Over-the-counter (OTC) markets are stock exchanges where stocks that aren't listed on major exchanges such as the New York Stock Exchange (NYSE) can be traded. About 12,400 stocks trade over the counter. The companies that issue these stocks choose to trade this way for a variety of reasons.

Here's a rundown of how the over-the-counter stock markets work and the types of securities you might find on the OTC markets. We'll also discuss some other key information you should know before you decide whether OTC stocks are right for you.

What are they?

What are the over-the-counter (OTC) markets?

Historically, the phrase trading over the counter referred to securities changing hands between two parties without the involvement of a stock exchange. However, in the U.S., over-the-counter trading is now conducted on separate exchanges.

Over-the-Counter (OTC)

OTC Markets Group (OTCM -2.63%) is the name of the company that operates a public market for securities that, for one reason or another, don't trade on major stock exchanges such as the NYSE and the Nasdaq stock exchange. It also provides a real-time quotation service to market participants, known as OTC Link.

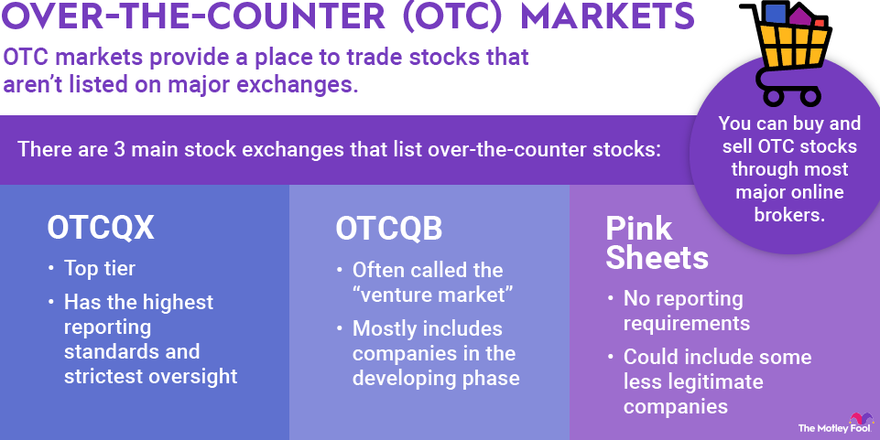

The term OTC markets refers to the stock exchanges that list more than 12,000 over-the-counter securities. Although they are often thought of as one big financial market, there are actually three separate stock exchanges that list over-the-counter stocks:

- Best Market (OTCQX): This is the most selective of the three. Only 4% of all OTC stocks listed are traded on the OTCQX Best Market. It has the highest reporting standards and strictest oversight. Companies must be up-to-date on all regulatory disclosures and must maintain audited financials, just to name a couple of requirements. The Best Market generally consists of foreign companies that list on major exchanges abroad, as well as some U.S. companies that plan to eventually list on the NYSE or the Nasdaq.

- Venture Market (OTCQB): The middle tier, the OTCQB Venture Market, has a large concentration of developing companies. OTCQB companies have to report their financials and submit to some oversight. One key takeaway is that companies that list on either of the Best or Venture markets are committing to follow U.S. securities law.

- Pink Sheets: Companies traded on the Pink Sheets, also sometimes called the OTC Pink Sheets, have no reporting requirements and don't have to register with the Securities and Exchange Commission (SEC). Although there are some legitimate companies on the Pink Sheets, this is where you'll find many shell companies and other companies with no actual business operations. Most stocks that fit the definition of penny stocks can be found on the Pink Sheets. (Note: In the book/movie The Wolf of Wall Street, which was based on true events, most of the stock scams were conducted with Pink Sheets securities.)

- Gray Market: This isn't an official OTC stock market but is worth mentioning. A gray market is an unofficial market for securities, and it is where stocks that are unlisted (by choice or by force) trade.

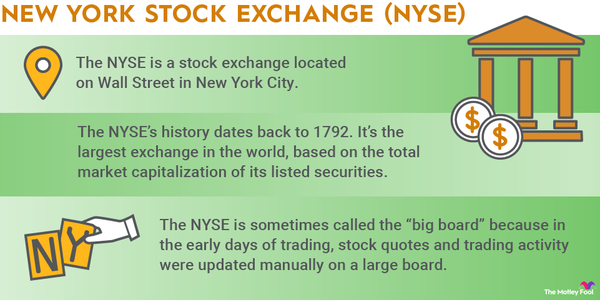

Before we move on, it's important to mention that there are some big differences between the OTC markets and the major exchanges like the NYSE and Nasdaq. Most significantly, OTC markets are decentralized. Unlike the NYSE and Nasdaq, they don't have a central physical location and use a network of broker-dealers that facilitates trades directly between investors. In contrast, the major exchanges have centralized locations and use matching technology to process trades immediately.

Pros and cons

Pros and cons of investing in OTC markets

Like any type of investment, putting your money into stocks that trade on the OTC markets has advantages and potential drawbacks. A wide variety of companies trade on the OTC markets, so it's unfair to generalize all OTC stocks. However, there are some general pros and cons to consider. Here are a few:

| Pros of OTC Markets | Cons of OTC Markets |

|---|---|

| Ability to invest in earlier-stage companies that aren't big enough to trade on the NYSE or Nasdaq. | Lower barriers to entry than major markets, which leads to increased fraud, especially in the Pink Sheets market. |

| Ability to invest in foreign companies that primarily trade on non-U.S. stock exchanges. | OTC stocks can be thinly traded and less liquid than NYSE- and Nasdaq-listed securities. It's also common to see significantly wider bid/ask spreads in OTC stocks for this reason. |

| Ability to invest in companies that are unable to list on a major U.S. exchange, such as most marijuana stocks. | Less strict reporting standards than major exchanges, which means investors have less visibility into a company's operations. |

Examples

Examples of over-the-counter securities

A few types of securities that trade on the OTC markets can potentially make good investments.

For example, you'll often find international stocks (including many large and well-known companies) listed on the OTC markets. Stocks listed on U.S. exchanges that primarily trade in foreign markets are known as American Depository Receipts, or ADRs.

Samsung Electronics (SSNL.F 9.01%) is one great example. The electronics giant has a market cap of more than $250 billion (USD equivalent) and trades primarily on the Korea Exchange. So, unless you have a brokerage account that allows you to buy stock on foreign markets, you'll have to buy the OTC version.

You'll also find stocks on the OTC markets that cannot list on the NYSE or the Nasdaq for legal or regulatory reasons.

Finally, many stocks list on the OTC markets simply because they're too small or too thinly traded to meet the standards of larger exchanges. Many of these companies plan to list on either the NYSE or the Nasdaq as they grow. For example, Walmart (WMT 0.44%) was an OTC stock from 1970-72, when the company was still a relatively small retail chain.

Other major exchanges

Other major exchanges

How to buy OTC stocks

How to buy OTC stocks

The process of buying OTC stocks is relatively easy. Because they trade like most other stocks, you can buy and sell OTC stocks through most major online brokers.

To buy shares of an OTC stock, you'll need to know the company's ticker symbol and have enough money in your brokerage account to buy the desired number of shares. It's worth noting that brokers may have special margin requirements and other restrictions with OTC stocks. For example, OTC stocks might not be eligible for fractional share trading.

Should you buy OTC stocks?

Should you buy OTC stocks?

Although it’s easy to buy OTC stocks, the tougher question to answer is whether you should buy OTC stocks.

As we've seen, some types of stocks trade on the OTC markets for very good reasons, and they could make excellent investment opportunities. On the other hand, many OTC stocks are issued by highly speculative businesses or even outright fraudulent companies involved in pump-and-dump scams.

As long as you understand the OTC marketplace and do your research on the stocks that interest you, you can avoid scams and other bad investments on the OTC and focus on finding solid long-term investments.

FAQs

OTC Market FAQs

What is the over-the-counter market?

Over-the-counter markets are those where stocks that aren't listed on major exchanges such as the New York Stock Exchange or the Nasdaq can be traded. More than 12,000 stocks trade over the counter, and the companies that issue these stocks choose to trade this way for a variety of reasons.

What are examples of OTC securities?

You'll often find international stocks (including many of large companies) on the OTC markets. Nestle (OTC:NSRGY) is one good example. The food and drink conglomerate is based in Switzerland and primarily trades on the SIX Swiss Exchange, but it also lists its shares on the Euronext and OTC markets to allow investors without easy access to the Swiss stock exchange to buy shares.

How do you buy OTC stocks?

Because they trade like most other stocks, you can buy and sell OTC stocks through most major online brokers. To buy shares of an OTC stock, you'll need to know the company's ticker symbol and have enough money in your brokerage account to buy the desired number of shares.