Balancing your portfolio means constructing a portfolio that fits your individual risk tolerance and investment goals. But it isn't enough to just "set it and forget it." You also need to make sure your portfolio stays balanced.

The process of ensuring that your portfolio stays in the desired allocation is known as rebalancing.

Here's a quick summary of what investors should know about balancing and rebalancing an investment portfolio:

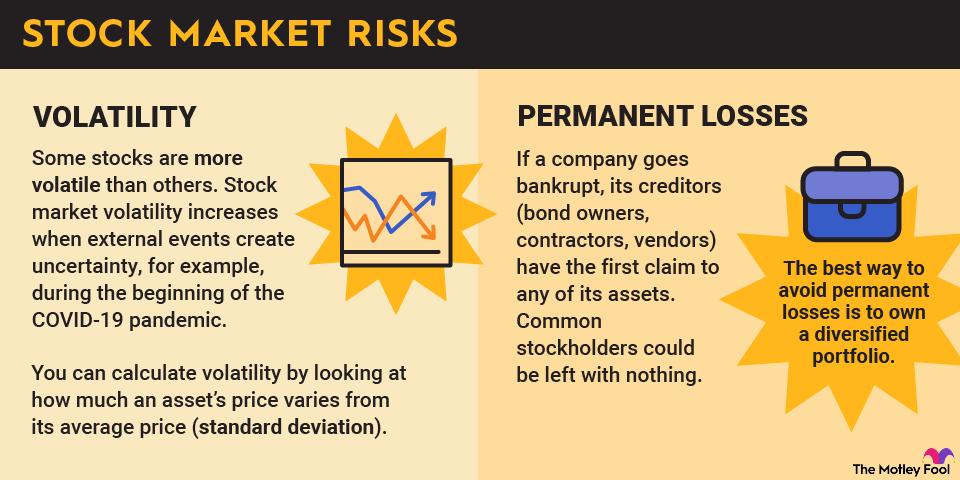

- Balancing your portfolio ensures that you have a mix of investment assets -- usually stocks and bonds -- appropriate for your risk tolerance and investment goals.

- Balancing can also mean making sure you don't have too much of your money invested in any particular stock.

- Rebalancing your portfolio allows you to maintain your desired level of risk over time.

- Portfolios naturally get out of balance as the prices of individual investments fluctuate over time.

- You can rebalance your portfolio at predetermined time intervals or when your allocations have deviated a certain amount from your ideal portfolio mix.

- Rebalancing can be done by either selling one investment and buying another or by allocating additional funds to either stocks or bonds.

With that in mind, what is the goal of balancing and rebalancing your portfolio? Why is balancing and rebalancing a portfolio so important? Let's take a closer look at these important questions.

Why is balancing and rebalancing a portfolio so important?

The purpose of balancing a portfolio is to achieve your desired proportions of risk and return potential in your investment portfolio.

When you first design and commit funds to an investment strategy, that is known as allocating your assets. As a simplified example, let's say that you want to have 70% of your portfolio in stocks and 30% in bonds. When you initially fund your portfolio in this manner, it would be what you consider a balanced portfolio.

The problem is that these allocations in your portfolio don't always stay the same. Let's say the stock market's value doubles in five years while the value of the bonds you own stays the same. I'll spare you the math, but this would give you a roughly 82% stock and 18% bond allocation, which puts your investment portfolio significantly out of balance.

You can and should rebalance your investment account to maintain a balanced portfolio over time. If your original risk tolerance prompted you to invest 70% of your money in stocks, then your rebalanced portfolio should be 70% stocks once again.

How to rebalance your portfolio

How does portfolio rebalancing work? In a nutshell, rebalancing generally means selling one or more assets and using the proceeds to buy others to achieve your desired asset allocations.

Continuing with the example above, you would either sell some of your stock investments and put the money into bonds or buy more bonds to realign your asset allocation with your risk tolerance.

Which of these options sounds more appealing to you?

- Sell existing investments and buy others to increase your allocation.

- Allocate new money strategically. For example, if one stock has become overweighted in your portfolio, invest your new deposits into other stocks you like until your portfolio is balanced again.

You may prefer the second option because rebalancing in the "traditional" way -- without investing any additional money -- often requires you to sell your highest-performing assets.

We're generally fans of the second option since rebalancing by contributing new funds enables you to leave your winners alone to (hopefully) continue to outperform. However, this might not be practical in all cases -- for example, if your IRA is out of balance, your ability to add new money is limited by the annual contribution limit.

Building a balanced portfolio

There's no perfect way to construct a properly balanced investment portfolio. We'll discuss a popular asset allocation rule of thumb in the next section, which will help you determine how much of your portfolio should be invested in bonds and stocks.

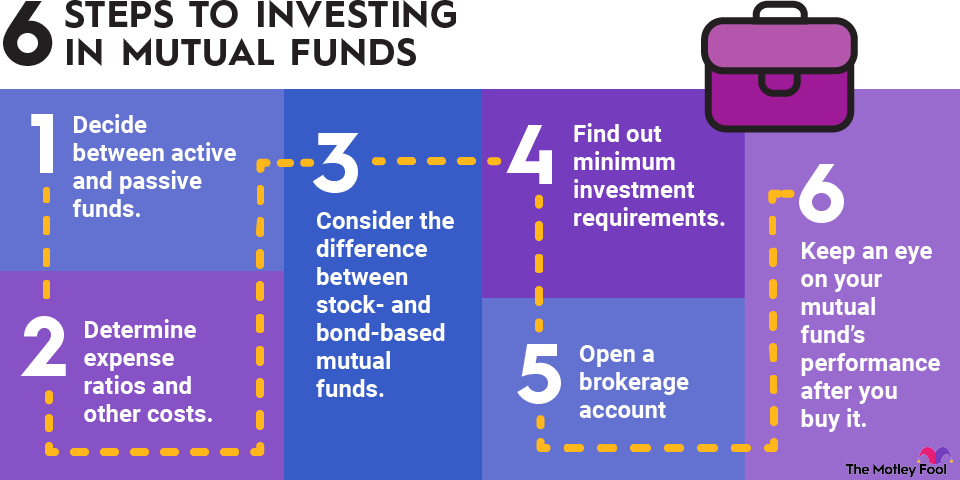

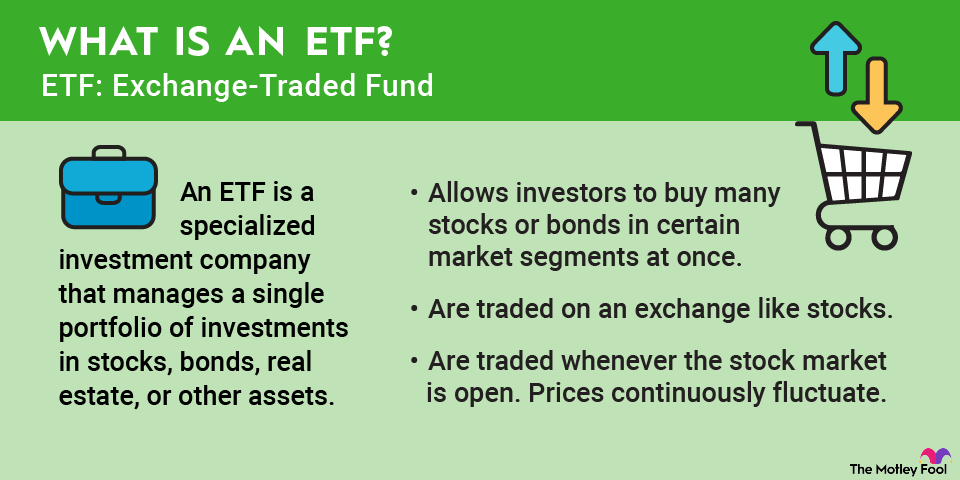

Within those two categories, there are a lot of different directions you can go. Do you want to invest in individual stocks or exchange-traded funds (ETFs) and mutual funds? Should you buy individual bonds like Treasuries or stick with a bond fund?

The point is that balancing a portfolio means something different to different investors. For example, I invest in individual stocks primarily, but don't like to have more than 5% of my portfolio in any single investment. For example, when my investment in Apple (AAPL -0.38%) soared a few years ago, it triggered the need to sell some to rebalance.

Determining how a balanced portfolio looks for you

Unfortunately, there's no perfect method of determining your ideal balanced portfolio.

One method of determining the best asset allocation for you is called the Rule of 110. Subtract your age from 110 to determine what percentage of your portfolio should be allocated to stocks, with the remainder mostly in bonds.

For example, if you are 40 years old, this means that about 70% of your portfolio should be in stocks, with the other 30% in bonds.

You can use this method, but it's also important to consider your individual situation. A portfolio that is balanced for me may not be -- and is probably not -- balanced for you!

When should you rebalance your portfolio?

Once you've determined your target asset allocation and have created a balanced portfolio, the next logical question is, "When should I rebalance my portfolio?"

There are two general ways to approach rebalancing. You can either rebalance your portfolio at a specific time interval (say, yearly), or you can rebalance only when your portfolio becomes clearly unbalanced.

There's no right or wrong method. However, unless your portfolio's value is extremely volatile, rebalancing once or twice a year should be more than sufficient.

Related investing topics

One big advantage of portfolio rebalancing for long-term investors

When market values plunge, instinct tells us to sell our holdings before conditions get worse. And, when market values only seem to rise and "everyone" is making money, that's when we want to put our money into the market. This is human nature, but it is also the exact opposite of buying low and selling high.

Rebalancing your portfolio essentially forces you to sell high and buy low. This is one of the most significant benefits of maintaining a balanced portfolio over time.

For example, if the stock market crashes and equities (stocks) lose 30% of their value, then the bond allocation in your portfolio is likely to become too high. Restoring balance to your portfolio could involve selling some of your bond investments and buying stocks while they're cheap.

Establishing a balanced portfolio and taking steps to keep it that way can help you avoid relying too much on emotions when making important investment decisions.