Artificial intelligence (AI) has been the driving force behind the rally in tech stocks over the past three years. Heavy spending on AI hardware and software solutions has led to a 115% surge in the tech-focused Nasdaq Composite during this period.

However, Apple (AAPL +0.43%) has underperformed the broader tech sector over the past three years, rising 89% compared with the triple-digit gains of the Nasdaq Composite. The lack of any groundbreaking AI-related move by Apple has been weighing on the stock. But if you're a patient investor, buying Apple stock and holding it for the long run could turn out to be a smart move, as it is likely to benefit from the proliferation of AI.

Let's see why that may be the case.

Image source: Getty Images.

AI could become a growth driver for Apple

Market research firm Counterpoint Research estimates that the global smartphone market recorded 2% shipment growth in 2025. Apple significantly outperformed the broader market, with iPhone shipments growing by 10% last year. This made Apple the largest smartphone OEM (original equipment manufacturer) in 2025, with a 20% market share.

NASDAQ: AAPL

Key Data Points

Apple's robust growth can be attributed to its latest iPhone lineup, which turned out to be a hit among customers. The fact that the tech giant offers its Apple Intelligence suite of features across the latest iPhone lineup seems to be one of the key reasons why its user base is shifting toward these phones.

More importantly, Apple is working on enhancing its AI offerings. For instance, the company is reportedly working to make its Siri voice assistant more intelligent with some help from Alphabet's (GOOG +1.97%) (GOOGL +2.01%) Gemini large language model (LLM).

Alphabet has been monetizing the Gemini app by offering multiple subscription tiers to customers, including a free one. The Gemini app allows users to generate images, conduct research, write text, edit videos, and access multiple AI models.

Alphabet may have to share a portion of its subscription revenue with Apple to gain access to the latter's huge installed base of devices. So, this partnership looks like a win-win situation for Apple, as it will not only be able to make its devices smarter, but also likely find a way to monetize its massive user base.

Alphabet's Gemini is gaining traction in the generative AI space by taking share away from OpenAI's ChatGPT. So, Apple's partnership with Alphabet could turn out to be a successful one, potentially paving the way for the two companies to capitalize on the fast-growing intelligent virtual assistant market that's expected to generate almost $179 billion in revenue by 2034.

Improving growth prospects could lead to stronger stock upside

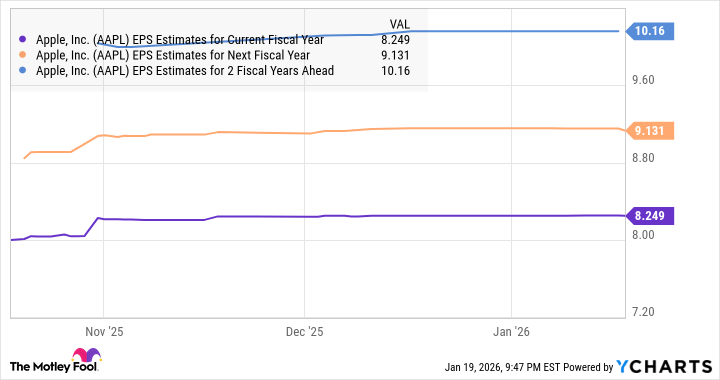

Apple's robust smartphone growth and the potential monetization of its AI offerings could eventually accelerate the company's growth. This is precisely what analysts are anticipating.

Data by YCharts.

If Apple's bottom-line growth continues to accelerate beyond 2028, the stock could deliver strong gains. For example, if its earnings grow by 15% in 2029 and 2030, Apple's bottom line could reach $13.44 per share by the end of the decade. If the stock trades at 33 times earnings at that time (in line with the tech-laden Nasdaq-100 index's multiple), Apple stock could jump to $443.

That points toward potential gains of 74%, though don't be surprised to see this tech stock clock bigger gains, as AI monetization could drive stronger earnings growth.