Nvidia (NVDA 2.82%) supplies the world's best graphics processing units (GPUs) for data centers, which are the primary chips used in artificial intelligence (AI) development. The company is gearing up to launch a new chip architecture this year that will reset the benchmark for the industry, and if history is any indication, demand will significantly outstrip supply.

Nvidia is scheduled to report its operating results for its fiscal 2026 fourth quarter (ended Jan. 25) on Feb. 25, and investors will be focused on the strength of GPU sales for the period, as well as the company's forward guidance. Plus, during the accompanying conference call, CEO Jensen Huang is likely to provide some additional color on the longer-term direction of the AI industry.

Here's why I predict Nvidia stock will soar following the Feb. 25 report.

Image source: Nvidia.

All eyes on Rubin

Since the start of 2024, the AI hardware industry has centered around Nvidia's Blackwell and Blackwell Ultra GPU architectures, which are leaps and bounds ahead of anything else on the market. The Blackwell Ultra GB300 GPU, for example, provides up to 50 times more performance than Nvidia's original AI data center chip, the Hopper-based H100, which launched in 2022. That gives you an idea of how quickly the company is innovating.

Last year, Nvidia unveiled an entirely new GPU architecture called Rubin, and it's expected to leave the Blackwell platform in the dust. It's so powerful that developers can train models with 75% fewer GPUs, and as a result, it reduces inference costs (the amount it costs for a model to accept a prompt from a user and generate an answer) by up to 90%.

Rubin GPUs are now in full production, and they are expected to start shipping in the second half of this year. Cloud computing and AI giants, like Amazon, Microsoft, Alphabet, and Oracle, will be among the first customers to receive them.

Nvidia's upcoming conference call with investors on Feb. 25 is likely to feature a number of valuable updates on the production and shipping timelines, which could dictate the company's financial results over the next few quarters.

Wall Street expects another blowout number

Nvidia generated $147.8 billion in total revenue during the first three quarters of fiscal 2026 (ended Oct. 26), a 62% increase from the year-ago period. The data center segment accounted for 89% of that revenue, coming in at $131.4 billion.

Wall Street's consensus estimate (provided by Yahoo! Finance) suggests Nvidia likely brought in around $65.5 billion in revenue during the fourth quarter, taking its annual total to $213.3 billion for fiscal 2026. The company often beats expectations, though, which has been very bullish for its stock price in the past.

At the bottom line, analysts forecast total fiscal 2026 earnings of $4.69 per share. This number plays perhaps the biggest role with respect to the direction of Nvidia stock, but more on that in a moment.

NASDAQ: NVDA

Key Data Points

Another important thing analysts will be watching on Feb. 25 is management's guidance for the upcoming fiscal 2027 first quarter. They are looking for $70.7 billion in revenue, so if Huang and his team forecast an even bigger number, that would also be extremely bullish for Nvidia stock.

Is Nvidia stock a buy ahead of Feb. 25?

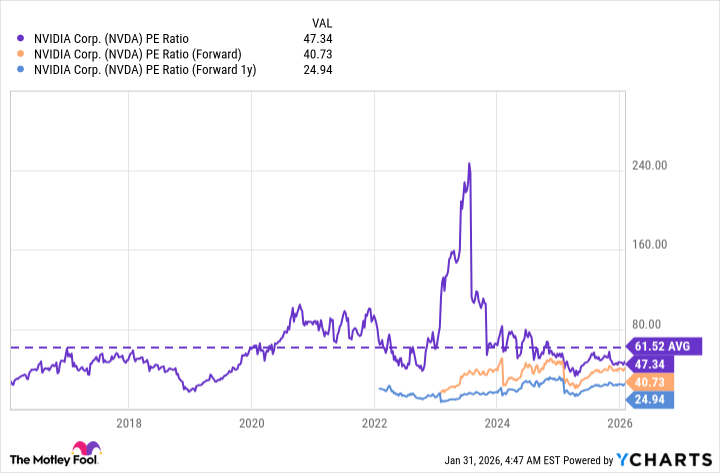

Based on Nvidia's trailing-12-month adjusted (non-GAAP) earnings of $4.05 per share, its stock is trading at a price-to-earnings (P/E) ratio of 47.3. That's a 23% discount to its 10-year average P/E ratio of 61.5, which suggests the stock might be cheap right now.

The stock looks even more attractive when we value it based on Nvidia's future potential earnings. If we assume the company's upcoming fourth-quarter report takes its total fiscal 2026 earnings to $4.69 per share as Wall Street expects, then its stock is trading at a forward P/E ratio of 40.7.

But it gets better, because analysts believe Nvidia can grow its earnings to $7.66 per share during fiscal 2027, placing its stock at a forward P/E ratio of just 24.9. If that proves to be true, then the stock will have to soar by 90% over the next 12 months just to maintain its current P/E ratio of 47.3. It would have to more than double to trade in line with its 10-year average P/E of 61.5.

Data by YCharts. PE Ratio = price-to-earnings ratio.

Therefore, as long as Nvidia's operating results meet or exceed expectations on Feb. 25, I think its stock could be poised for significant upside.