Industrials are the companies that keep the economy running. They build and move essential goods, maintain critical systems, and provide services that businesses and governments rely on every day.

For investors, industrial stocks offer a mix of stability and cyclical upside. Some operate steady, cash-generating businesses that can hold up during downturns. Others are more sensitive to economic growth, benefiting when construction, manufacturing, and global trade accelerate. The best long-term industrial investments tend to share a few traits: durable demand, strong balance sheets, and the ability to keep investing through economic cycles.

Industrial stocks include companies across a wide range of real-economy activities, such as commercial and professional services, transportation and logistics, aerospace and defense, industrial machinery, construction equipment, electrical equipment, and waste management. Because the sector touches so many parts of the economy, industrial performance often reflects broader business conditions, making company quality and financial strength especially important.

Here are some of the best industrial stocks to consider, along with a framework for how to evaluate the sector.

Top industrial stocks to consider

These industrial stocks are some of the sector’s most durable long-term investments:

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| WM (NYSE:WM) | $93.2 billion | 1.43% | Commercial Services and Supplies |

| FedEx (NYSE:FDX) | $73.5 billion | 1.83% | Air Freight and Logistics |

| Ge Vernova (NYSE:GEV) | $187.9 billion | 0.18% | Electrical Equipment |

| Lockheed Martin (NYSE:LMT) | $137.7 billion | 2.24% | Aerospace and Defense |

| Caterpillar (NYSE:CAT) | $299.0 billion | 0.93% | Machinery |

1. Waste Management

NYSE: WM

Key Data Points

Waste Management (WM +0.11%), or WM, is one of the leading waste management companies in North America. It provides waste collection, transfer, and disposal services, as well as recycling and resource recovery. The company is also a leading developer and operator of landfill gas-to-energy facilities that produce renewable natural gas (RNG).

It provides its services to residential, commercial, industrial, and municipal customers. With demand for waste hauling relatively stable, its business is more recession-resistant than other industrial companies.

Over the years, WM has invested in automating its collection truck fleet and converting it to run on cleaner, cheaper natural gas, including RNG. Moves like these have allowed WM to consistently generate free cash flow, giving it the funds to make acquisitions. In late 2024, it acquired Stericycle to expand its comprehensive environmental solutions into the growing healthcare sector. It's also investing $3 billion through 2026 on new or upgraded recycling facilities and RNG production facilities, and plans to make another $100 million to $200 million of tuck-in acquisitions in 2026.

The company also routinely returns money to shareholders via dividends and share repurchases while maintaining an investment-grade balance sheet. It hiked its dividend 14.5% for 2026 -- its 23rd straight year of increases -- and approved a new $3 billion share repurchase authorization. This strategy of expanding and also rewarding shareholders has enabled WM to create significant shareholder value over the years.

2. FedEx

NYSE: FDX

Key Data Points

3. Lockheed Martin

NYSE: LMT

Key Data Points

Lockheed Martin (LMT +0.39%) is a leading global security and aerospace company. It researches, designs, develops, and manufactures advanced technology systems, products, and services, primarily for government customers. The defense contractor has four main business segments: aeronautics, missiles and fire control, rotary and mission systems, and space.

The company invests billions of dollars annually on research and development (R&D) to advance the latest defense technology. It routinely complements its internal R&D program with acquisitions. In late 2024, the company acquired Terran Orbital to enhance its space capabilities. It also bought Amentum's Rapid Solutions business in 2025 to enhance its ability to deliver innovative defense technology.

The defense contractor should continue growing in the coming years. Recent wars in Ukraine and the Middle East have increased global defense spending. That trend will likely continue as geopolitical tensions remain high.

Lockheed Martin also has an excellent record of returning cash to shareholders through dividends and repurchases. In late 2025, it delivered its 23rd annual dividend increase, while boosting its share repurchase authorization by $2 billion to boost its available remaining capacity to $9.1 billion.

4. Caterpillar

NYSE: CAT

Key Data Points

5. GE Vernova

NYSE: GEV

Key Data Points

The practical takeaway for investors is simple: timing and quality matter more in cyclicals than in many other sectors.

How to identify the best industrial companies

The strongest industrial companies tend to share three traits:

- Diversified operations: Less dependence on any single end market or customer base

- Cost advantages: Efficient operations that hold up under inflation or weak demand

- Strong balance sheets: Investment-grade credit and access to capital, which matters in a capital-intensive sector

Because industrial demand can drop quickly in a downturn, investors should pay close attention to how a company performs in stressful periods. Companies with strong liquidity and disciplined capital allocation are often in the best position to keep investing while competitors pull back.

How to buy industrial stocks

Anyone can buy industrial stocks. Here's a step-by-step guide on how to add one to your portfolio:

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should you buy industrial company stocks?

Industrial stocks can be a good fit if you want exposure to the real economy and are comfortable with some cyclical volatility.

They may be a better fit for you if:

- You want a mix of dividend income and long-term growth

- You can hold through economic cycles

- You prefer businesses with tangible demand drivers and pricing power

You may want to be more cautious if:

- You need short-term stability

- You are investing heavily near the early stages of a recession

- You are uncomfortable with cyclical drawdowns

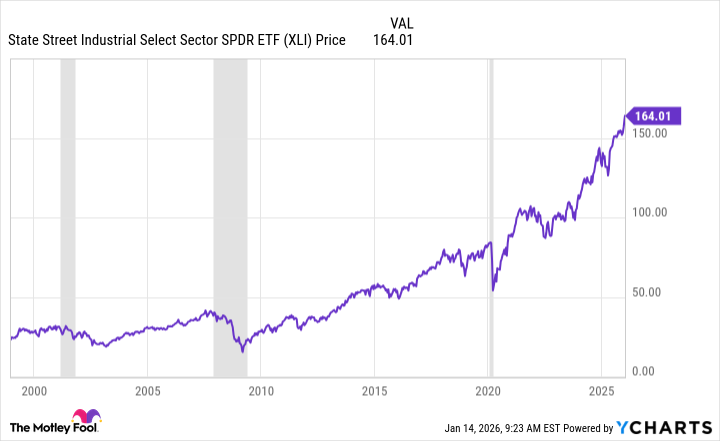

If you want diversification without choosing individual stocks, industrial ETFs can also provide broad exposure.