The Renaissance IPO ETF (IPO -0.72%) is an exchange traded fund (ETF) that provides investors with exposure to a portfolio of companies that have recently completed their initial public offerings (IPOs) in the U.S. This allows investors to participate in the potential growth of these companies before they become widely established in traditional equity portfolios.

NYSEMKT: IPO

Key Data Points

If you're interested in buying shares of the Renaissance IPO ETF, here's what you need to know about how to invest: its holdings, dividends, expense ratio, and more.

What is the Renaissance IPO ETF?

The Renaissance IPO ETF aims to track the performance of the Renaissance IPO Index, a market cap–weighted index of the largest and most liquid recently listed U.S. IPOs. It typically holds stocks for three years after their initial listings, after which they are removed. This ETF provides exposure to multiple IPOs in a single security, reducing the risk of single-stock ownership.

Launched on Oct. 14, 2013, the IPO ETF invests across various sectors and market capitalizations. It uses a full replication technique, which means it directly holds all of the stocks in the index to mirror its benchmark's performance as closely as possible.

Exchange-Traded Fund (ETF)

How to buy the Renaissance IPO ETF

Buying shares of the Renaissance IPO ETF is fast and easy. Here's what you need to do.

- Open your brokerage account: Log in to your brokerage account where you handle your investments.

- Search for the ETF: Enter the ticker or ETF name into the search bar to bring up the ETF's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this ETF.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should I invest in Renaissance IPO ETF?

Whether you should put your money to work in the Renaissance IPO ETF will depend on your individual investing style, risk tolerance, and long-term financial goals.

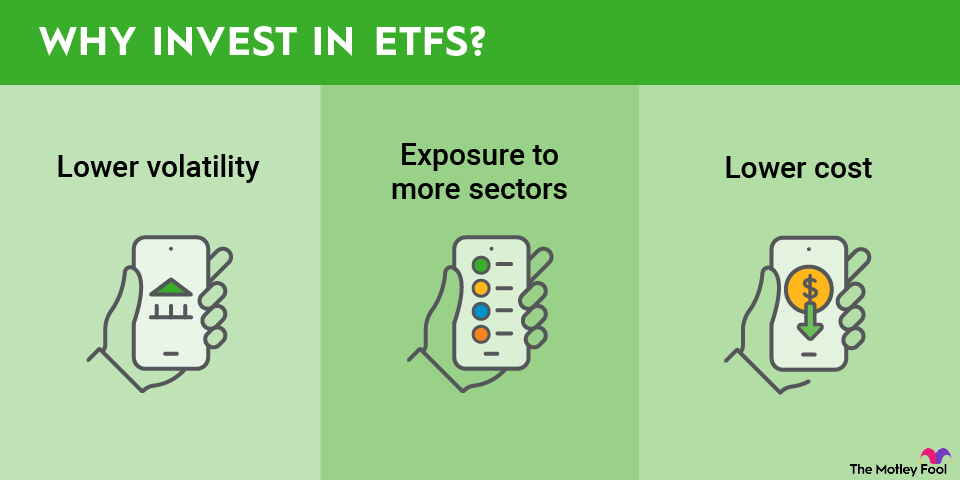

The Renaissance IPO ETF offers several potential benefits for investors, including:

- Exposure to new technologies and innovations. This ETF focuses on companies that have recently gone public, often representing cutting-edge technologies and innovative business models.

- Diversification through new stocks. Investors can diversify their portfolios without having to research and invest in individual IPOs.

- Opportunity to invest before mainstream adoption. The ETF provides investors with the potential to benefit from recent IPOs' growth before wider market awareness.

- Liquidity and flexibility in investing. The IPO ETF is traded on stock exchanges, making it easy to buy and sell shares, and its holdings and performance are transparent and easily accessible to investors.

- Potential for high growth. This ETF provides a way to capture the high growth potential of IPOs through a diversified basket of companies. ETFs generally have lower expense ratios compared to actively managed mutual funds, offering a cost-effective way to invest in IPOs.

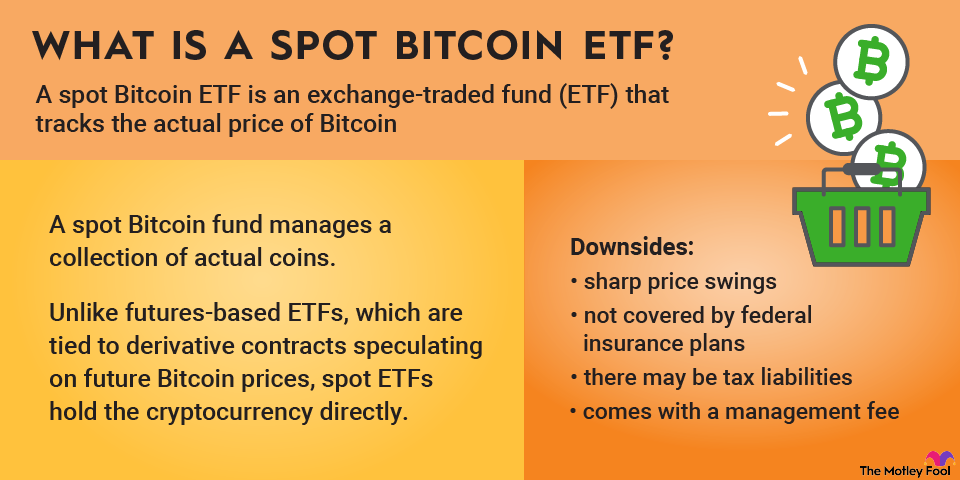

However, there are some downsides to the Renaissance IPO ETF to consider, including:

- Potential for volatility. IPOs can be volatile, and the ETF may experience price swings due to the nature of its holdings.

- Concentration risk. The ETF may be subject to concentration risk, meaning a significant portion of its assets may be concentrated in a few companies.

- Risks associated with growing industries and sectors. The ETF may be subject to sector-specific risks, particularly in the technology and financial sectors, as IPOs are often concentrated in these areas. The Renaissance ETF may also invest in companies from emerging markets, which can be more volatile and less liquid than established markets.

- High portfolio turnover. The ETF may experience high portfolio turnover as new IPOs are added and older ones are removed, which can impact costs and potentially affect returns. The potential for high turnover may make the fund less appealing if you're interested in long-term ETF investing.

Does Renaissance IPO ETF pay a dividend?

Yes, the Renaissance IPO ETF does pay a dividend, which it distributes on a quarterly basis. Its distribution as of Q3 2025 was $0.1758 per share. The ETF yields 0.68%. For context, the average S&P 500 dividend-paying stock yields approximately 1.3%.

What is Renaissance IPO ETF’s expense ratio?

The Renaissance IPO ETF has an expense ratio of about 0.60%. This means that a $10,000 investment in this ETF would incur an annual fee of around $60.

Expense Ratio

Historical performance of Renaissance IPO ETF

Let see how the ETF has delivered on its objective through the years.

Renaissance IPO ETF | 1 Year | 3 Year | 5 Year | 10 Year |

|---|---|---|---|---|

Market Price | 16.42% | 20.73% | -0.88% | 9.85% |

Net Asset Value (NAV) | 16.61% | 20.77% | -0.84% | 9.85% |

S&P 500 Index | 17.60% | 24.94% | 16.47% | 15.30% |

Related investing topics

The bottom line on the Renaissance IPO ETF

The Renaissance IPO ETF may be too risky for some investors, primarily because of the potential downsides associated with investing in newly public companies. IPOs are new stocks that lack an established trading history and research coverage, making them susceptible to significant price fluctuations.

The ETF is disproportionately exposed to sectors like technology and consumer discretionary, which can be highly volatile and sensitive to economic conditions. Many IPO stocks are smaller companies that may have less stable financial performance and higher risk profiles compared to larger, more established companies.

On the other hand, the Renaissance IPO ETF offers investors exposure to a diversified portfolio of newly public companies, specifically those that have recently completed their initial IPOs.

This means investors can gain access to potentially high-growth companies entering the public market without having to individually select IPO stocks. For investors with a healthy risk tolerance and appropriate investment horizon, the ETF could be worth considering.