Greenwashing is the practice of using misleading or false environmental or sustainability claims to appeal to consumers or investors. Companies use greenwashing as a way to capitalize on rising consumer interest in environmental and social issues. One way they do this is by building marketing campaigns around green slogans, whether or not these campaigns have any basis in reality.

According to a 2024 study by RepRisk, global greenwashing cases saw a 12% decrease for the first time in six years. Meanwhile, high-severity cases surged by more than 30%, while almost 30% of companies flagged for greenwashing in 2023 were repeat offenders in 2024.

According to RepRisk's findings, cases in the European Union experienced a notable drop, while U.S. cases saw a slight increase over the year after previously showing a brief downward trend. Companies are using various tactics to mislead consumers and investors, including vague or ambiguous language, irrelevant claims, and opacity.

However, consumers and investors are demanding sustainability and companies are responding. That’s the good news.

According to a study by Morgan Stanley (MS -0.51%), 77% of investors have expressed interest in sustainable investing, with 57% saying their interest has grown in the past two years. In the U.S., 84% of individual investors are interested in sustainable investing, with Millennials and Generation X showing the highest interest.

Several factors are driving the growth of sustainable investing, including changing regulations, investment performance, an increasing number of options, and broader megatrends like the clean energy transition.

Many companies are taking steps toward corporate social responsibility or a positive environmental impact. That said, sustainable investors need to weed out greenwashed companies from committed businesses.

This article covers how to spot greenwashing and how to find companies committed to people, planet, and profits.

What is greenwashing?

Greenwashing is any sort of false, misleading, or vague claim about the sustainable nature of a product or company. If the marketing campaigns cost more than the steps taken toward sustainability, it is a clear case of greenwashing. Some companies, for example, now place green leaves or green packaging on their products to make consumers believe they are working for the environment or sustainability.

The types of greenwashing are as varied as the companies creating them. Here are some common greenwashing techniques:

Misleading claims

Unless a term is regulated, claims such as “all natural,” “organic,” or “no harmful chemicals” may be used to mislead consumers. Food, supplements, cosmetics, and personal care product companies are frequent offenders when it comes to greenwashing claims. Other misleading claims can include “recycled,” “made with recycled materials,” “carbon-neutral,” “sustainable,” or “environmentally friendly.”

Irrelevant claims

Companies use irrelevant claims to appear better than competitors even though all products in the category have the same property. Examples are a laundry detergent free of a banned substance or a food product that is naturally without gluten sporting a “gluten-free” label.

Unsubstantiated claims

There are a vast number of regulated official seals, including certified B Corp, LEED-certified buildings, USDA Organic, and Energy Star. A company making a claim without a regulated third-party certification or other proof may be engaged in greenwashing.

Natural imagery

A verdant meadow or a pristine ocean landscape can conjure images of a positive environmental impact. Companies play on consumer psychology and automatic assumptions to create a sustainable public image that may be unsubstantiated.

Larger carbon footprints

Some companies will attempt to make green or vegan products while creating a larger carbon footprint. This is especially true of petroleum, clothing, and textile companies. Although the product may appear sustainable, check the overall effect. A variation on this theme is when companies reduce their carbon footprint in the U.S. while increasing emissions in other countries where they operate.

These misleading actions can influence consumers and investors by building a false sense of trust or shared goals. For sustainable investors, these companies may have none of the benefits of environmental, social, and governance (ESG) such as reduced long-term potential risks. They also have a major downside: a lack of transparency in reporting practices and marketing that can lead to additional risk or volatility in the future.

How greenwashing works

Greenwashing capitalizes on public awareness of and enthusiasm for pressing issues such as climate change and social justice. Since marketing is an unregulated field, many companies build effective marketing campaigns that lead the public to believe they are making a difference. These claims range from an exaggeration of impact to false claims or irrelevant information.

Greenwashing takes advantage of human psychology by delivering information in a way that portrays a green or eco-friendly image. Marketing professionals are skilled at creating an impression even if it is false or baseless. Eco-conscious investors need to be aware of the natural assumptions people tend to make when exposed to these marketing campaigns.

In some cases, the greenwashing campaign may seem like it involves harmless claims. However, such campaigns have two dangerous effects. First, they build consumer trust and market share for companies that are not taking action to combat the very serious issues of climate change and social injustice. Second, they lull investors into supporting companies that may actually be harming the environment more than competitors.

How to spot greenwashing

If ESG investing is a priority, investors will need to do independent research. Look for consumer labels with clearly defined standards. These third-party certifications assure investors that companies have invested the resources into upholding established standards for their stated values.

The MSCI and Sustainalytics ESG ratings are third-party certifications of companies related to environmental, social, and governance issues. MSCI rates more than 680,000 equity and fixed income securities and 8,500 companies globally. This ESG rating system scores companies on a scale of 0 to 10.0 and gives a corresponding rating from CCC to AAA. Leading ESG companies achieve ratings of AA or AAA.

ESG reporting can also offer insight into company practices and ESG priorities. However, there is not yet a standard reporting system, allowing companies to potentially greenwash their reports. Look for those using the most respected ESG reporting frameworks for their reports such as the IFRS, GRI, UNPRI, or SASB standards.

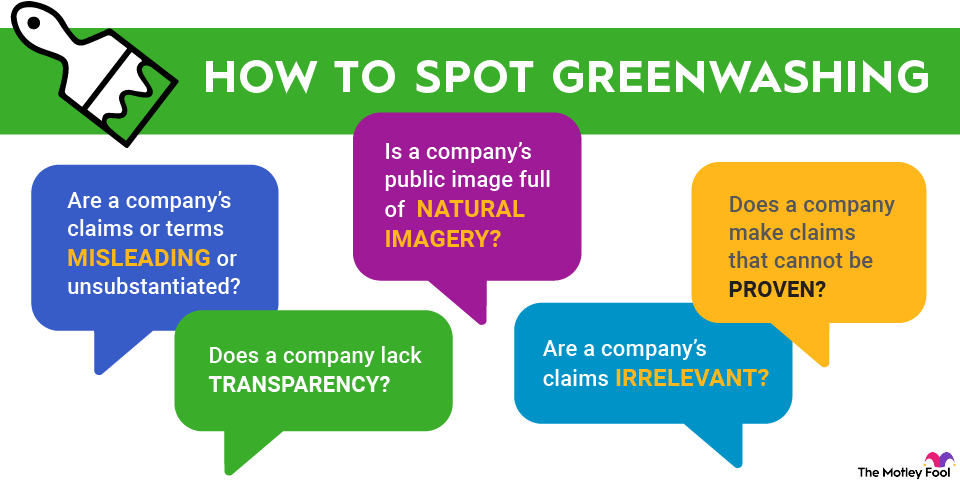

In summary, beware and do more research if you see any of the following greenwashing practices:

- Vague claims

- Unsubstantiated claims or slogans

- Irrelevant claims

- Lack of proof

- Lack of transparency

- Natural imagery

Investors have power in their hands. By learning to spot greenwashing, investors can support companies that meet sustainability metrics for corporate social responsibility and environmental impact as well as financial benchmarks.