On Tuesday December 17, 2013, John Mackey and Walter Robb, the co-CEO's of Whole Foods Market (WFM +0.00%) announced their intention to grow their healthy food store concept to 1,200 locations in the United States. With only 347 locations within the U.S. and another 15 abroad as of its Fiscal 2013, this leaves a lot of work to do and a lot of potential to profit as a shareholder. But you know the saying; money talks and... well... you get the point. Does Whole Foods have what it takes to grow to their lofty goal of 1,200 locations domestically and join the ranks of big players like Wal-Mart Stores (WMT 1.24%) and Costco Wholesale Corporation (COST 0.61%) or is this goal too lofty?

Whole Foods has powerful margins

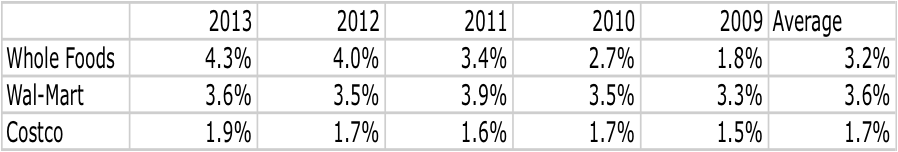

Over the past five years, Whole Foods has improved its net profit margin, especially compared to its peers, considerably.

Net Profit Margins:

Every year since at least 2009, the company has seen its net profit margin improve. Not only that, but its improvement has significantly outpaced both Wal-Mart and Costco, while its average margin smashes Costco's and is on track to surpass Wal-Mart's if the trend continues. This increase in net profit margin over time can be attributed to a 275.3% jump in net income as costs have fallen as a percentage of sales.

If Whole Foods were a big player with more market power or if it was accepting higher margins at the cost of growth, it would make sense for the company's performance to be so impressive. However, neither of these cases appears to be true. Aside from having fewer locations than its peers, the company's market cap of $21.3 billion is a fraction the size of Costco's $51.4 billion or Wal-Mart's gargantuan $250 billion.

Furthermore, the company's revenue has grown by 60.8% from $8 billion to $12.9 billion over this timeframe. This is a nice clip higher than the 47.2% from $71.4 billion to $105.2 billion seen by Costco and worlds apart from the 16% increase from $404.4 billion to $469.2 billion experienced by Wal-Mart.

Show me the cash, baby!

While revenue and net income growth are nice to see, neither of these are terribly important in helping the company expand. Rather, they only tell whether it makes sense for management to grow the business or to focus instead on cost containment. If we want to see if whether or not Whole Foods really has what it takes to grow its number of locations by nearly 250%, it's imperative to look at cash flows.

During the company's 2013 fiscal year, it brought in cash flow from operating activities of $1 billion. From this, $339 million was used to add 32 stores at an average cost of $10.6 million per store. Meanwhile, $198 million was used for miscellaneous capital expenditures and the remaining $472 million comprised free cash flow.

In theory, if management were to utilize all of the $1 billion it has as cash on hand and if it could generate the same amount of cash and have the same miscellaneous capital expenditures next year as it did this year, management could add up to over 170 locations in the next year. However, out of a fear of depleting cash too much and growing too quickly, management has outlined a plan to open between 33 and 38 locations next year, followed by 35 to 40 locations in 2015. More likely than not, this scaling up approach is far better than rushing things and potentially overextending themselves, but it appears as though management won't have much difficulty growing unless profitability falls substantially in the years to come.

Foolish takeaway

As we can see, Whole Foods is in a very unique position right now. Not only is the company more profitable than it's peers; it's growing at a much faster rate. When you add to this the strong cash flow and significant cash on hand that management has at its disposal, it's not difficult to see a future where Whole Foods reaches 1,200 locations. The only question that remains is the amount of time it takes and the payoff investors would receive as a result.

Currently, shares are trading at 39 times earnings, which is far higher than Wal-Mart and Costco. This suggests Wall Street already expects rapid growth but even if the company increases its store count by the 11% it's expected to next year until it reaches the 1,200 locations it's striving for, shareholders wouldn't see management achieve its goal for another 12 years. So, while investing in Whole Foods will likely pay off big if management can stay the course, investors should sit by the sidelines and wait for the price to make sense to them before jumping in.