There's a lot of confusion about what makes up an official recession and how long it typically lasts. That's because while a recession tends to feature at least two consecutive quarters of declining gross domestic product (GDP), there's more to it than that simple definition. The National Bureau of Economic Research (NBER), which officially tracks recessions, takes more factors into account than GDP.

Here's a closer look at what comprises a recession, how long they typically last, and a history of past recessions. We'll also look at how to prepare your finances and portfolio for a downturn.

What is it?

What is a recession?

The NBER defines a recession as a "significant decline in economic activity that is spread across the economy and lasts more than a few months." It interprets this definition using three criteria -- depth, diffusion, and duration -- in a somewhat interchangeable manner. While a recession needs to meet each factor to some degree, there are extreme cases where the severity of one component can partially offset the lack of another. For example, the economic decline in early 2020 due to the COVID-19 pandemic was so severe and widely dispersed that the NBER classified it as a recession despite a very short duration.

A recession must be a broad-based decline in economic activity, so the NBER uses several data points to measure economic changes. These include:

- Real personal income (less transfers)

- Nonfarm payroll employment

- Employment as measured by the household survey

- Real personal consumption expenditures

- Wholesale-retail sales adjusted for price changes

- Industrial production

The NBER doesn't have fixed rules to determine the measures that contribute to its process or how much it weighs these factors in making an official declaration of a recession. However, it has put more weight on real personal income (less transfers) and nonfarm payroll employment in recent decades to influence its determination of when a recession starts and ends.

Causes

What causes recessions?

Recessions tend to happen because of one of the following catalysts:

- An overheating economy: Most recessions occur because the economy overheats as demand grows faster than supply and expands past full employment and the capacity of the country's resources. A typical overheating economy features rising inflation and unemployment below the natural rate (historically between 4.6% and 6.3%).

- A financial bubble: The rupturing of an asset bubble can cause a recession. For example, the popping of the "dot.com" stock market bubble caused a recession in 2001, while the housing bubble burst caused a recession in 2007-09.

- An economic shock: An external shock to the economy can also cause a recession. For example, oil price shocks in the 1970s and 1980s drove the country into a recession, as did the COVID-19 pandemic in early 2020.

Duration

How long do recessions last?

According to the NBER, the average recession since 1854 has lasted about 17 months. However, recessions have been much shorter since World War II, with the typical economic downturn lasting approximately 10 months in the U.S. They can be much longer than that -- the Great Recession lasted 18 months -- or very short -- the COVID-19 recession of 2020 only lasted two months.

A recession's duration generally depends on several factors, including market conditions, the underlying cause, and the response. For example, the underlying cause of the financial crisis (an asset bubble) prolonged that downturn. On the other hand, the economy quickly recovered from the COVID-19 shock because it was in good shape heading into the recession. There was also a swift response from the Federal Reserve Board and Congress to jump-start the economy.

It's also important to note that recessions tend to be much shorter than economic expansions.

The economic cycle typically features a multiyear expansionary phase -- usually four to five years -- followed by a contraction of less than 18 months on average.

History

History of U.S. recessions

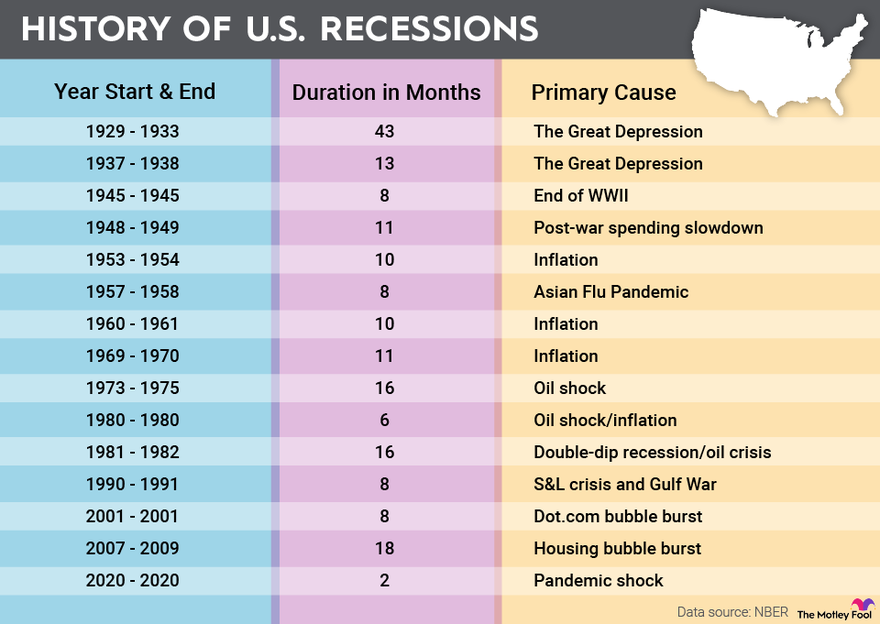

The NBER has been tracking U.S. recessions since the late 1850s. Here's a look at the history of U.S. recessions since the Great Depression:

Preparation

How to prepare for a recession

While the NBER focuses on several data points when determining a recession, two important factors are real personal income and nonfarm payroll employment. That's because most recessions feature a decline in household earnings as companies reduce compensation and headcount due to slowing business conditions. As a result, recessions can have a significant impact on household finances.

The best way to prepare for a recession is to get your financial house in order before one occurs. Steps you can take to improve your family's finances include:

- Evaluate your finances: Take the time to thoroughly review your finances, including available cash savings, debt, monthly living expenses, and planned major life events. Make necessary spending adjustments to free up additional financial flexibility for other uses.

- Increase your emergency fund: Make sure you have an emergency fund with at least three to six months of expenses saved up. Start increasing your savings to build up a bigger emergency fund.

- Focus on repaying debt. Continue making your debt payments. If possible, pay more than the minimum on your credit cards since that would give you more financial flexibility during a recession.

- Consider your career opportunities: Recessions can lead to job losses. It's important to have a backup plan in case you lose your job. Stay connected with your professional network, update your resume, and consider ways to gain new skills. It might also be helpful to pick up a side hustle or start freelancing if you're worried about losing your job.

Preparing for a recession in advance can help take away some of the stress should one occur and affect your income.

Investors can also prepare their portfolios for a possible recession. One way to invest in a recession is to shift from cyclical stocks to more defensive, recession-proof stocks. Investors can also increase their cash position by selling lower-conviction holdings to have more money to invest in opportunities that could arise during a recession.

Related investing topics

The bottom line

Although there's no specific rule determining a recession, an economic downturn usually occurs when wages and employment decline due to an overheated economy, a bursting asset bubble, or an economic shock. They tend to last several months and can be challenging periods for consumers.

However, recessions eventually give way to expansionary periods, which tend to last much longer. It's best to prepare for a recession before it happens so you can endure the short-term challenges as you wait for the eventual recovery.

FAQ

Recession FAQ

Are we currently in a recession?

As of late 2024, the NBER had not officially declared that the U.S. was in a recession. There have been some concerns that high interest rates to combat inflation would slow the economy. While higher rates have negatively affected the real estate industry and other rate-sensitive sectors, it hasn't yet spilled over into the broader economy. Likewise, employment remains strong despite weaker job numbers heading into the election.

What was the longest recession in history?

The longest recession in U.S. history was the Long Depression, which began in 1873. It was a series of recessions that lasted for more than five years and was caused by the U.S. financial markets' inability to keep pace with industrialization and monetary policies.