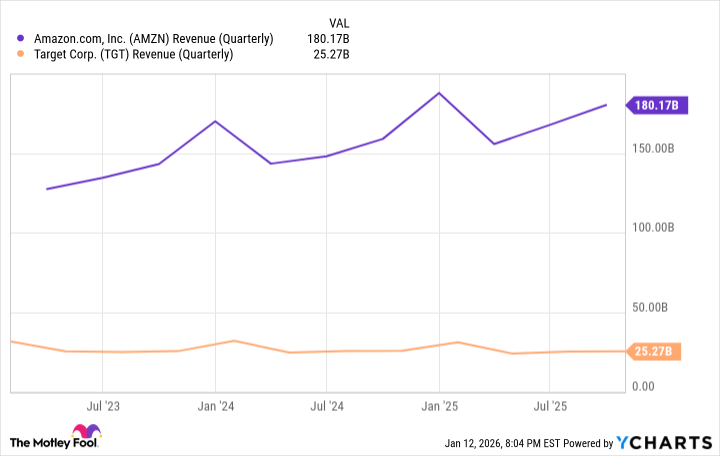

Despite that, Amazon remains a good long-term buy, especially given its three big segments: e-commerce, cloud computing, and advertising. The e-commerce business has transformed shopping as we know it and continues to be a cash cow. In the third quarter of 2025, its North America segment alone brought in $106.3 billion (nearly 59% of total revenue). That's more than Target's revenue over the past four quarters combined.

AMZN Revenue (Quarterly); data by YCharts.

While e-commerce is the company's largest revenue generator, the profit machine is Amazon Web Services (AWS). It's the world's largest cloud platform and one of the internet's most crucial foundations. Many of the world's most important companies rely on AWS to keep their websites and apps running and store their data.

AWS growth has slowed in recent years, but that was to be expected at some point, given its size. It still has opportunities, especially with the rise of artificial intelligence (AI) and companies' need for computing power and cloud services.

NASDAQ: AMZN

Key Data Points

Amazon's most underrated segment, however, may be its advertising business. It's the company's current fastest-growing segment and comes with much higher margins than its e-commerce and AWS. Combined, you have three segments that will keep Amazon growing for the foreseeable future.

The stock has been stagnant recently, but Amazon remains one of the most dynamic companies around.

2. American Express

American Express (AXP +0.27%) is Berkshire's second-largest holding after Apple, accounting for 17.4% of its stock portfolio (151,610,700 shares) as of Sept. 30, 2025. Amex has built its brand on prestige and exclusivity, positioning itself as the premium brand in the finance world. This plays into what Buffett appreciates about the business: a powerful brand that acts as a competitive moat.

NYSE: AXP

Key Data Points

Although it's primarily a credit card company, Amex's business model differentiates it from competitors like Visa and Mastercard. Those two companies operate the payment networks that handle transactions, but they don't issue cards or directly lend money to people. Amex operates its own payment network and issues its own cards, essentially acting like its own bank.

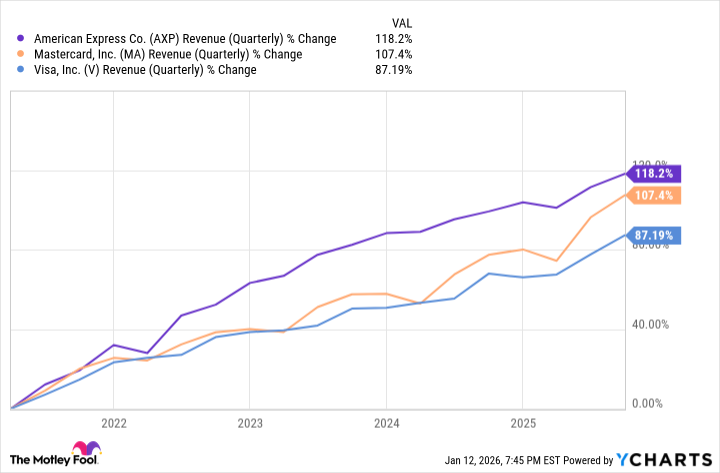

This comes with more risk because it has to eat the costs of consumer defaults, but it also works in its favor because it makes money from transactions, merchant fees, annual card fees, and interest. It's been paying off, too, with its revenue increase over the past five years outpacing Visa and Mastercard.

AXP Revenue (Quarterly); data by YCharts.

Amex is doing a great job at attracting and retaining millennials and Gen-Zers. As of the end of the third quarter of 2025, around 64% of new accounts were opened by those two demographic groups. They also perform around 25% more transactions per customer than older demographics.

By attracting millennial and Gen-Z customers, Amex ensures it has a strong pipeline of consumers who can ideally become loyal cardholders. It will be a long-term staple in the finance world.