One of the most interesting aspects from the rise of artificial intelligence (AI) is how the technology has allowed some companies to reinvent themselves. Take Palantir Technologies (PLTR +2.87%) as a prime example.

Prior to the AI revolution, Palantir was mostly seen as a secretive data-mining company that worked closely with the Department of Defense (DOD). But today? The company seems to be everywhere. Beyond the defense landscape, large private enterprises across healthcare, financial services, manufacturing, and more are touting unprecedented efficiency gains thanks to Palantir's Artificial Intelligence Platform (AIP).

Let's look at what makes it unique and analyze how AI has become a bellwether for the company. From there, we'll do some valuation analysis to help determine if Palantir is a good fit for your portfolio.

Image source: Getty Images.

How does AI affect the software industry?

One of the most widespread inventions from AI so far is the large language model (LLM), such as ChatGPT, Gemini, or Claude. They employ generative AI to help users perform tasks more efficiently.

Besides answering a general query, LLMs can be integrated with adjacent software programs to help digest large volumes of data. In turn, generative AI can use this information to help engineers write software code or assist a data scientist in quickly sifting through complicated inputs to more easily arrive at an optimal solution to a sophisticated problem.

NASDAQ: PLTR

Key Data Points

Palantir focuses on designing ontologies, which are detailed visualized maps that can zoom in on a company's most granular levels of data. This is advantageous because it helps decision-makers model and simulate different scenarios based on real-time information, as opposed to being stuck with a backward-looking dashboard tool.

Given how broad-based Palantir's AIP platform is, it's not surprising that Wall Street sees a huge opportunity. Morningstar analyst Mark Giarelli writes that "anywhere from $1.2 trillion to $1.8 trillion is possible" for Palantir's total addressable market (TAM).

Palantir's growth is explosive

On Feb. 2, management reported earnings for the fourth quarter and full year 2025. Spoiler alert: Palantir knocked the cover off the ball. For the full year, revenue grew 56% year over year to $4.5 billion. The company's non-government segment is thriving, with U.S. private sector sales growing 109% year over year to $1.5 billion.

The pace at which Palantir's top line is accelerating is undoubtedly impressive. But what's even more encouraging is the company's rising profitability. Hypergrowth companies will often reinvest cash flow into their business at the expense of continued customer acquisition. In this sense, Wall Street may give management a free pass if the company remains temporarily unprofitable. Palantir is defying these dynamics. In 2025, the company generated $1.6 billion in net income and $2.3 billion in adjusted free cash flow.

The financial profile is robust, but it has barely scratched the surface of what it can achieve given its huge, expanding TAM.

Is the valuation justified?

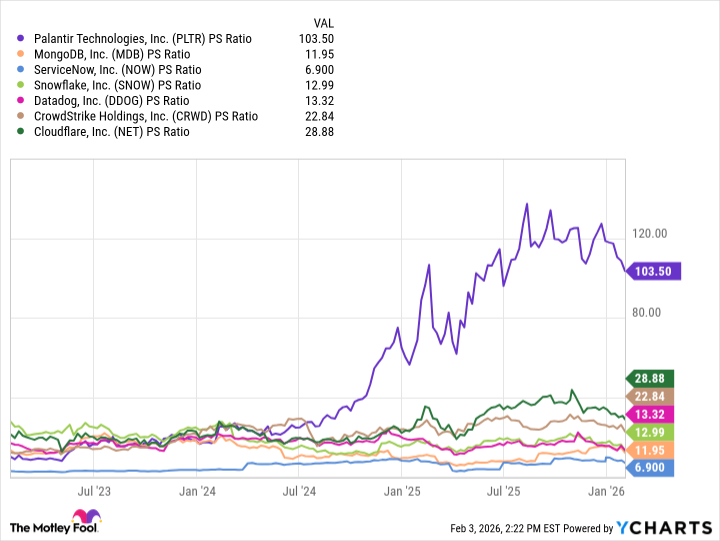

When it comes to leading software-as-a-service (SaaS) companies, investors are pricing Palantir in a league of its own. The company's price-to-sales ratio (P/S) of 103 is unparalleled compared to other industry peers -- and it's expanding.

Data by YCharts.

Generally speaking, investors will place a premium on a company relative to its cohorts if it is growing at a faster, more profitable pace. Palantir does check off these boxes, but its soaring valuation is making it evermore polarizing in the eyes of analysts.

With that said, smart investors understand that they have options. Given the volatility of growth stocks, betting the farm on a company such as Palantir is not the prudent move.

Instead, steadily acquiring shares at different price points over the course of a long-term time horizon is a simple way to benefit from the company's upside without requiring keen analysis of each passing earnings report. This is a strategy known as dollar-cost averaging.

In my eyes, the company remains one of the most compelling opportunities in AI outside of the "Magnificent Seven." Investors seeking exposure to category leaders beyond the usual suspects in big tech may want to consider building a position in Palantir Technologies as the company's growth arc continues to take shape.