When the S&P 500 is soaring, it's easy to forget about the power of dividend stocks. You may be tempted to get in on high-growth names, the stocks that are driving the current momentum. And that might be a good move, especially if you're an aggressive investor looking for stocks that may double or triple in value. But this doesn't mean you should ignore the companies that will pay you just for owning shares.

Whether you're an aggressive or cautious investor, these players make a great addition to your portfolio during any market environment. They could offer you safety during a downturn, ensuring you passive income even if many of your investments are down. And during a market boom, they offer you an extra lift.

So, if you're looking for passive income in 2026 and beyond, here are three Dividend Kings to buy hand over fist.

Image source: Getty Images.

1. Abbott Laboratories

To make it onto the Dividend King list, a company must have increased its dividend for at least the past 50 years. Abbott Laboratories (ABT +3.03%) and the others mentioned below have done just that. This long-standing commitment to passive income suggests paying out dividends is important to the company -- so the policy may continue.

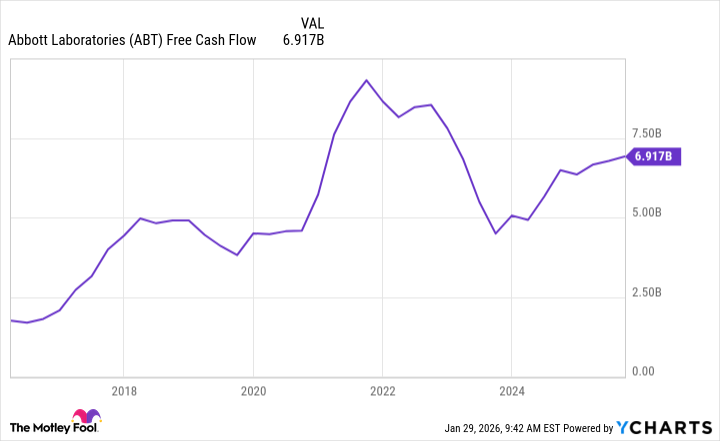

Abbott pays a dividend of $2.52, representing a dividend yield of 2.4% -- that surpasses the 1.1% dividend yield of the S&P 500. The company's long track record of boosting its payouts is positive, and the level of free cash flow shows Abbott has the resources to keep this pattern going.

ABT Free Cash Flow data by YCharts

I also like Abbott for its well-diversified healthcare business that has delivered growth over the long term. The company has four units: medical devices, diagnostics, nutrition, and established pharmaceuticals. And the positive thing here is that if one of these businesses faces a stumbling block or slowdown, others may compensate. All of this offers you, as an investor, a great deal of security.

2. Target

I have to start out by saying Target (TGT +2.56%) has had a rough time over the past few years. The company, after a period of explosive growth during early pandemic days, has more recently faced a variety of challenges -- from customers seeking out essentials, which are lower margin for Target, to theft in some of its stores.

But the dark cloud has a silver lining. Target last year began to put into place several efforts to turn things around, for example, creating an enterprise acceleration office to streamline processes. And in February, longtime Target executive Michael Fiddelke will be taking over the role of chief executive officer, and his priority is to spur recovery and growth. So right now, Target is a fantastic recovery story buy.

NYSE: TGT

Key Data Points

Meanwhile, as a Target shareholder, you'll collect the company's dividend of $4.56, at a yield of 4.5%. So, over time, you may benefit from the stock's potential rebound and a great deal of passive income.

3. Johnson & Johnson

A few years ago, Johnson & Johnson (JNJ 0.02%) spun off its consumer health business -- one you may know well for products like Tylenol and Band-Aid brand bandages -- to create Kenvue. The idea was to focus investment on its two higher-growth businesses, innovative medicine and medtech.

And this plan has been bearing fruit. Last year, the company delivered a 6% increase in sales to more than $94 billion, and adjusted diluted earnings per share climbed more than 8%. Chief executive officer Joaquin Duato said that J&J has the strongest commercial portfolio and pipeline in the company's history -- this bodes well for revenue growth in the coming quarters and years.

NYSE: JNJ

Key Data Points

J&J is proving its ability to compensate for the loss of exclusivity concerning blockbuster immunology drug Stelara thanks to the growth of drugs in oncology, neuroscience, as well as other immunology drugs.

Meanwhile, you can also count on J&J for passive income. It pays a dividend of $5.20 at a dividend yield of 2.3%. And this makes this pharma giant a solid dividend stock to buy hand over fist if you're looking for passive income in 2026.