Source: Flickr / woodleywonderworks.

With over $250 billion to invest, Blackstone (BX +0.00%) makes bold moves when it sees an opportunity. That helps explain why it bought over 40,000 single-family homes after the housing crash. Now, however, it's pulling back on the buying spree. Is this megainvestor saying the opportunity is over?

Cheap homes

The 2007 to 2009 recession was more than just an economic soft spot. It struck at the core of the American dream because it engulfed the U.S. housing market. Too many people used too much debt to buy overpriced homes. When the buying stopped, home prices fell hard. Speculators were hurt particularly hard, but so were buyers looking for a place to call home.

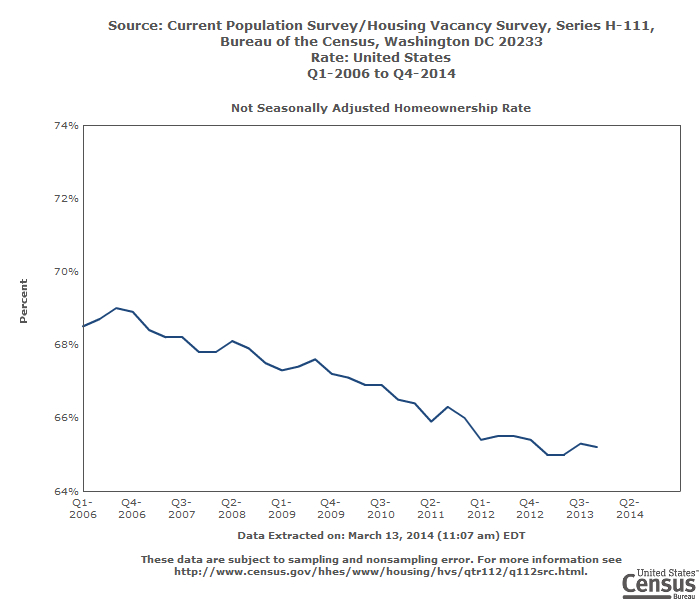

The dream of owning a home now appears to be less important to many. Home-ownership rates have fallen regularly since 2006. That change, however, means more renters. And with low prices, Blackstone moved in to build Invitation Homes, now the largest landlord in the single-family home space.

Others followed suit, or were actually ahead of giant Blackstone. The list includes American Homes 4 Rent (AMH 0.03%), American Residential Properties (NYSE: ARPI), Silver Bay Realty (NYSE: SBY), and newer entrant Starwood Waypoint Residential (NYSE: SWAY).

American Homes 4 Rent is the biggest of the quartet. This real estate investment trust (REIT) was created by Wayne Hughes, the founder of giant Public Storage (PSA +0.38%). It owns about 25,000 homes. Much smaller, American Residential owns just over 6,000 homes, Silver Bay controls 5,600, and Barry Sternlicht's (of Starwood Property Trust (STWD 0.71%)) Starwood Waypoint Residential started its public life in February with nearly 7,000 homes.

Buy, buy, stop!

Although all of these single-family forays are still quite new, there's already been a sea change. At first, the companies were aggressive property acquirers. For example, as Stephen G. Schmitz, CEO of American Residential, noted in his company's fourth-quarter-earnings release, "We increased the number of homes in our portfolio by more than 240% during [2013]." That's huge growth, but only 633 of the year's 4,298 purchases occurred in the fourth quarter.

Silver Bay saw a similar slow down. It owned 5,575 properties at the end of the third quarter and just 5,642 by the end of the year. It started 2013 with 3,400 homes. These slowdowns buttress the shift taking place at Blackstone. Not only has the company shifted gears by offering financing to would-be landlords, but its buying is down as much as 70% from previous levels, according to Jonathan Gray, who oversees Blackstone's global real-estate business.

Gray recently told Bloomberg, "The institutional wave has passed." That doesn't mean that Blackstone or the single-family home REITs are done buying, but it does suggest that the big opportunity is over.

Undervalued

Still, that doesn't mean you can't get a good deal. For example, Starwood Waypoint Residential owns homes and underwater mortgage debt. That debt gives it the opportunity to build its portfolio via foreclosures. That's not an easy way to grow, but the company's around $1 billion worth of home loans means it has a pipeline of potentially low-priced properties ahead of it. And since it already has a sizable collection of homes, the company's approach is more balanced than Altisource Residential (RESI +0.00%), which is focused just on debt.

Silver Bay is also touting what it calls estimated net asset value (NAV), which takes into consideration the "estimated fair market value" of the company's properties. At the end of the year Silver Bay's own estimate of its NAV was $20.21 per share. The shares are trading well below that level. So, perhaps there's now an opportunity in buying single-family REITs instead of individual homes.

Regardless of how you look at it, however, the institutional single-family home market has matured quickly. There may still be investment opportunities in the space, but you'll need to be more selective. That goes for individual properties, if that's your game, and the REIT landlords.