If you've got $5,000 sitting around and are looking for some stocks to invest in, I can find few better options than these three. Taiwan Semiconductor Manufacturing (TSM 2.66%), Broadcom (AVGO +0.17%), and The Trade Desk (TTD 2.90%) all look like great bargains in this market, and could be slated for huge gains throughout 2026.

If you don't own any of these stocks, now could be a great time to scoop them up before the market rallies behind these massive winners in 2026.

Image source: Getty Images.

1. Taiwan Semiconductor Manufacturing

When you hear about all the massive artificial intelligence (AI) spending going on, you may naturally think of a chip designer like Nvidia. However, Taiwan Semiconductor Manufacturing (TSMC) is doing a lot of the actual labor, as it produces logic chips for Nvidia and its competitors.

TSMC has a massive market share in this space, and is the world's largest company by revenue. This gives it unparalleled insight into where demand is going, as it can interact with several customers.

NYSE: TSM

Key Data Points

Between 2024 and 2029, TSMC expects AI-related chips to deliver nearly a 60% compounded annual growth rate (CAGR). That's huge demand, and we're not even halfway through this super cycle yet.

Additionally, TSMC believes the demand is so high and will last for a while that it is investing $52 billion to $56 billion this year to increase its production capacity. That's serious commitment, and shows that the company's stock could be primed to soar over the next few years.

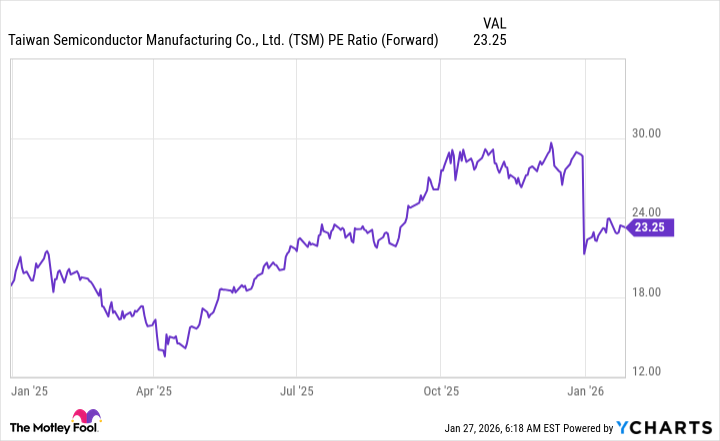

With the stock trading at a pretty reasonable 23 times forward earnings, I can think of few better bargains in the AI space than TSMC.

TSM PE Ratio (Forward) data by YCharts

2. Broadcom

Broadcom offers a wide variety of products, but what investors are most interested in are its custom AI chips. Instead of offering a broad-purpose computing unit like a graphics processing unit (GPU) that's meant for a one-size-fits-all application, it's partnering directly with AI hyperscalers to design their own custom AI chip. These are known as ASICs, or application-specific integrated circuits. ASICs are nothing new, but Broadcom is unique in adapting them to AI computing applications.

NASDAQ: AVGO

Key Data Points

This is leading to monster growth, as Broadcom expects its AI semiconductor revenue to double year over year in Q1. While this division won't quite make up half of Broadcom's revenue in Q1, it may by the end of FY 2026.

Broadcom's ASIC chips are a potentially viable alternative to Nvidia's GPUs, which many companies are looking for. I'd expect massive growth from Broadcom over the next few years, making its stock a no-brainer buy right now.

3. The Trade Desk

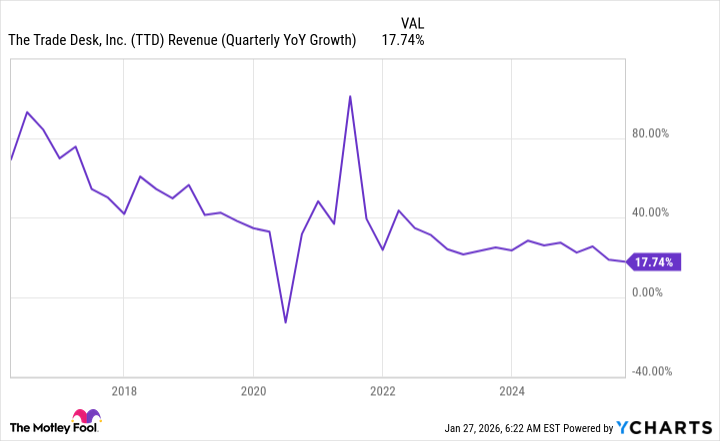

While Broadcom and TSMC have massive growth they are churning through, The Trade Desk has a different problem. Its growth is slowing, and Q3 represents The Trade Desk's slowest revenue growth rate in company history outside of one quarter in 2020 that was influenced by COVID-19 spending pullbacks.

TTD Revenue (Quarterly YoY Growth) data by YCharts

Still, 18% growth is nothing to be concerned about. Plus, Wall Street analysts project 16% growth for 2026. That's still a strong company, and investors would be thrilled to own a company with market-beating growth, especially one that trades for a mere 16 times forward earnings.

Although The Trade Desk's ad platform isn't growing as quickly as it once was and is seeing rising competition, that doesn't mean that it's going extinct. Instead, investors should use this pullback as a buying opportunity, because the stock is priced for absolute failure, even when it's still delivering impressive results.

The Trade Desk is primed for a rebound in 2026, and I think it's a top stock to buy right now.