BlackRock (BLK +1.03%) is a leading global investment management firm. The company hit a record $12.5 trillion of assets under management (AUM) toward the end of 2025. These assets run the gamut from shares in large publicly traded companies to single-family homes and critical infrastructure assets like pipelines. The company manages these assets on behalf of retail, institutional, and exchange-traded fund (ETF) clients.

NYSE: BLK

Key Data Points

At its core, BlackRock is in the asset management business, meaning it manages assets on behalf of the clients who own those resources. So, while BlackRock's funds hold significant stakes in some of the largest companies in the world, the investors in those funds actually own the equity interests in those companies -- not BlackRock.

BlackRock is a massive company with significant assets on its balance sheet ($57.9 billion at the end of 2025's third quarter). In addition, while BlackRock will seed new funds with balance sheet capital and co-invest in others, they're relatively small investments.

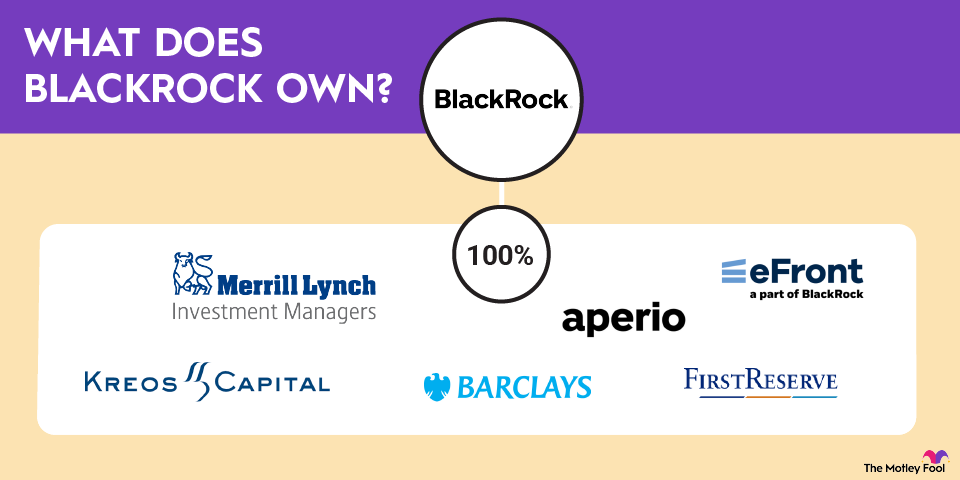

To help address some of the misconceptions about BlackRock, here's a look at some of the companies it actually owns and a peek at what it might buy next. Understanding what BlackRock owns and does will help investors better understand the company and determine whether they want to invest money in its stock.

What companies does BlackRock own?

BlackRock has acquired several companies over the years to expand its investment management capabilities. Here's a look at some of the companies it now owns:

1. Merrill Lynch Investment Management

The company bought Merrill Lynch Investment Management in 2006 to expand its retail and international investment management capabilities. It paid $9.7 billion for the business, creating one of the largest investment management firms with almost $1.5 trillion in assets under management (AUM) at the time.

2. Barclays Global Investor

BlackRock bought the investment management arm of British bank Barclays (BCS +0.34%), Barclays Global Investor (BGI), in 2009 for $13.5 billion. The transformational transaction created the world's biggest asset manager, doubling BlackRock's AUM to $2.7 trillion.

As part of the deal, BlackRock acquired the popular exchange-traded fund (ETF) platform iShares. The platform now manages more than $3.3 trillion in AUM across 1,400 ETFs. Its largest ETF is the iShares Core S&P 500 ETF (IVV +0.82%), with almost $590 billion in AUM in 2025. It was the third-largest ETF in the world by AUM at the time.

3. First Reserve Infrastructure Funds

The company bought the equity energy infrastructure franchise of First Reserve for an undisclosed sum in 2017. The acquisition of First Reserve Infrastructure Funds expanded the BlackRock Real Assets platform to $36.5 billion in client assets.

4. Kreos Capital

BlackRock bought private debt manager Kreos Capital for a reported $400 million in 2023. The company is a leading provider of growth and venture debt funding for companies in the healthcare and technology sectors. The acquisition bolstered BlackRock's leading global credit asset management capabilities while enhancing its ability to provide clients with private market investment products and solutions.

5. eFront

The investment management firm bought eFront in 2019 for $1.3 billion. The acquisition helped strengthen BlackRock's technology platform.

6. Aperio Group

The company bought Aperio in 2021 for about $1.1 billion. Aperio is a pioneer in customizing tax-optimized index equity separately managed accounts (SMAs). It builds and manages personalized public equity portfolios for clients.

7. Global Infrastructure Partners (GIP)

BlackRock closed its acquisition of Global Infrastructure Partners in October 2024. The $12.5 billion deal created a world-leading infrastructure investment platform for private markets. The market-leading multi-asset-class platform had more than $170 billion in AUM when the deal closed.

8. SpiderRock Advisors

The investment management firm bought the remaining equity interest in SpiderRock Advisors in early 2024 after initially making a minority investment in 2021. SpiderRock enhances the company's ability to offer personalized SMAs, one of the fastest-growing product segments in the U.S. wealth industry.

Asset Management

Other investments

In addition to wholly owned companies, BlackRock has made several strategic minority investments, including:

- Acorns: The company invested in the micro-investing app in 2018. BlackRock has expanded the partnership and its investment over the years, and it is now an anchor investor in Acorns.

- iCapital: BlackRock increased its stake in the leading technology platform for alternative investments in 2020. It's the largest minority investor in the company.

What companies could BlackRock buy in the future?

BlackRock is an active acquirer. It routinely makes tactical acquisitions to expand its investment management platform. The company reached agreements to acquire additional companies in 2024:

- Prequin: BlackRock agreed to buy the leading independent provider of private markets data for $3.2 billion in cash in mid-2024. The acquisition will expand its tech business into the rapidly growing private market's data sector.

- HPS Investment Partners: The company agreed to buy the leading global credit investment manager for $12 billion in stock in December 2024. The deal will create an integrated private credit franchise with $220 billion in client assets.

Given that the company has already made several acquisitions in 2024, it could be a while before BlackRock makes its next deal because it will need to spend some time integrating the new businesses. However, when the company is ready to make another deal, it has the financial flexibility to continue buying companies.

BlackRock has a well-defined strategy for inorganic investments. It will make tactical acquisitions to build out its platform capabilities and make strategic minority investments in companies it could seek to acquire.

Related investing topics

The bottom line on companies BlackRock owns

There are a lot of misconceptions about the companies BlackRock owns. The investment manager is often one of the top shareholders of many large U.S. companies. However, it manages those shares on behalf of clients in its ETFs and other investment products that are the actual equity owners in the companies and other assets BlackRock manages. BlackRock owns a few companies, such as investment management and technology platforms. Learning about what BlackRock owns and how it makes money can help investors gauge whether it's a good stock to buy and hold for the long term.