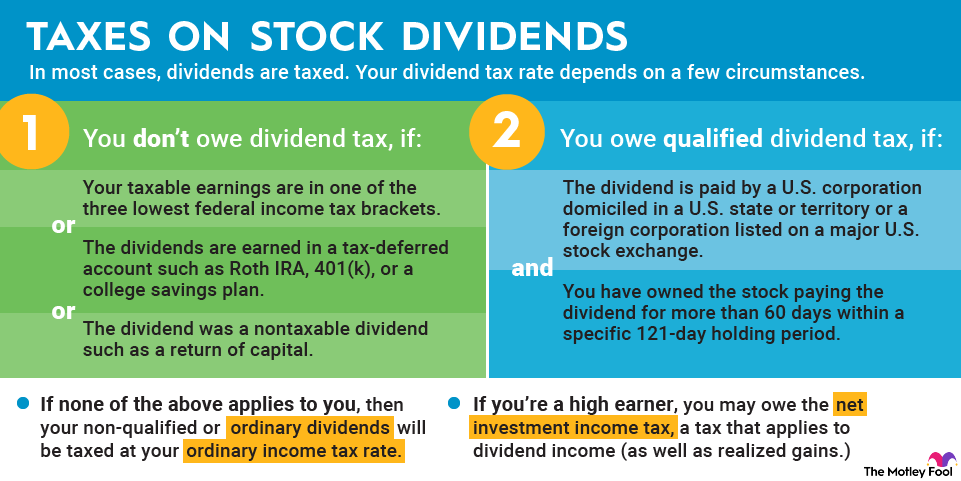

Like other investment earnings, dividend income is generally taxable. However, the amount you owe depends on several factors: your taxable income, the type of dividend you received, and the kind of account holding the investment. Understanding these factors can help you plan ahead and potentially minimize what you owe.

When dividends aren't taxed

While the IRS taxes most dividend income, there are important exceptions worth knowing about.

- Retirement and tax-advantaged accounts: Dividends paid on stocks held in retirement accounts -- Roth IRAs, traditional IRAs, 401(k)s, 529 plans, and Coverdell ESAs -- are not taxed. Most income and capital gains in these accounts are tax-deferred or tax-free. One caveat: certain pass-through entities like master limited partnerships can create tax obligations even in retirement accounts.

- Low-income earners: If your taxable income falls into the three lowest federal tax brackets, you won't owe any tax on qualified dividends. For 2025, that means single filers with taxable income of $48,350 or less, or married couples filing jointly with $96,700 or less. These thresholds increase to $49,450 and $98,900 respectively for 2026.

- Return of capital: Some companies pay what looks like a dividend but is classified as a return of capital, essentially sending back part of your original investment. These payments aren't taxable when you receive them, but they reduce your cost basis in the stock, which means you'll pay more in capital gains tax when you eventually sell.

Here's how that works: If you buy a share for $20 and receive a $0.50 return of capital dividend, your cost basis drops to $19.50. When you sell that share later, you'll owe capital gains tax on an extra $0.50 of profit per share.

What determines your dividend tax

Three factors determine whether and how much you'll owe on dividend income:

- Type of investment account: You may owe tax on dividends from stocks in a taxable brokerage account. You won't owe tax on dividends from stocks in retirement accounts (Roth IRA, 401(k)) or college savings plans (529 plan, Coverdell ESA), with limited exceptions for certain pass-through entities.

- Type of dividend: Qualified dividends are taxed at preferential capital gains rates (0%, 15%, or 20%). Ordinary (nonqualified) dividends are taxed at your regular income tax rate. Return of capital distributions aren't immediately taxable but reduce your cost basis.

- Your taxable income: Your tax bracket determines the rate applied to both qualified and ordinary dividends. Lower earners benefit most from qualified dividend treatment—those in the bottom three tax brackets pay 0% on qualified dividends.

Qualified vs. ordinary dividends

The distinction between qualified and ordinary dividends makes a significant difference in what you owe. Qualified dividends are taxed at favorable capital gains rates, while ordinary dividends are taxed at your regular income rate -- potentially 37% for high earners.

For a dividend to qualify for preferential treatment, it must meet two criteria:

- Source requirement: The dividend must be paid by a U.S. corporation or a qualified foreign corporation listed on a major U.S. stock exchange. Note that payouts from real estate investment trusts (REITs), master limited partnerships, and certain other pass-through entities typically don't qualify. They're taxed as ordinary income.

- Holding period requirement: You must own the stock for more than 60 days within a 121-day window that begins 60 days before the ex-dividend date. This prevents traders from buying stock just before the dividend, collecting the payment, and immediately selling while still getting preferential tax treatment.

2025 Dividend tax rates

Qualified dividends in 2025

2025 Qualified Dividend Tax Rate | For Single Taxpayers | For Married Couples Filing Jointly | For Heads of Household |

|---|---|---|---|

0% | Up to $48,350 | Up to $96,700 | Up to $64,750 |

15% | $48,350 to $533,400 | $96,700 to $600,050 | $64,750 to $566,700 |

20% | More than $533,400 | More than $600,050 | More than $566,700 |

Ordinary dividends in 2025

2025 Ordinary Dividend Tax Rate | For Single Taxpayers | For Married Couples Filing Jointly | For Heads of Household |

|---|---|---|---|

10% | Up to $11,925 | Up to $23,850 | Up to $17,000 |

12% | $11,925 to $48,475 | $23,850 to $96,950 | $17,000 to $64,850 |

22% | $48,475 to $103,350 | $96,950 to $206,700 | $64,850 to $103,350 |

24% | $103,350 to $197,300 | $206,700 to $394,600 | $103,350 to $197,300 |

32% | $197,300 to $250,525 | $394,600 to $501,050 | $197,300 to $250,500 |

35% | $250,525 to $626,350 | $501,050 to $751,600 | $250,500 to $626,350 |

37% | Over $626,350 | Over $751,600 | Over $626,350 |

2026 Dividend tax rates

Qualified dividends in 2026

2026 Qualified Dividend Tax Rate | For Single Taxpayers | For Married Couples Filing Jointly | For Heads of Household |

|---|---|---|---|

0% | Up to $49,450 | Up to $98,900 | Up to $66,200 |

15% | $49,450 to $545,500 | $98,900 to $613,700 | $66,200 to $579,600 |

20% | More than $545,500 | More than $613,700 | More than $579,600 |

Ordinary dividends in 2026

2026 Ordinary Dividend Tax Rate | For Single Taxpayers | For Married Couples Filing Jointly | For Heads of Household |

|---|---|---|---|

10% | $0 to $12,400 | $0 to $24,800 | $0 to $17,700 |

12% | $12,401 to $50,400 | $24,801 to $100,800 | $17,701 to $67,450 |

22% | $50,401 to $105,700 | $100,801 to $211,400 | $67,451 to $105,700 |

24% | $105,701 to $201,775 | $211,401 to $403,550 | $105,701 to $201,775 |

32% | $201,776 to $256,225 | $403,551 to $512,450 | $201,776 to $256,200 |

35% | $256,226 to $640,600 | $512,451 to $768,700 | $256,201 to $640,600 |

37% | $640,601 or more | $768,701 or more | $640,601 or more |

The Net Investment Income Tax for high earners

High-income investors face an additional tax on dividend income. The Net Investment Income Tax adds 3.8% to your effective tax rate on dividends and capital gains if your modified adjusted gross income exceeds $200,000 (single filers) or $250,000 (married filing jointly).

This surtax applies to both qualified and ordinary dividends, meaning a high earner in the top bracket could pay up to 23.8% on qualified dividends (20% + 3.8%) or as much as 40.8% on ordinary dividends (37% + 3.8%).

Even with this additional tax, qualified dividends still receive significantly preferential treatment compared to regular income -- an important consideration when building a tax-efficient portfolio.

The bottom line

Dividend taxation is more nuanced than it first appears, but the key takeaway is simple: qualified dividends receive favorable tax treatment that can save you significant money over time. For investors in the lowest tax brackets, qualified dividends are completely tax-free. For others, the maximum 20% rate (or 23.8% with the Net Investment Income Tax) is substantially lower than ordinary income rates.

The preferential treatment doesn't reduce investment risk, but it does let you keep more of your returns. When evaluating dividend-paying stocks, factor in the tax implications along with the yield -- a slightly lower-yielding qualified dividend may deliver better after-tax returns than a higher-yielding ordinary dividend or REIT distribution.