Novo Nordisk (NVO +1.25%) is a leading global healthcare company headquartered in Denmark. The company has spent the past century helping defeat serious chronic diseases, such as diabetes. In addition to the company's COVID-19 vaccine research leading to the first COVID-19 mRNA vaccine, it developed the breakthrough medication semaglutide to treat type 2 diabetes and weight loss, marketed under the brands Ozempic and Wegovy.

NYSE: NVO

Key Data Points

Sales of the products are soaring, driving a profit margin of 83% with further growth predicted to explode according to Noro Nordisk's 2025 Q2 reporting. That growth potential has many people interested in learning how to invest in Novo Nordisk stock.

How to buy Novo Nordisk stock

As a public company, anyone can invest in Novo Nordisk. Here's a four-step guide to help you add the pharmaceutical stock to your portfolio.

Step 1: Open a brokerage account

You'll have to open and fund a brokerage account before buying shares of any company. If you don't currently have one open, come research which broker will suit you best with our list of the best-rated brokers and trading platforms.

Step 2: Figure out your budget

Before making your first trade, you'll need to determine a budget for how much money you want to invest. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years.

You don't have to get there on the first day, though. For example, if you have $1,000 available to start investing, you might want to begin by allocating that money equally across at least 10 stocks and then grow from there.

Step 3: Do your research

It's essential to thoroughly research a company before buying its shares. You should learn about its competitors, review its balance sheet, find out how it makes money, and consider other factors to make sure you have a solid grasp on whether the company can grow value for its shareholders over the long term.

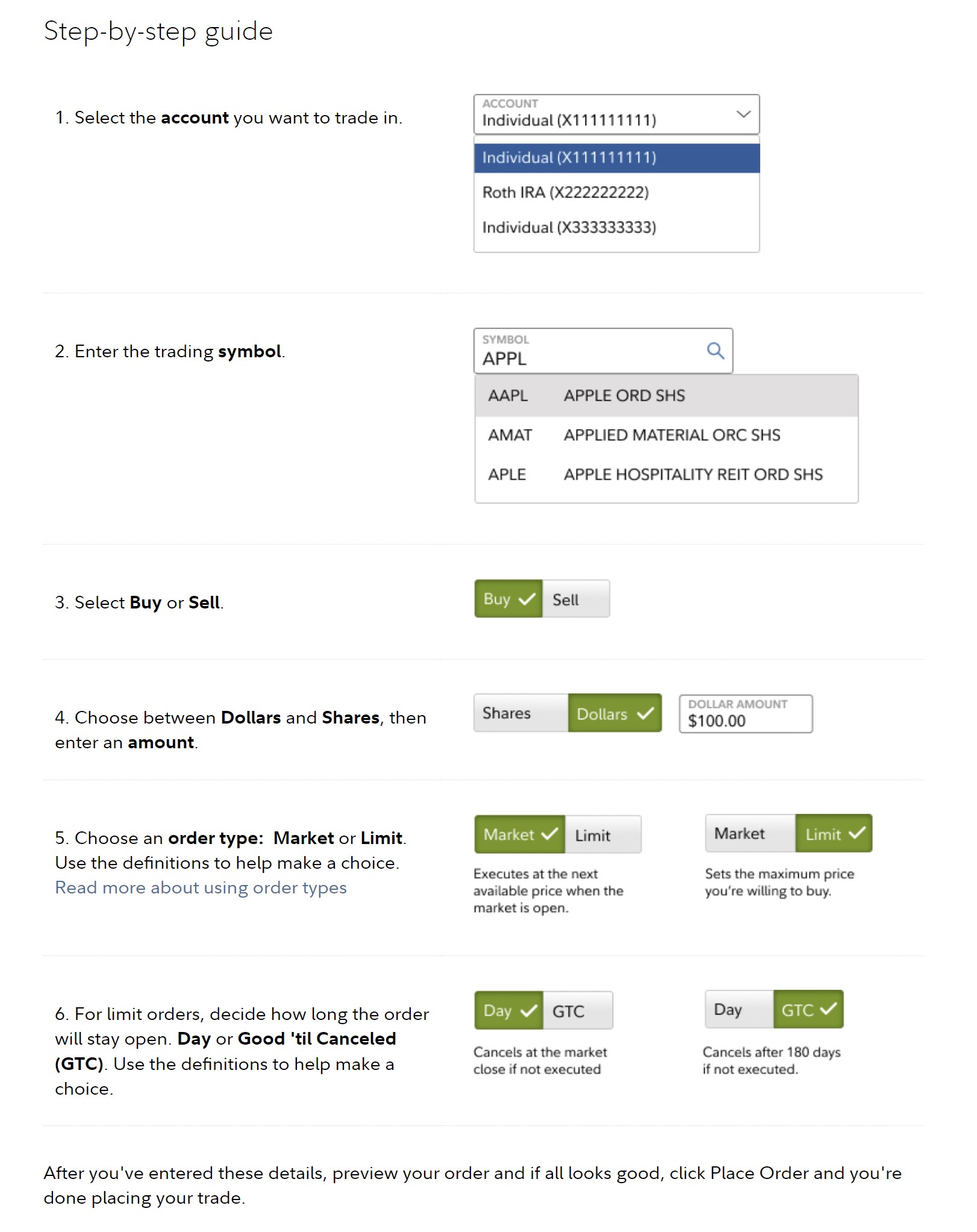

Step 4: Place an order

Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (Novo Nordisk is NYSE: NVO).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at market price.

Here's a screenshot of how to buy a stock with the five-star-rated platform Fidelity:

Once you complete the order page, click to submit your trade and become a shareholder of the pharmaceutical giant.

Should I invest in Novo Nordisk?

Deciding whether to invest in any company is a personal decision that should be based on a number of factors.

- You take one or more medications sold by Novo Nordisk.

- You believe the company's semaglutide products for weight loss and type 2 diabetes have tremendous sales growth potential.

- You want to invest in a company that pays a growing dividend.

- You're comfortable with the risks of investing in a pharmaceutical stock.

- Adding Novo Nordisk would help diversify your portfolio by adding some international exposure.

- You believe the company can grow into its high valuation (over 30% growth rate in operational profit in early 2025).

On the other hand, here are some reasons you might not want to buy shares of Novo Nordisk:

- You're unsure whether weight loss drugs like Wegovy will live up to their hype.

- You're concerned about the company's high valuation or a stock bubble.

- You prefer to take a more natural approach to health and wellness.

- You're in or approaching retirement and need more dividend income than Novo Nordisk currently supplies.

- You already own several other pharmaceutical and healthcare stocks and are worried about over-exposure.

- You'd prefer to only invest in companies headquartered in the U.S.

Is Novo Nordisk profitable?

Researching a company's profitability is important because profits are crucial to its long-term success. Profit growth tends to drive a stock's performance over the long term. That's why investors will want to see that a company is growing its earnings or at least on track to make money.

Novo Nordisk is a very profitable company. It reported 129 billion Danish kroner (about $20.2 billion at the exchange rate in mid-2025) of gross profit in Q3 of 2025. The company's sales were up 21% when compared to 2024. Driving that strong growth was the blockbuster performance of its diabetes and obesity treatments.

The company expects those blockbuster drugs to continue driving strong sales growth in 2025 and beyond. It anticipates sales rising 14% in 2025, which should drive more than 20% operating profit growth.

Meanwhile, the company expects to deliver solid sales and operating income growth in 2026, driven by a target of capturing a third of the global diabetes market and controlling over 71% of the market for more specific drugs across the world.

Novo Nordisk's growing sales and profits position it to deliver strong free cash flow, which should enable it to return lots of money to shareholders in the coming years through dividends and share repurchases.

Does Novo Nordisk pay a dividend?

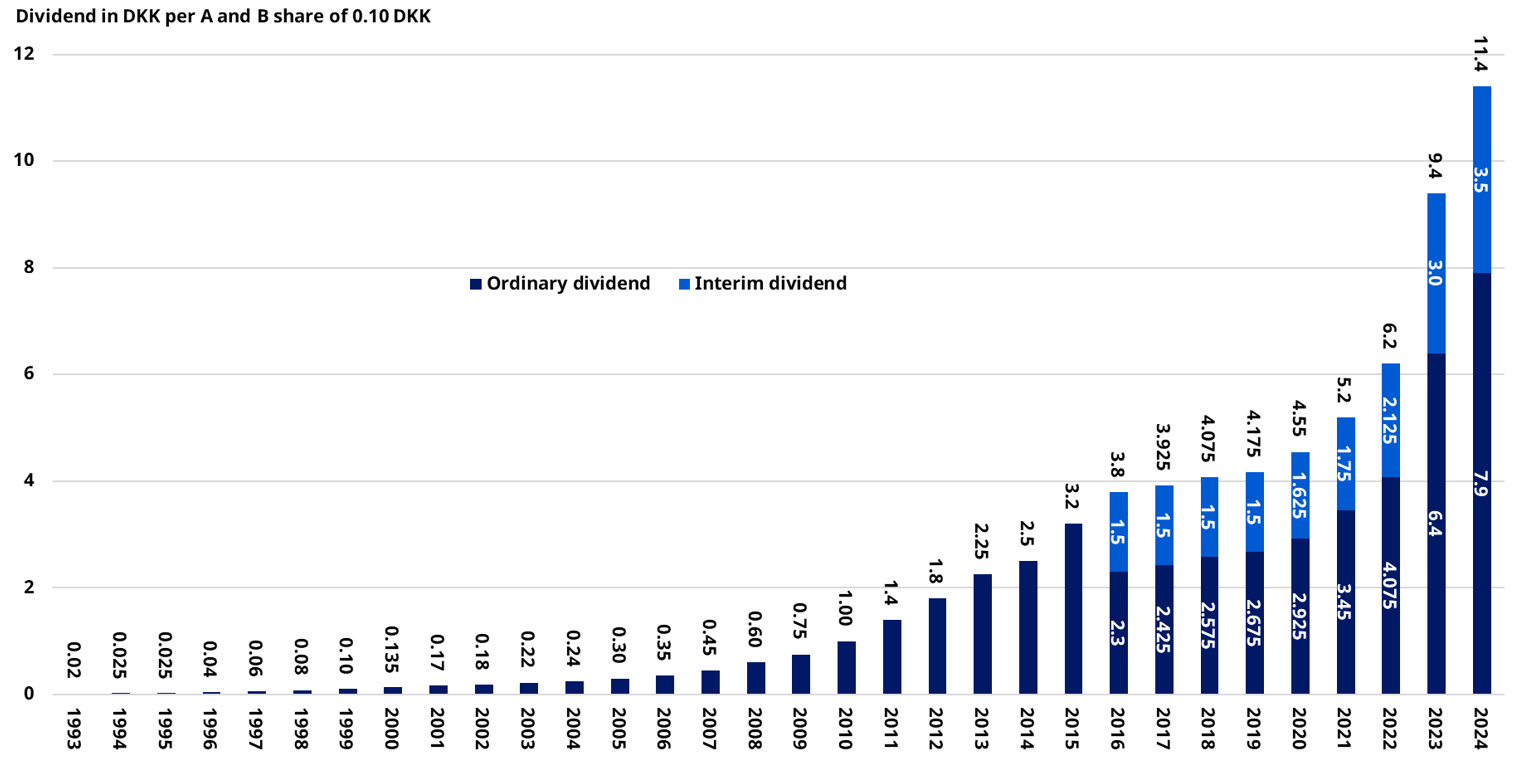

Novo Nordisk's guiding principle is to return any excess capital after funding its growth to investors via dividends and share repurchases. It has a long history of paying dividends to its shareholders. Payouts have steadily risen over time as the company's profits and excess cash flow have increased. As of 2025, Novo Nordisk is paying 3.2% in dividends, but this is always subject to change.

One thing worth pointing out about Novo Nordisk's dividend is that it pays on a different schedule than its counterparts in the U.S. pharmaceutical industry. Whereas most U.S. companies pay quarterly dividends, European companies tend to pay annual or biannual dividends. Novo Nordisk moved from paying annual to biannual dividends in 2016.

ETFs with exposure to Novo Nordisk

Many prefer to invest passively instead of actively picking a portfolio of stocks that they must manage. Thanks to exchange-traded funds (ETFs), that's very easy nowadays. Many ETFs allow you to gain passive exposure to a company, theme, or broad market index.

Stock Split

The bottom line on Novo Nordisk

Novo Nordisk has developed several blockbuster drugs over the years. Its latest breakthroughs for Type 2 diabetes and weight loss are selling briskly, which could drive robust profit growth for the global pharmaceutical giant. That could send its share price higher in the coming years, making it a potentially lucrative investment.