Since debuting on the New York Stock Exchange in September 2021, shares of electric vertical takeoff and landing (eVTOL) stock Archer Aviation (ACHR 7.99%) have plummeted 26%. For most of its trading history, Archer has been a spectacle of retail investor enthusiasm. These dynamics are swiftly changing, though.

According to a recent 13G filing from BlackRock (BLK 1.19%), the world's largest asset manager just increased its ownership stake in Archer to 8.1%. Let's dig into why BlackRock recently bought more shares of the popular eVTOL stock and explore if now is a good time for investors to follow suit.

Image source: Archer Aviation.

Is BlackRock betting big on Archer Aviation?

Given BlackRock's growing position in Archer, you might think the money manager has some special intent when it comes to the aircraft company. This isn't necessarily the case, though. The Securities and Exchange Commission (SEC) requires that ownership stakes of 5% or more are disclosed to the public. However, the type of filing can help signal the meaning behind these purchases.

A 13G signals that an investor has acquired a significant stake in a company but does not have the intent to influence its operations. In other words, BlackRock's position in Archer is not an activist move. Rather, it is a passive position spread across the bank's various exchange-traded funds (ETFs).

NYSE: ACHR

Key Data Points

What makes Archer Aviation an attractive investment?

Archer could be thought of as an asymmetric investment. The downsides are that the company never achieves enough regulatory approval or that Archer mismanages its capital and struggles to reach commercial scale. The upside, however, could be massive as Archer seeks to disrupt the aviation and mobility markets. Given the speculative nature of Archer's underlying business, why would a fiduciary like BlackRock take such a massive position in the stock?

From a business standpoint, Archer has gotten a lot of attention from high-profile companies such as Palantir Technologies, Nvidia, United Airlines, Stellantis, and even the U.S. government. Some of these companies are strategic investors in Archer, while others are collaborating with the company on next-generation products bridging artificial intelligence (AI), aviation systems, and defense tech.

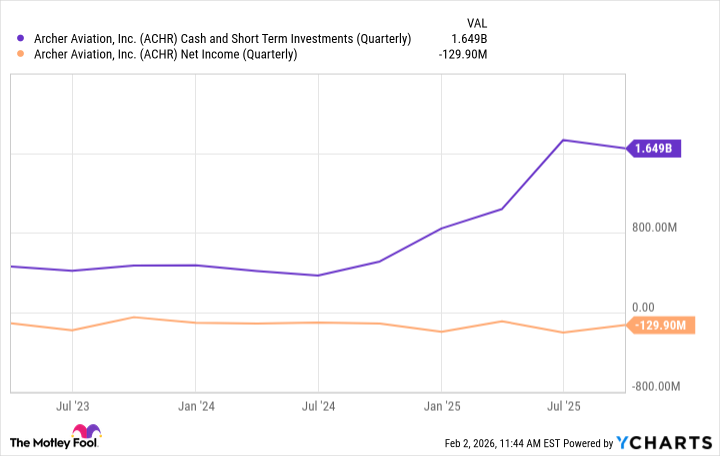

In addition, at the end of the third quarter, Archer boasted $1.6 billion of liquidity on its balance sheet. While manufacturing eVTOLs is capital-intensive, Archer's rising cash balance is a function of its partners doubling down on their investment. This profile suggests that Archer has little in the way of execution risk as its investors continue to act as a support base until the company reaches commercial deployments.

ACHR Cash and Short Term Investments (Quarterly) data by YCharts

Is Archer Aviation a good stock to buy?

The consensus price target on Archer stock is about $12 -- implying roughly 71% upside from current levels. With that said, Archer is a stock that largely trades on headlines and narratives given its lack of actual business results.

Against this backdrop, I view Archer as a speculative stock to own -- similar to investing in a late-stage start-up. While the upside could be massive, there's no guarantee of success. For these reasons, smart investors should not follow BlackRock blindly into Archer stock. Instead, a position in Archer should be reserved for those who expect and can handle outsized volatility and uncertainty.