Most, but not all, preferred stocks have a "cumulative" provision. This says that if any dividend payments have been skipped, they must be paid out to preferred shareholders before common shareholders are paid any current dividends. Cumulative dividend provisions are intended to give preferred shareholders confidence that they'll receive the stated return on their investments.

This can occur when a company decides to suspend dividend payments during tough financial times, as we saw with several companies during the 2008 financial crisis.

As a current example, Goodrich Petroleum Corporation suspended preferred dividends on three different series of its preferred stock in August 2015 and made it clear in a press release that the unpaid dividends will accumulate. If a similar situation occurs with any preferred stocks you own, here's how to calculate the cumulative dividends owed to you.

Calculating cumulative dividends per share

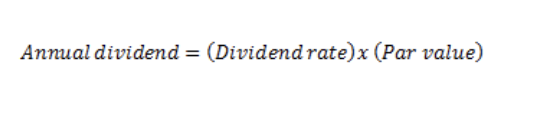

First, determine the preferred stock's annual dividend payment by multiplying the dividend rate by its par value. Both of these can be found in the company's preferred stock prospectus, and par value is usually $25 or $50 per share, although there are exceptions.

Annual dividend = (Dividend rate) × (Par value)

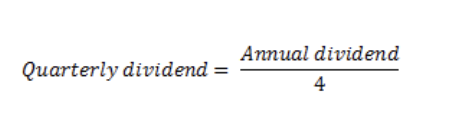

Next, divide the annual dividend by four to calculate the preferred stock's quarterly dividend payment.

Quarterly dividend = Annual dividend / 4

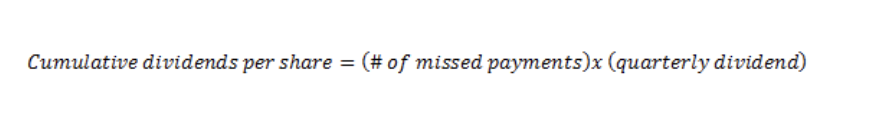

Finally, multiply the number of missed dividend payments by the quarterly dividend amount to calculate the cumulative preferred dividends per share that you're owed.

Cumulative dividends per share = (# of missed payments) × (quarterly dividend)

It's also important to mention that some, but not all, cumulative preferred stocks have additional provisions to compensate shareholders if preferred dividends are suspended. For example, some preferred stocks require accumulated dividends to be repaid with interest. In Goodrich Petroleum's case, if dividends remain unpaid for six quarters, the preferred shareholders become entitled to two seats on the company's board. One series also increases its dividend rate by 1% per year until all accumulated and unpaid dividends are paid in full.

Related investing topics

An example

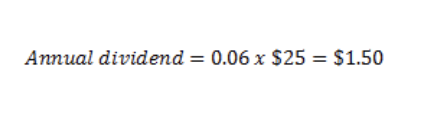

To illustrate this, let's say that you own the preferred stock of a company that has run into financial trouble and has been forced to suspend its dividend payments for the past three quarters. If your preferred shares pay a 6% dividend rate and have a par value of $25, you can determine the cumulative dividends with the three steps discussed above.

Annual dividend = 0.06 × $25 = $1.50

Note: Be sure to convert the percentage to a decimal before doing your calculation. To do this, simply divide the percentage by 100.

Quarterly dividend = $1.50 / 4 = $0.375

Cumulative dividends per share = $0.375 × 3 missed payments = $1.125

Once the company resumes paying dividends, it must pay $1.125 per share to preferred shareholders before making any dividend payments to common shareholders.