Microsoft (MSFT 4.95%) is one of the world's most diversified technology companies, with a presence in software, cloud computing, gaming, social media, and more. It's leveraging its dominant position in some of those industries to participate in the artificial intelligence (AI) boom, and it's having incredible success despite some bumps in the road.

Microsoft reported its operating results for its fiscal 2026 second quarter (ended Dec. 31) on Jan. 28, which sent its stock tumbling to a one-day loss of over 10%. Despite strong results across the board, investors were concerned about some modest weakness in its AI software and cloud businesses.

The stock is now down 22% from its record high, but it's still one of the best-performing investments in history, with a 580,650% gain since its initial public offering (IPO) in 1986. The recent sell-off might be a temporary blip on the way to further positive returns, so should investors take this opportunity to buy?

Image source: Getty Images.

Copilot concerns are emerging

AI chatbots have become extremely common, but Microsoft has a distinct advantage over the competition in this space because it can integrate its Copilot virtual assistant into its existing software that already serves billions of people collectively worldwide. Copilot is free to use in the Windows operating system, Bing search engine, and Edge internet browser, and it's also available as a paid add-on for the 365 productivity suite, which includes Word, Excel, Outlook, and more.

Companies around the world have bought more than 400 million Microsoft 365 licenses for their employees, and all of them are candidates for the Copilot add-on, making it a huge financial opportunity. However, as of the fiscal 2026 second quarter, businesses had purchased just 15 million Copilot licenses for Microsoft 365, and while that number doubled compared to the year-ago period, it represents a very modest penetration rate of just 3.7%. This is one of the numbers that sent the stock plunging after Jan. 28.

But 365 isn't Microsoft's only opportunity in this space. During the second quarter, paid Copilot subscriptions for individual software developers jumped by 77% compared to the previous quarter, just three months earlier. And Microsoft's Dragon Copilot for healthcare providers now helps over 100,000 medical professionals automate their administrative workflows. It documented 21 million patient encounters during the second quarter, tripling from the year-ago period.

Azure remained strong, but growth decelerated

Azure is Microsoft's cloud computing platform, where businesses can tap into hundreds of digital services to help them with simple requirements (like data storage) and more complex tasks (like software development). Azure has also become a major hub for AI developers because it's home to the Foundry platform, which offers all the tools they need to create AI software, including access to data center infrastructure and ready-made large language models (LLMs) from third parties like OpenAI.

NASDAQ: MSFT

Key Data Points

Azure revenue grew by 39% year over year during the second quarter, which was above Wall Street's consensus forecast of 37.1%, but it was slower than the 40% growth the company delivered in the previous quarter, three months earlier. To be clear, 39% is a blistering growth rate, but investors might be worried about a potential loss of momentum.

Azure revenue could have grown even faster if not for a shortage of data center capacity. Microsoft's order backlog from customers waiting for more infrastructure to come online soared by 110% year over year to $625 billion.

That was great news at face value, but it's worth pointing out that 45% of the backlog is from OpenAI alone, which is a problem because the start-up certainly doesn't have the $281 billion in cash on hand to cover the OpenAI commitment. It will rely on a combination of external funding from investors and substantial revenue growth to come up with the money -- neither of which is a guarantee. This is another reason the stock declined sharply after Jan. 28.

Microsoft's stock trades at an attractive valuation now

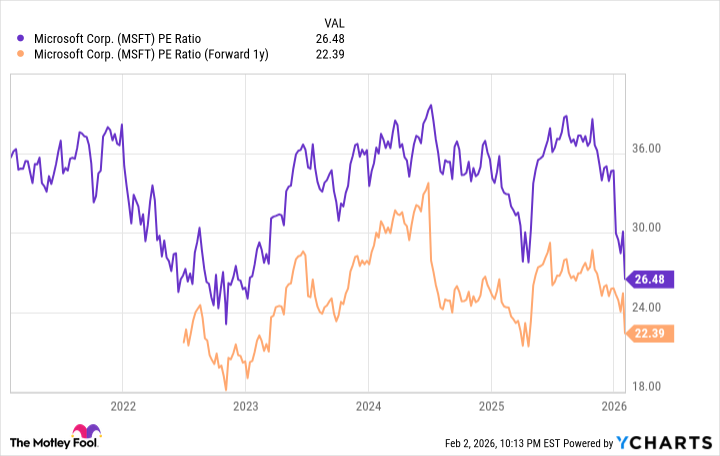

Based on trailing-12-month earnings of $15.98 per share, its stock is trading at a price-to-earnings ratio (P/E) of 26.5. Not only is that the company's cheapest valuation in three years, but it's also a steep discount to the P/E of the Nasdaq-100 index, which is currently 32.8. So you could argue Microsoft is extremely cheap relative to its big-tech peers.

Plus, Wall Street's consensus estimate (provided by Yahoo! Finance) suggests the company's earnings could grow to $19.06 per share during fiscal 2027 (which begins in July 2026), placing its stock at a forward P/E of just 22.4.

Data by YCharts.

In summary, the recent 20% decline in Microsoft stock has given investors an opportunity to buy it at the cheapest level in years. While there have been some speed bumps for Copilot and Azure, the company continues to spend record amounts of money to build AI infrastructure, which speaks to its confidence in this technological revolution. As a result, I think long-term investors could do well by adding a few shares at the current price.