With the first month of 2026 nearly over, there are some themes starting to take shape. First, investors are still skeptical that artificial intelligence (AI) spending is real. However, if you paid attention to Taiwan Semiconductor Manufacturing's (TSM 1.85%) fourth-quarter results, then you know that it's real and only going to get bigger.

However, the market hasn't caught on to that yet. That leads to a few stocks looking like incredible buys, but there are also some other non-AI stocks that look like strong buys for 2026 that are suffering a bit from a 2025 hangover.

I think these are among the best stocks to buy now, and investors should consider doing so as soon as possible, before the market catches on.

Image source: Getty Images.

1. Nvidia

It should be no surprise that Nvidia (NVDA +0.11%) is included in this list. It's still the top AI computing provider, and its graphics processing units (GPUs) continue to push the limit of what's possible with traditional computing. Demand for its GPUs continues to grow, and will likely increase through 2030, when Nvidia believes there will be $3 trillion to $4 trillion in global annual data center spending.

NASDAQ: NVDA

Key Data Points

That's a huge projection, and if it actually turns out to be correct, the stock will be a must-own. I think the tailwinds in the AI realm are still howling, making Nvidia a no-brainer to buy this year.

2. Taiwan Semiconductor

As mentioned above, Taiwan Semiconductor already reported fourth-quarter results and crushed it. Revenue was up 26% year over year in U.S. dollars, and management gave guidance for nearly 30% revenue growth in 2026. Underscoring this announcement was its decision to spend $52 billion to $56 billion on production capabilities throughout the year.

NYSE: TSM

Key Data Points

This shows there is huge and lasting chip demand in the AI space, giving further credence to the idea that AI spending is just getting started.

3. Nebius

Nebius Group (NBIS 7.92%) is less known than the previous two because it's a smaller business that's deploying Nvidia GPUs filled with TSMC chips to be rented out to clients looking for AI training power. This is a similar business model to the already proven cloud computing one that several big tech companies use. By focusing on AI, they are targeting a niche that needs as much computing power as possible as soon as possible.

Demand for Nebius' platform to expand is incredible, and management believes it will grow from a $551 million annual run rate at the end of the third quarter to a $7 billion to $9 billion run rate at the end of the year. That's a huge increase that I want to be a part of, since the stock a great buy now.

4. The Trade Desk

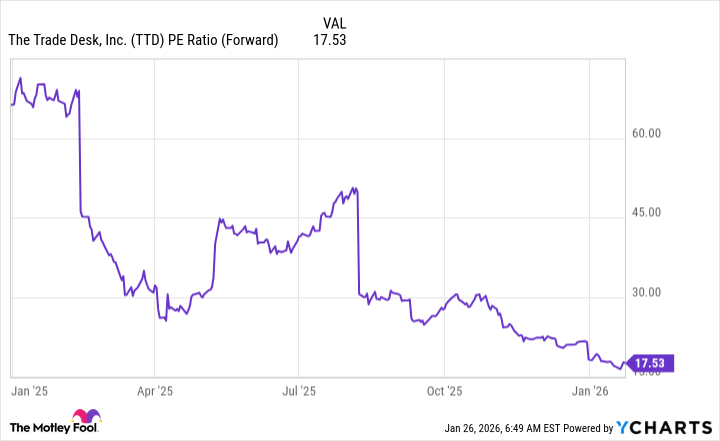

Moving to stocks not focused on AI, The Trade Desk (TTD 2.58%) is one I think will have a strong comeback in 2026. The Trade Desk had an abysmal 2025, falling nearly 70%. However, I think that decline is overblown, because Wall Street analysts still expect 18% revenue growth for this year and 16% next year.

The demand for ad technology software is still growing, and The Trade Desk is in position to capture it. But because of recent pessimism, you can now buy the stock at a mere 17.5 times forward earnings.

TTD PE Ratio (Forward) data by YCharts; PE = price to earnings.

That's an absolute steal of a price, and investors should be flocking to the stock.

5. MercadoLibre

MercadoLibre (MELI 1.63%) is a diversification play, since its business is based in Latin America, giving investors exposure to a different part of the world. While I'm not a fan of diversifying just for diversification's sake, MercadoLibre is a business well worth owning. It has built itself into an e-commerce giant, complete with a fintech platform in Latin America. As a result, MercadoLibre has its hand in many transactions that occur in that part of the world.

NASDAQ: MELI

Key Data Points

The stock is down around 20%, which happens now and again because the market sometimes forgets it's not associated with the U.S. This makes it a perfect buying opportunity because the company has a fantastic record of increasing the business. There is still a large part of the Latin American population that hasn't come onto the platform yet, leaving plenty of room for MercadoLibre to expand.