Foreign exchange trading -- colloquially known as "forex trading" -- has become increasingly popular among retail traders over the past several years. Swapping one currency for another in hopes of capturing interest or exchange rate differences can be a way to make money fast, but it also comes with substantial risks and uncertainties.

Here, we'll give a brief overview of the history of foreign exchange, review why someone might want to trade currencies, explore the forex market as a whole, consider the pros and cons of forex trading, and list and define some of the more common forex trading terms. Finally, we'll offer answers to some of the more commonly asked questions about forex trading.

Understanding forex trading

Foreign exchange trading exists because people use different currencies to buy goods and services across the world. Depending on where you are, you'll be required to use the local currency, whether or not it's the same as your home currency. You might need to exchange the currency you own for another that can be used in day-to-day transactions.

Currency values fluctuate based on supply and demand. As such, you can swap currencies by taking advantage of short-term differences in supply and demand to profit from the exchange rate. In other words, if the value of the currency you own increases relative to another, you can exchange currencies and enjoy a relative advantage in the new currency.

Someone might be interested in forex trading if they're looking to capitalize on short-term exchange rate fluctuations. Forex traders also can conduct business with relatively low (or no) commissions and operate in a market open 24 hours a day, five days a week. Traders can take both long and short positions, and they can also employ leverage when desired. Although leverage can lead to outsized gains relative to initial investments, it can also lead to magnified losses.

Overall, most forex trading is considered speculative; as a result, it's smart to exercise caution when engaging in any sort of currency exchange for profit.

History of forex trading

After World War II, the world economy was in shambles and entered a sustained period of rebuilding. To stabilize prices internationally, the United States created the Bretton Woods system -- a monetary mechanism that pegged all international currencies to the U.S. dollar and the gold standard (within some margin of error). International currencies could then be easily converted to U.S. dollars without major price destabilization.

The Bretton Woods agreement met its demise in 1971, and currencies again began to float freely against one another. This created additional opportunity for traders to capitalize on exchange rate differences between currency pairs. Increasing usage of computer technology allowed for supply and demand to truly dictate the price of any given security and to efficiently swap currencies at large amounts and/or with the use of leverage.

Soon enough, retail traders gained access to low or no-cost trading platforms that made forex trading possible at the personal level. People are now able to trade currencies from their phones at any time of day with very few restrictions. Although this access has created tremendous opportunity, there still exists the possibility for substantial losses when trading currencies at size.

Related investing topics

The forex market

Understanding how the forex market works is key to getting started as a currency trader. First, currencies are listed by a capitalized three-letter code that is standardized across exchanges. Some of the more common codes include USD (U.S. dollar), CAN (Canadian dollar), EUR (Euro), CHF (Swiss franc), JPY (Japanese yen), and GBP (British pound sterling).

Each denomination can be swapped for another, creating what's known as a "currency pair." The four major currency pairs are EUR/USD, USD/JPY, GBP/USD, and USD/CHF. These pairs are the most heavily traded across the foreign exchange market and are important drivers across the international economy.

The first-listed currency in a currency pair is also known as the "base currency," while the second currency is termed the "quote currency," or the "price currency." The listed price represents how much of the quote currency is needed to purchase one unit of the base currency. As an example, the current EUR/USD quote is 1.06, meaning 1.06 USD is needed to purchase one EUR.

The "spot market" is another way of saying the "current exchange rate market." Currency pair prices listed at spot are those that can be settled immediately and at current exchange rates. The idea is that two traders can move their currency right now; there's no need to wait a specified period of time during which rates might fluctuate in either direction.

The "forward market" in the forex world allows traders to lock in a particular exchange rate to buy or sell a specific currency at a certain point in the future. Forwards can be standardized to accommodate different trade sizes and are typically used as a hedging tool to protect against large swings in exchange rates over the life of the forward contract.

The "futures market" in currency trading is similar to the forward market, but contracts are standardized and are traded on an exchange. While forward currency contracts settle at a mutually-agreed upon time, futures contracts are marked-to-market on a daily basis. Futures contracts are also commonly used as a hedging tool against fluctuating exchange rates.

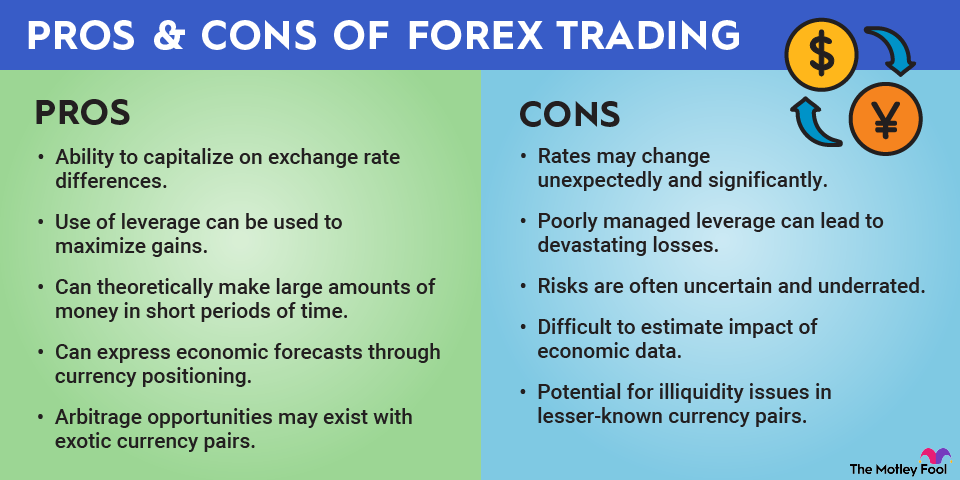

Pros and cons of forex trading

Learn about some of the pros and cons of foreign exchange trading below:

Forex terms to know

Some of the more common currency terms include:

- Currency pair: Two currencies listed in succession, representing the current exchange rate between the two. The first listed currency is known as the base currency, and the second is known as the quote or price currency. A currency pair reflects one currency's value versus another's value.

- Bid-ask spread: The difference between the current bid and ask prices for a currency (or other listed security). The bid price is the highest price a buyer will pay for a particular currency (and at a given size), while the ask price is the lowest price a seller will accept for the same currency.

- Pip: The smallest unit of measurement in currency exchange. It is most directly defined as 1/100th of 1%, or one basis point. In numerical terms, it's presented as either .0001 or .01%.

- Lot: A standard lot represents 100,000 units of currency. A mini-lot represents 10,000 units, while a micro-lot represents 1,000 units.

- Leverage: Another way of saying "borrowed money" in forex trading. Leverage allows a trader to take larger positions in a particular currency, which allows for magnified gains, or, in the opposite case, magnified losses. In other words, traders can be liable to lose more than their initial investment if they decide to employ leverage.

- Margin: A good-faith deposit with a broker that allows a trader to take positions in one or more currencies. If the value of the trader's positions falls below a certain level, they will need to replenish their margin deposit.

- Sniping and hunting: Buying and selling currencies near a specific price point to maximize profit-taking opportunities.

The bottom line on forex trading

It's definitely possible to make money by trading currencies. It's been done before, and it will continue to happen. However, most foreign currency trading is done successfully by large trading institutions that can access global markets instantly, efficiently, and cost-effectively. Institutions also have access to significant amounts of leverage, which can help to amplify profits when trades go right.

The forex trading game for retail traders is a different animal entirely. Because there's such a focus on short-term profits, you'll need to be heavily dialed into minute-to-minute price changes within currency pair markets to achieve any success. And, even if you do have the determination, a lot of external variables have to fall favorably for you to make money over any meaningful period of time.

The Motley Fool stands behind our view that long-term investing is the best way to generate robust wealth. A focus on short-term, speculative strategies has the potential to make you rich, but it also has the potential to cause catastrophic and irreversible losses. Be sure that you're able to detect the difference before putting up any of your hard-earned money.