Breakfast News: Tech Stock Sell-Off

November 5, 2025

| Tuesday's Markets |

|---|

| S&P 500 6,772 (-1.17%) |

| Nasdaq 23,349 (-2.04%) |

| Dow 47,085 (-0.53%) |

| Bitcoin $99,490 (-6.63%) |

1. Fear Strikes AI Stocks

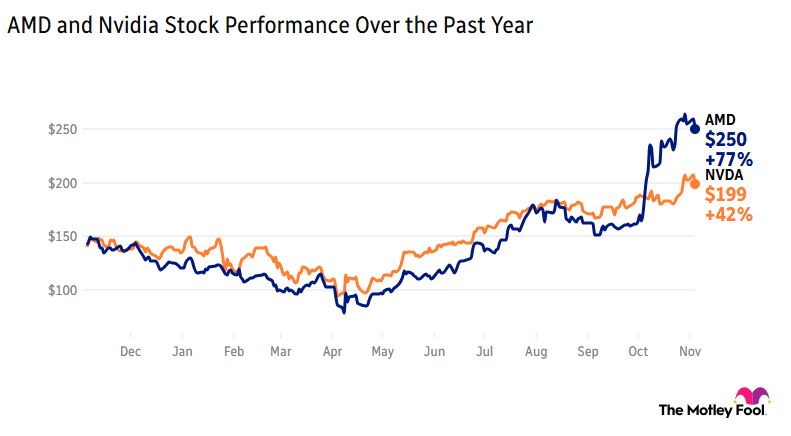

Yesterday's tech stock sell-off pushed the Nasdaq down over 2%, on the back of fears of AI-led overvaluation, as bearish hedge fund manager Michael Burry revealed short positions on Nvidia (NVDA +1.36%) and Palantir (PLTR 2.02%). Hidden Gems recommendation Bitcoin (BTC +1.81%) fell below $100,000 for the first time in more than four months, with appetite for risk appearing to fade.

- "We need to remain open-minded to the possibility that this could still further build": Chris Weston at Pepperstone added "Simplistically, there aren't many reasons to buy here." Long-term Foolish investors might disagree.

- "Record revenue and profitability": Stock Advisor rec Advanced Micro Devices (AMD +0.07%) got away lighter than many, falling 4% overnight despite beating estimates for third-quarter revenue and earnings.

2. Tuesday Tech Earnings Disappoint

Arista Networks (ANET +0.54%) slumped 11% in pre-market trading, even though earnings per share rose 25% after the company reported strong demand for AI and data center networking in yesterday's Q3 update. The stock is still up nearly 40% year to date.

- Loan originations 128% ahead of Q3 last year: AI-based lending platform Upstart (UPST 1.86%) reported a welcome return to profit, after revenue rose 71% year over year, though margins are a bit squeezed. Shares fell 14% after hours in the sell-off.

- Revenue up 17% year over year: Pinterest (PINS 0.32%) posted a 19% rise in earnings per share, and expects revenue to grow 14% to 16% in a strongly profitable Q4. The stock dipped 19% pre-market.

3. More Drops Despite Revenue Pops

It's not just tech stocks suffering, as decking manufacturer Trex (TREX 0.14%) slumped 30% overnight, though Q3 revenue and earnings came in ahead of the same quarter last year. But both measures fell short of Wall Street expectations, and management lowered full-year guidance.

- Superscore of 70 on our Moneyball database: CAVA (CAVA +3.77%) fell 10% after close, even after a 20% year-over-year rise in Q3 revenue. The Mediterranean-themed restaurant chain lowered its same-restaurant sales outlook and profit guidance.

- Beating the S&P 500 by 168% since 2021 Rule Breakers rec: Axon Enterprise (AXON 4.46%), the maker of TASER and other public safety devices, saw annual recurring revenue rise 41% year over year in the third quarter, though earnings per share fell 19%. The stock looks set to open around 20% down.

4. Next Up: Notable Earnings on Wednesday

Novo Nordisk (NVO 3.08%) bucked the market trend, gaining 2% in early trading after posting a quarterly profit in line with expectations. Weight-loss drug Wegovy was a key growth driver, with sales up 18% year over year. Management narrowed full-year sales growth guidance to between 8% and 11%.

- Moving into AI chips: The Qualcomm (QCOM +0.00%) share price remains stable ahead of Q4 earnings due after the closing bell, as the company diversifies from smartphones and into data center processors and rack systems.

- Beating estimates for four quarters in a row: It's Q3 time for cloud-based CRM platform HubSpot (HUBS +0.99%) after market close, with analysts predicting a 17% revenue rise year over year.

5. Your Take

Today we're asking simply, how are you reacting to the current sell-off? Share with friends and family, or become a member to hear what your fellow Fools are saying.