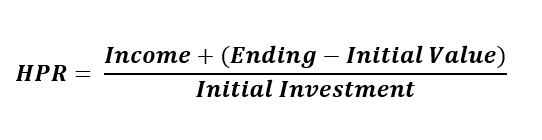

Example of holding period return

We'll look at two examples to illustrate this concept. First, consider a bond investment. We'll say you invest $1,000 in a 30-year Treasury bond that pays 4% interest ($40 per year). You hold the bond for five years, and its market value at the end of the five-year holding period is $1,050.

In this case, you can calculate your holding period return as follows:

As another example, we’ll say that you invest $1,000 into a dividend stock and hold it for five years. For simplicity, we'll say that you receive a $10 quarterly dividend payment ($40 per year) but that your dividends are automatically reinvested to buy additional shares. At the end of five years, your investment is worth $2,100, and your holding period return is:

As mentioned, in cases involving dividend reinvestment, the income you received is already included in your investment’s ending value, so there's no need to consider it separately.