Real estate investment trusts, or REITs, are known for their dividends. The average dividend yield for REITs was over 4% in late 2025 -- triple the dividend yield of the average dividend stock. (The S&P 500's dividend yield was approaching 1%.) Meanwhile, some high-dividend REITs offer yields significantly more than the industry average, potentially making them excellent options for those seeking passive income from real estate.

Types of high-dividend REITs

There are two main types of REITs:

- Equity REITs: These REITs invest in equity ownership of commercial real estate, entitling them to the rental income generated by a property. Equity REITs pay out a percentage of their cash flow in dividends and often have high yields.

- Mortgage REITs: Mortgage REITs invest in real estate-backed loans, such as mortgages. These investments generate interest income, which the REITs distribute to investors by paying dividends.

What to look for in a REIT before investing

It's important to look at more than a REIT's yield when investing for dividend income. You'll want to look at metrics that will give you more insight into the health of a REIT and how likely it is to provide you with sustainable dividend payments each year.

You want to make sure the dividend yield isn't too good to be true when investing in a high-dividend REIT. There are a few red flags to look for that may point to some trouble on the horizon.

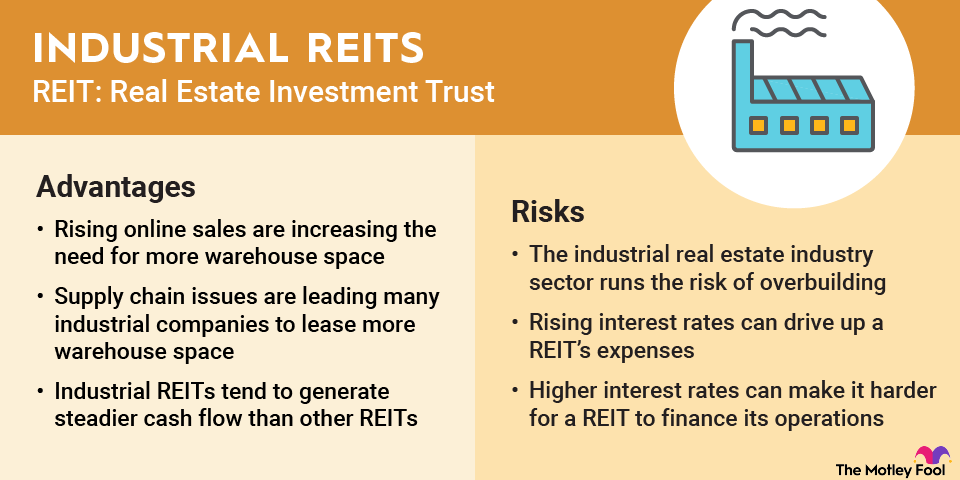

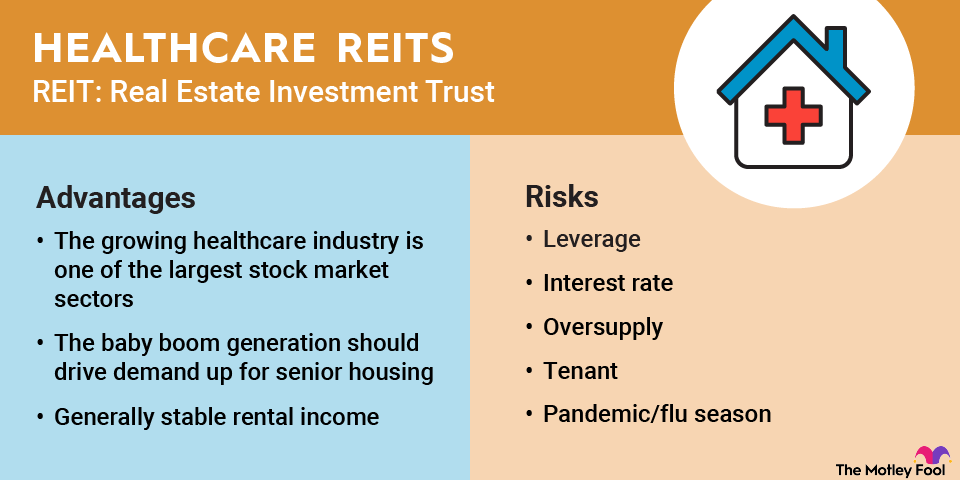

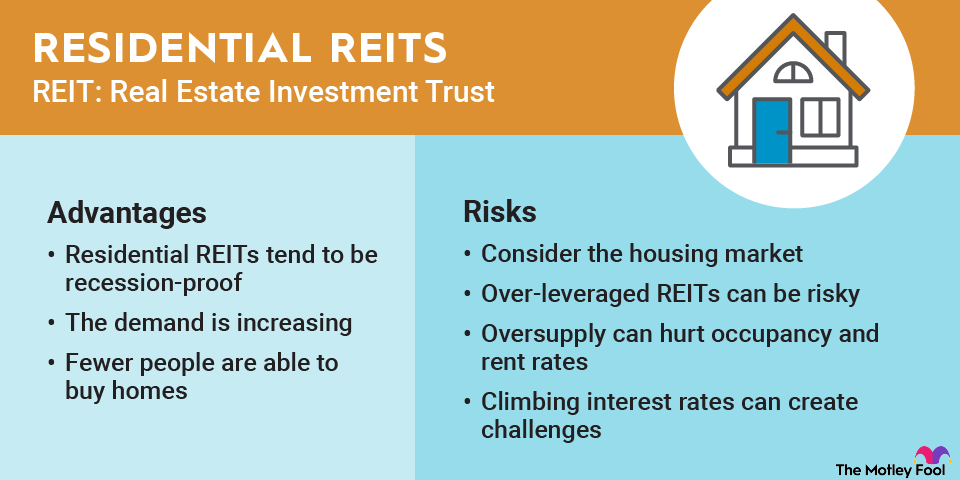

- A high leverage ratio: A REIT may be paying high dividends because it's using too much leverage to acquire its properties. They are quite vulnerable to any dips in the real estate market or spikes in vacancy if their real estate investment portfolio is overleveraged. Ideally, look for a REIT with a leverage ratio below 6.0 times.

- High dividend payout ratio: REITs pay high dividends because the IRS requires that they pay 90% of their taxable income to shareholders. However, that taxable income doesn't include tax deductions like depreciation. That gives them some room to keep cash on hand. Most REITs use metrics like funds from operations (FFO) to better reflect the actual cash flow they produce that they could use to pay dividends. Ideally, a REIT should have a payout ratio of less than 80% of its FFO.

- Declining cash flow: A major red flag for any type of investment is falling earnings. A bad quarter can be easily overlooked. A steady decline in income is usually something to stay away from. A REIT may be invested in properties leased to struggling tenants or property types that are losing demand, which would hurt their rental income. They may also be selling properties to pay off debt, which would also result in less rental income.

1. Realty Income

NYSE: O

Key Data Points

Realty Income lives up to its name. The diversified REIT declared its 664th consecutive monthly dividend in late 2025. The company had increased its payout for 112 consecutive quarters and every year since it went public in 1994. It has grown its payout at a 4.2% annual rate since its public market listing.

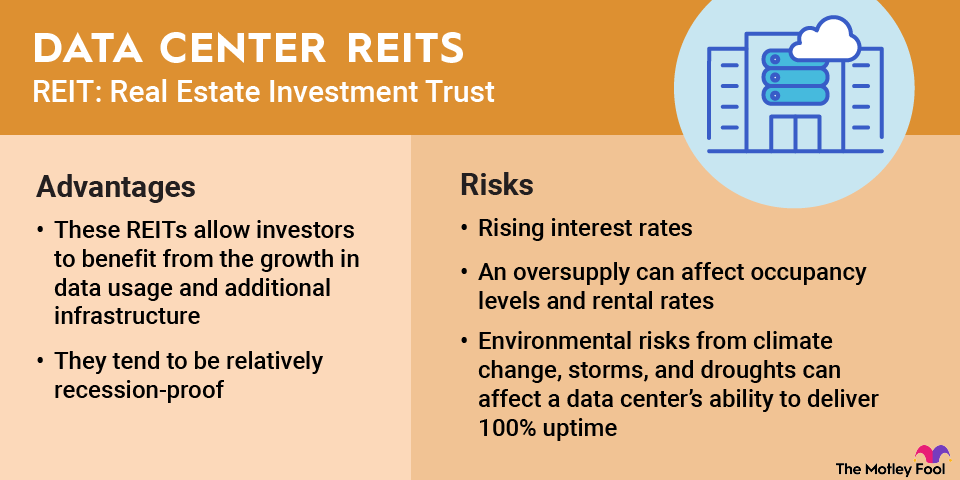

The REIT generates very stable rental income. It owns a diversified portfolio of properties across the retail, industrial, gaming, and data center sectors. More than 90% of its rent comes from tenants in industries resilient to economic downturns or isolated from the pressures of e-commerce. The REIT net leases these properties to high-quality tenants under long-term contracts, often with annual rental escalation clauses. Those leases supply the REIT with steadily rising rental income.

Meanwhile, Realty Income has a conservative dividend payout ratio (less than 75% in late 2025) and one of the strongest balance sheets in the REIT sector (5.4 times leverage ratio). Those features give it the financial flexibility to acquire additional income-producing properties. Those new investments will grow its income, allowing Realty Income to continue increasing its dividend.

2. NNN REIT

NNN REIT is a retail REIT that owns freestanding properties triple net leased (NNN) to growing national and regional retailers. It focuses on durable properties like automotive services, convenience stores, restaurants, and family entertainment centers. Those leases provide it with steadily rising rental income.

The REIT has an exceptional record of increasing its dividend. It delivered its 36th consecutive year of dividend growth in 2025. That put it in an elite group. Only two other REITs and fewer than 80 publicly traded companies in the U.S. have delivered 35 or more years of increasing their dividends.

NNN REIT is in an excellent position to continue increasing its high-yielding dividend. It has a low dividend payout ratio (less than 70% of its FFO in late 2025) and a conservative balance sheet with a 5.6x leverage ratio. That gives it the financial flexibility to continue buying income-producing retail properties. Its steadily growing portfolio and cash flow should enable it to continue increasing its high-yielding dividend.

3. Vici Properties

NYSE: VICI

Key Data Points

More real estate topics

Investing for dividend income

High-dividend REITs can provide consistent income to investors. However, it's important to do your research when choosing REITs to avoid falling into a yield trap. Realty Income, NNN REIT, and Vici Properties all have well-covered payout ratios, sound financial profiles, and growing rental income, so these three high-dividend REITs should provide investors with steadily rising dividend income in the coming years.