Fresh off an incredible run in 2025, Rocket Lab (RKLB 9.41%) stock continued to climb in January, finishing the month up 14.8%.

A major Space Force contract fueled momentum

Rocket Lab stock was riding a wave of enthusiasm into January following a string of positive news stories and announcements, including the mid-month revelation that the company had secured another major contract with the Department of Defense.

The company said on Dec 19th that it had been awarded a $816 million contract to "design and manufacture 18 satellites" for the U.S. Space Force. The deal now brings the company's total defense contract value well above $1 billion, helping cement it as a serious player in the space.

NASDAQ: RKLB

Key Data Points

Wall Street upped the ante on Rocket Lab stock

On Jan. 16, Morgan Stanley upgraded the stock from "Equal Weight" to "Overweight," raising its price target from $67 to $105 per share. Analyst Kristine Liwag cited the company's "proven and repeatable launch execution" and its "credible pathway into a capacity-constrained medium-lift market" as key factors driving the upgrade.

The company got a similar nod from Bank of America, which reiterated its "Buy" rating while boosting its price target to $120 from $60.

Rocket Lab also successfully launched two rockets, the first on Jan. 22, surpassing the 80-mission mark, and the second on Jan 30. Investors cheered the continued high-level execution.

There were some setbacks, too

It wasn't all positive for Rocket Lab investors, however. The stock was hit when Congress killed the Mars Sample Return (MSR) program, which would have seen stranded samples from the Perseverance rover on Mars. The potential contract was for a whopping $4 billion, so it's no wonder that Rocket Lab stock was hit hard by the news.

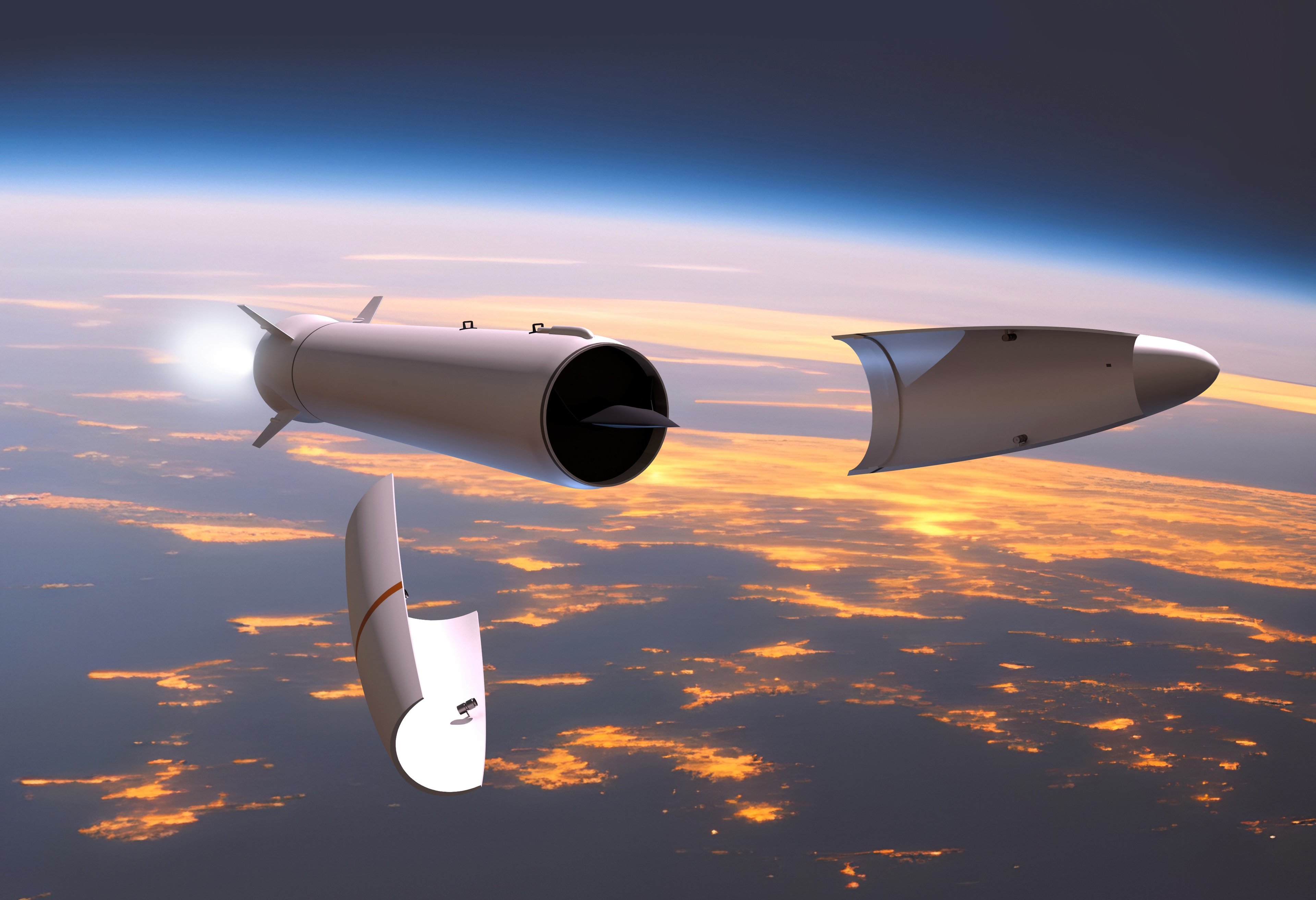

Image source: Getty Images.

The company also suffered a setback in its Neutron rocket program after a testing failure. Neutron rockets are much larger than their Electron predecessors and are essential to Rocket Lab's growth story.

And this comes right as many high-growth and more speculative stocks are under pressure. There are renewed fears of an artificial intelligence (AI) bubble following concerning earnings reports from several key players, while at the same time, the Federal Reserve has chosen to hold interest rates steady. Rocket Lab would benefit greatly from lowered borrowing costs.

Is Rocket Lab stock a buy?

January 2026 reminded investors that Rocket Lab, for all its accomplishments, remains a company with significant execution risk. Its stock has been on such a run that the company has to deliver nearly flawlessly. That's a tall order in the industry it's in.

Still, I think Rocket Lab is worth owning for investors with an appetite for risk.