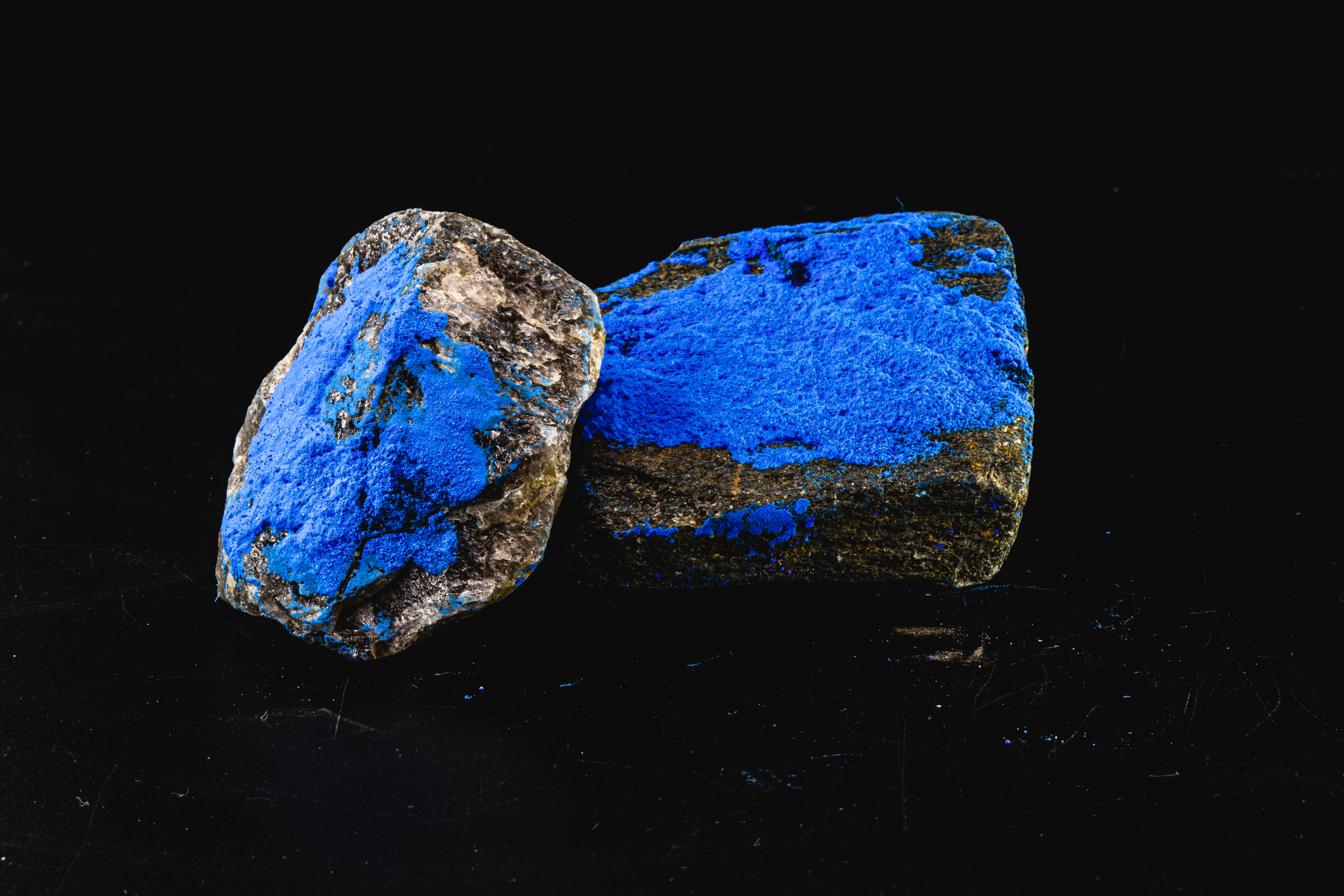

Cobalt exchange-traded funds (ETFs) are investment vehicles that focus on holding stocks involved in cobalt mining. This common element is typically a byproduct of refining copper or nickel and has widespread uses. Cobalt is essential for many commercial, industrial, and military applications.

However, a big demand driver in recent years has been its use in electric vehicles (EVs). The leading use of cobalt is in electrodes for rechargeable lithium-ion batteries. As more automakers electrify their vehicles, the demand for cobalt should rise.

Many mining companies extract cobalt for commercial purposes, though few focus specifically on the metal. That can make it hard for investors to choose the best option to take advantage of the potential growth in cobalt demand to support EVs. Investors may want to consider taking a broader approach by investing in an exchange-traded fund (ETF) with exposure to the cobalt sector.

Here's a closer look at some of the top ETFs to consider buying to capitalize on the expected rise in cobalt demand.

Investing in top cobalt ETFs in 2025

Since cobalt is obtained by mining other metals, no ETF focuses solely on the metal. However, investors can invest in this essential element through various mining stocks and base materials ETFs.

Exchange Traded Fund | Annual Expense Ratio | Assets Under Management | Description |

|---|---|---|---|

Vanguard Materials ETF (NYSEMKT:VAW) | 0.09% | $4.1 billion | An ETF that invests in mining and base materials stocks |

iShares MSCI Global Metals & Mining Producers ETF (NYSEMKT:PICK) | 0.39% | $846.6 million | An ETF that holds a portfolio of metal and material mining stocks from around the world |

Amplify Lithium & Battery Technology ETF (NYSEMKT:BATT) | 0.59% | $92.3 million | A fund focused on stocks in the lithium-ion battery industry |

ProShares S&P Global Core Battery Metals ETF (NYSEMKT:ION) | 0.58% | $4.2 million | An ETF focused solely on companies mining battery metals |

1. Vanguard Materials ETF

The Vanguard Materials ETF is a large fund that focuses on companies producing base materials and metals. It offers broad exposure to the material sector (including cobalt) for a very low ETF expense ratio of 0.09%.

NYSEMKT: VAW

Key Data Points

The ETF held nearly 110 stocks as of late 2025. It's most heavily weighted toward specialty chemicals (22.8% of the fund's holdings) and industrial gases (20.9%). However, it offers exposure to copper producers (4.1%), many of which also tend to produce cobalt.

The Vanguard Materials ETF offers a modest dividend yield of 1.7% (higher than the S&P 500's yield of around 1.1%), making it an option for investors seeking passive investment income. Although it's not a pure play on cobalt, this ETF is lower risk because it offers broader exposure to the entire materials sector.

NYSEMKT: PICK

Key Data Points

The iShares MSCI Global Metals & Mining Producers ETF has top holdings in some of the world's largest cobalt producers. Notable names include Glencore (GLNCY +0.19%) and top copper producer BHP Group (BHP -0.34%), which obtains cobalt from its nickel and copper refining activity.

3. Amplify Lithium & Battery Technology ETF

The Amplify Lithium & Battery Technology ETF also isn't a direct investment in cobalt. The fund focuses more on battery technology, which is a key driver of cobalt demand. The small ETF held nearly 55 battery-related stocks as of late 2025.

NYSEMKT: BATT

Key Data Points

NYSEMKT: ION

Key Data Points

As of late 2025, it held over 50 companies. Many of its top holdings are lithium stocks. However, it also owns shares in top global mining companies, such as BHP Group and Glencore, which produce some cobalt. Given its focus on battery metals, the stocks in the ETF have lots of growth potential as EV adoption accelerates.

Benefits and risks of investing in cobalt ETFs

Investing in cobalt ETFs has pros and cons. Some of the benefits include:

- Growth potential: Demand for cobalt should rise in the future due to its usage in electrodes for batteries.

- Diversification: ETFs can provide broad exposure to companies that mine cobalt and other metals, as well as battery technology companies.

Meanwhile, some of the risks of investing in cobalt ETFs are:

- No pure plays: No mining companies or ETFs focus solely on cobalt because it's a byproduct produced by mining other metals. Because of that, you can't invest specifically in a pure-play cobalt ETF.

- Underperformance potential: An ETF might underperform a mining company with meaningful exposure to cobalt due to its diversification.

How to choose the right cobalt ETF?

Investors need to consider a few factors to determine which cobalt ETF is right for them, including:

- Investment focus: Since there are no true pure-play cobalt ETFs, investors need to decide whether they want an ETF focused on mining stocks or battery technology to gain exposure to cobalt.

- Fund size: Small ETFs are at risk of closing and returning capital to investors.

- Cost: Investors need to determine whether an ETF's expense ratio is worth it.

Related investing topics

ETFs offer exposure to cobalt and more

Since cobalt is a byproduct of other mining activities, investing directly in the element outside of specific mining stocks isn't easy. Cobalt prices are also likely to be volatile, as supply and demand fluctuate from year to year. Investing in an ETF, along with other metal and base materials stocks, could be a top way to play this key ingredient in EVs and batteries.