One of the most important tech companies in the world is semiconductor (chip) producer Taiwan Semiconductor Manufacturing (TSM +2.21%), or TSMC. It's the world's largest semiconductor foundry and one of the most valuable companies, with a market cap of over $1.7 trillion as of market open on Jan. 21.

If TSMC's stock price momentum were to continue, it could be a stock that turns $1,000 into $16,000. It won't happen overnight or in the next year -- or even in a few years -- but it's very much within reach for long-term investors who have patience.

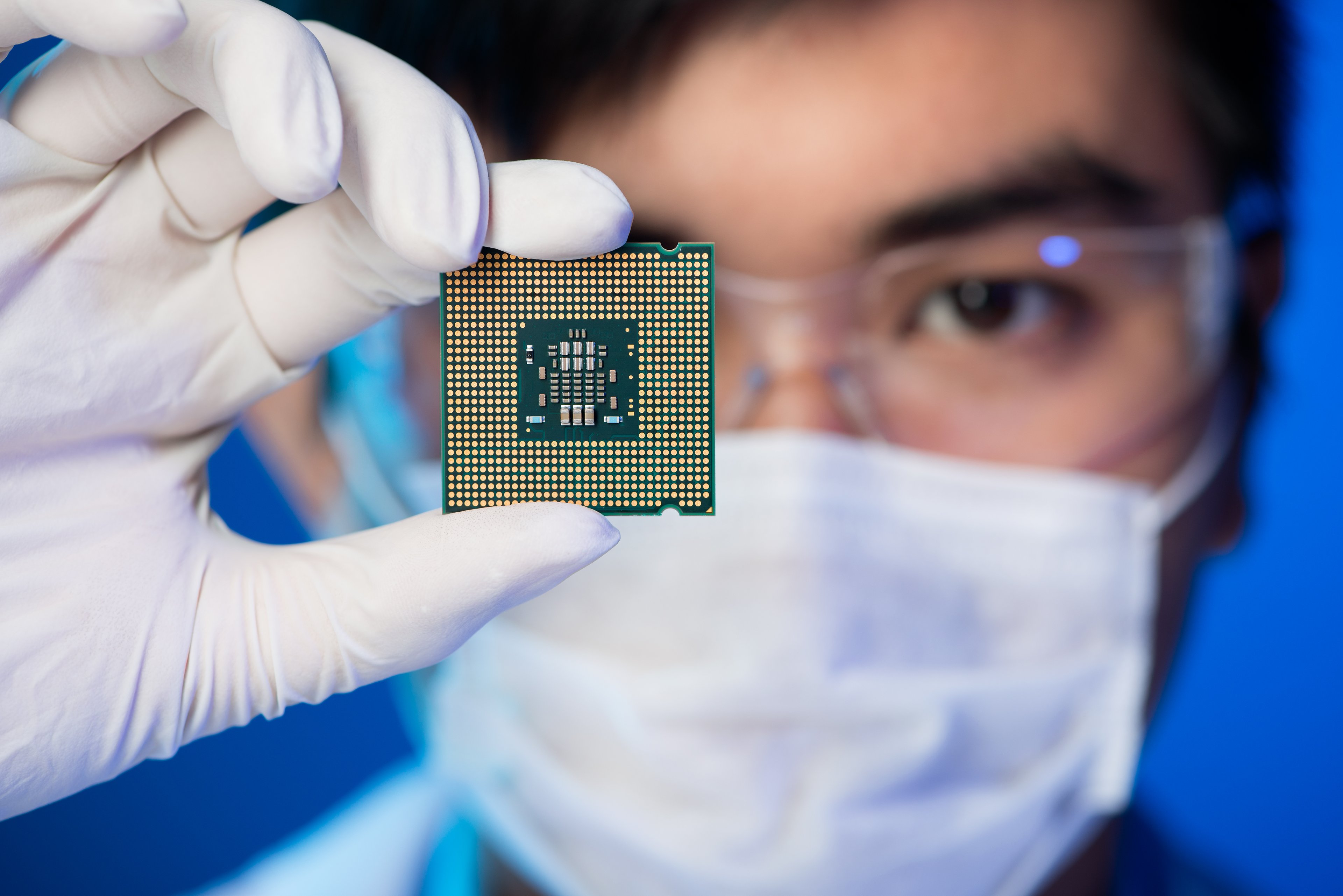

Image source: TSMC.

Over the past 20 years, Taiwan Semiconductor's stock has averaged 19% returns (or 23% when including dividends). I don't expect this to continue over the next 20 years, but if we take a more "conservative" 15% annual average return estimate, a $1,000 investment today could be worth over $16,300 in 20 years.

NYSE: TSM

Key Data Points

Only time will tell how Taiwan Semiconductor's stock performs, but one thing is for sure: Its business is built for sustained success. Its chip manufacturing capabilities are leagues ahead of that of its closest competitor, making it the go-to for chips used in everything from smartphones to computers to TVs, to data centers to cars and more.

With the tens of billions in investments and years of research and development it takes to build and maintain cutting-edge fabrication plants (where chips are created), I don't foresee TSMC losing its dominant position anytime in the foreseeable future.