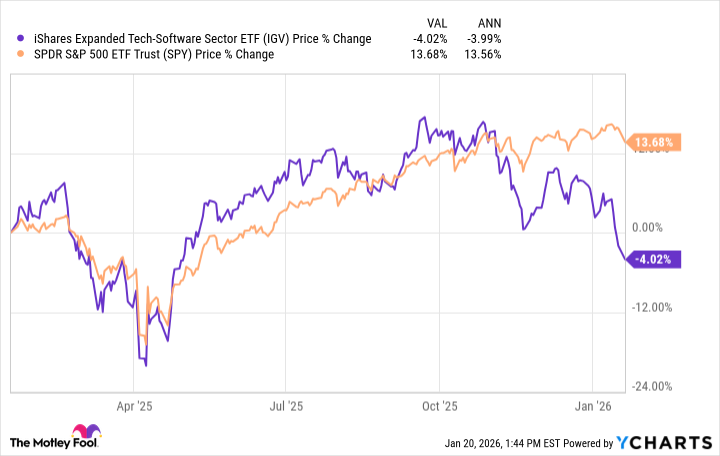

So far in 2026, the S&P 500 continues to float near its all-time high. However, not all industries have joined in on this success. Take the broader software niche as an example.

IGV and SPY data by YCharts

After closely tracking the index for much of 2025, the software industry has underperformed the S&P 500 by a wide margin during the past quarter. While a certain amount of this drop may stem from the threat of artificial intelligence (AI) eating into software companies' operations, this fear may be overdone -- especially for the two stocks we'll look at in this article.

With an array of mission-critical, hard-for-AI-to-disrupt software solutions, here's the case for buying these steady dividend-growth stocks on the dip in 2026.

Motorola Solutions: Down 20% from its 52-week high

Motorola Solutions (MSI +0.64%) has been a 13-bagger during the past 15 years as the company expanded beyond its mission-critical networks business. While Motorola remains a leader in the critical communications niche, with more than 13,000 land mobile radio (LMR) networks globally (for example, the networks used by emergency services when cell towers might fail during a hurricane), its two newer business lines offer most of the company's growth potential. These units -- video security and access control, as well as command center -- have annual revenue in the double-digit percentages and are comprised chiefly of software and services. Thanks to its license plate reading solutions, body cameras, and the fact that 60% of 911 centers in the U.S. use Motorola's command center software, the company is quickly becoming the Pepsi to Axon Enterprise's Coca-Cola in that niche.

Better yet for investors, Motorola has proven to be a masterful capital allocator. The company has made 30 tuck-in acquisitions since 2015, while maintaining a top-tier return on invested capital (ROIC) of 26%, highlighting the outsize profits it generates from these purchases. Furthermore, Motorola has a 1.2% dividend yield and has increased its payments for 14 consecutive years.

As Motorola continues to expand its burgeoning video and command center businesses -- which combine for a total addressable market more than double that of its core segment -- it should generate high-single-digit percentage sales growth for years to come. Furthermore, the company generates only 28% of its revenue internationally, which presents another growth area. With international sales rising 13% in the past quarter, compared to 8% overall, its push into new markets could pay dividends. Now trading at a more reasonable 28 times free cash flow (FCF) following its 20% share dip, and with 72% of its backlog tied to higher-margin software and services, Motorola is a stock I will be looking to buy in 2026.

Image source: Getty Images.

Roper Technologies: Down 32% from its 52-week high

Roper Technologies's (ROP +0.70%) downturn has been a bit more severe, as it battles an array of analyst downgrades citing AI threats as a problem for the business. This argument makes some sense given that Roper earns roughly 75% of its sales from software solutions, with the remainder from its medical and water products unit. However, with the stock now trading at just 18 times FCF -- despite sales rising 14% during the past year and appointing two new AI executives to help battle and incorporate AI technology -- I think Roper deserves a second look.

Essentially, Roper is a portfolio of acquired application software and network software companies. During the past decade, the company has made about a dozen acquisitions, including its most recent, Subsplash and CentralReach. Subsplash provides software and financial management solutions for more than 20,000 church and faith organizations. Meanwhile, CentralReach delivers workflow and administrative software to provide care for individuals with autism. I highlight these two recent acquisitions to show that while it's fair to say Roper will have to fend off AI-related threats, the company's focus on specialized markets protects it somewhat.

Since its initial public offering in 1992, Roper has been a 254-bagger. Since 2000, it has been a 26-bagger. Morphing from an industrial business into an industrial controls and technology-enabled operation, and now primarily a software business, Roper has consistently shown an ability to reinvent itself -- and I think it will do it again.

As for the company's dividend, Roper has increased its payments for 33 straight years and currently pays a 0.9% yield. These dividends have increased 15% annually during the past decade, even as the company has grown through acquisitions. Armed with a new $3 billion share repurchase authorization -- good for 7% of its shares outstanding -- I will happily buy this promising dividend growth stock along with management while it's at a discount.