Net asset value is a measure of a fund's net worth. It's what's left over after you subtract all of a fund's liabilities from its assets. It's similar to shareholder's equity, which you'd find on the balance sheet of a public company.

Hedge funds are slightly more complicated than mutual funds because they can use more leverage and buy more obscure investments. Even still, calculating the net asset value for a hedge fund should be relatively easy to do if you have access to the hedge fund's financials.

To show you how to calculate the net asset value of a hedge fund, we'll look at the financial statements of Pershing Square Holdings, a publicly traded "hedge fund" that's managed by Bill Ackman. Because Pershing Square Holdings is publicly traded, all investors have access to its balance sheet.

Calculating hedge fund NAVs

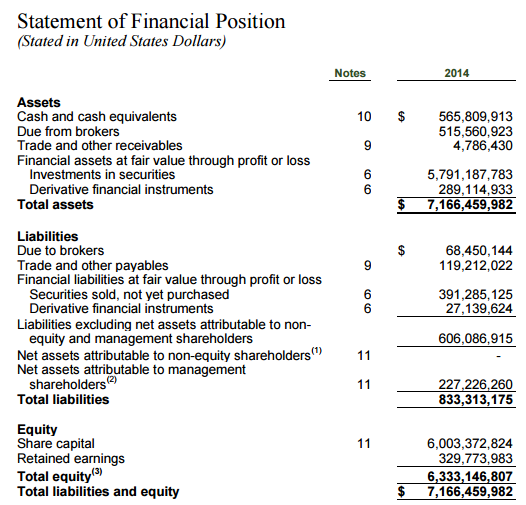

The balance sheet below shows the value of Pershing Square Holding's assets and liabilities as of the end of the 2014 year. We'll start by defining the various assets and liabilities and then calculating the fund's net asset value based on the available data.

Using the balance sheet above as a reference, let's start digesting the Pershing Square Holdings balance sheet, starting with the assets.

The most obvious assets are the fund's cash and cash due from brokers. Cash is, well, cash. Cash due from brokers is basically an account receivable -- a payment that a fund expects from the sale of securities or cash that the fund puts up as collateral on a trade, among other things. Trade and other receivables are similar, related to dividends the company expects to soon collect and interest earned on investments.

Finally, the last remaining assets are the value of the specific investments. Pershing Square Holdings primarily holds stocks, so the total value of all the stock it holds is summed and added to the value of its derivative investments. All of these assets combined tally up to about $7.17 billion.

The liabilities are simpler. Liabilities represent all the amounts owed to other parties, including debt that the hedge fund uses to leverage its returns and fees payable to the manager (trade and other payables and financial liabilities), amounts required to close out a short sale of stock (securities sold, not yet purchased), and payments that are due to brokers for buying investments (due to brokers). Pershing Square Holdings' liabilities tallied $833 million at the end of 2014.

Related investing topics

Tally it up!

When you add up all the assets of Pershing Square Holdings (about $7.17 billion) and subtract all the liabilities (about $833.3 million), you get the fund's net asset value of $6.33 billion. If Pershing Square were to liquidate at the end of 2014, its investors would split up $6.33 billion among them.

Liquidation is unlikely, and it certainly didn't happen in 2014. But knowing its net asset value tells us exactly how much the fund is worth to the people who own the equity -- investors who want to invest in Bill Ackman's ability to pick stocks.