How to Calculate Net Change in Cash From a Cash Flow Statement

How to Calculate Accrued Interest

How to Calculate Semi-Annual Bond Yield

How to Calculate a Monthly Return on Investment

How to Calculate the Number of Shares a Company Has

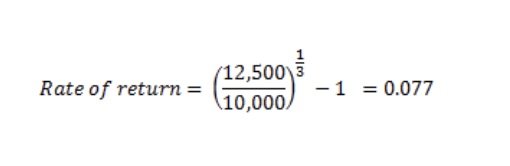

How to Calculate the Price of a Treasury Bill

Calculating the Percentage of an Over-Budgeted Amount

How to Calculate Annualized Volatility

How to Calculate Tax on W-9 Income

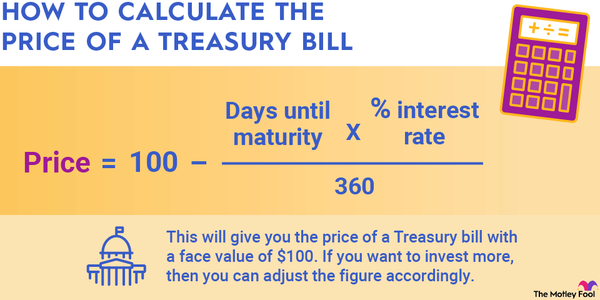

How to Calculate the Taxable Amount of an IRA Withdrawal

How to Calculate Revenue Growth for 3 Years

How to Calculate the Percentage of Annual Decline

How to Calculate the Present Value of Free Cash Flow

How to Calculate Average Shareholder Equity

How to Calculate Interest Rate Using Present and Future Value

How to Calculate the Net Worth on Financial Statements

How to Calculate Take-Home Pay as a Percentage of Gross Pay

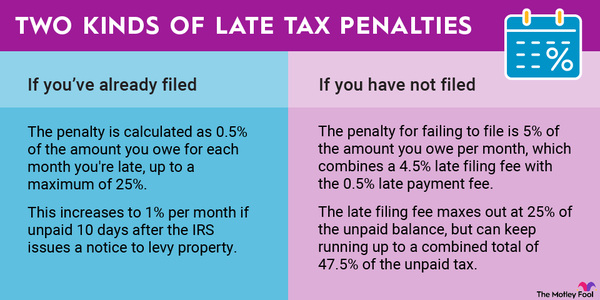

How to Calculate Interest Rate and Penalties on Late Taxes

How to Calculate the Annual Growth Rate for Real GDP

How to Calculate Taxes Using a Paycheck Stub

How to Calculate Interest Expenses on a Payable Bond

How to Calculate Annual Rate of Growth of Salary Increase

How to Calculate My Monthly Take-Home Salary

How to Calculate Unrealized Gain and Loss of Investment Assets

How to Calculate Total Expenses From Total Revenue and Owners' Equity

How to Calculate Weighted Average Price Per Share

How to Calculate the Interest Rate From an Income Statement

How to Calculate Income as a Percentage of Revenue

How to Calculate Cash Inflow Using Accounts Payable and Accounts Receivable

How to Calculate Direct Labor Rates in Accounting

How to Calculate Amortization and Depreciation on an Income Statement

How to Calculate Percentages of Total Revenue

How to Calculate Common Stock Outstanding From a Balance Sheet

How to Figure Out Beginning Stockholders' Equity

How to Calculate the Ratio of a Selling Price to an Asking Price

How to Calculate Total Monthly Net Income as a Percentage of Revenue

How to Calculate Provisional Income

How to Calculate Cost Basis in Dividend Reinvestment Plans

How to Calculate the Weights of Stocks

How to Calculate Interest on a Promissory Note

How to Calculate the Value of Stock Warrants

How to Calculate Foreign Exchange Gains or Losses

How to Calculate the Issue Price Per Share of Stock

How to Calculate Dividend Distribution of Preferred Stocks

How to Calculate the Historical Variance of Stock Returns

How to Calculate Return on Indices in a Stock Market

How to Calculate Pre-Tax Profit With Net Income and Tax Rate

How to Calculate Total Assets, Liabilities, and Stockholders' Equity

How to Calculate Par Value in Financial Accounting

How to Calculate a Marginal Revenue Derivative

How to Calculate Closing Costs When Paying Cash for a Home

How to Calculate Dividends Per Share From an Income Statement

How to Calculate Projected Annual Sales Growth

How to Calculate Additional Paid-In Capital in Accounting

How to Calculate an Average Percentage Difference Between Two Dollar Amounts

How to Calculate Total Revenue Growth in Accounting

How to Calculate Year-to-Date Earnings

How to Calculate Deadweight Loss to Taxation

How to Calculate the Turnover Ratio for Mutual Fund Investment Assets

How to Calculate Deferred Rent Expense

How to Calculate a Default Risk Premium

How to Calculate Market Price Using Supply and Demand

How to Calculate Cumulative Dividends Per Share

How to Calculate What My Penalty Will Be If I Cash Out My Retirement Account

How to Calculate the Marginal Tax Rate in Economics

How to Calculate a Company's Weighted Average Number of Outstanding Shares

How to Calculate Real Interest on After-Tax Income

How to Calculate the Average Revenue Per Unit

How to Calculate the Market Value of a Firm's Equity

How to Calculate Stockholders' Equity for a Balance Sheet

How to Calculate Your Tangible Net Worth With Subordinated Debt

How to Calculate Operating Income Return on Investment

How to Calculate Preferred Stock Outstanding

How to Calculate Taxable Income for Georgia State Income Tax

How to Calculate the Cost of Debt Pre-Tax

How to Calculate Yield for a Callable Bond

How to Calculate Interest Receivable and Interest Revenue for Notes Receivable

How to Calculate a Missing Account on an Income Statement

How to Calculate the Number of Shares of Common Stock Outstanding

How to Calculate Missouri's Capital Gains Tax

How to Calculate Capital Loss Carryover

How to Calculate Proceeds From Sales of Bonds

How to Calculate Dollar-Weighted Investment Returns

How to Calculate Selling and Administrative Expenses in Managerial Accounting

How to Calculate Change in Assets

How to Calculate Gain or Loss on a Bond Redemption

How to Calculate the Break-Even Interest Rate on Bonds

How to Calculate Capital Lease Interest Rates

How to Calculate Stock Price After Dividend

Calculating A Company's Net Income And Why It Matters

How to Calculate Cost Basis for Inherited Real Estate

How to Calculate Minority Interest Share in a Subsidiary

How to Calculate Modified Duration

How to Calculate Unearned Revenue

How to Calculate Net Revenue Interest for Oil & Gas

How to Calculate the Deduction for an S-Corp Home Office

How to Calculate Return on Assets for an Unlevered Company

How to Calculate Net Assets in a Statement of Activities and Changes in Net Assets

How to Calculate Impairment of Fixed Assets

How to Calculate Liquidity Premium and Real Risk

How to Calculate Percentage of Authorized Common Stock Issued

How to Calculate Average Treasury Stock Paid

How to Calculate Financial Variance When Budgeting for a Loss

How to Calculate Volatility With Spot and Strip Prices

How to Calculate a Bank's Liquidity Position

How to Calculate a Company's Total Margin Financial Ratio

How to Calculate Additions to Net Working Capital

How to Calculate Aggregate Adjustments

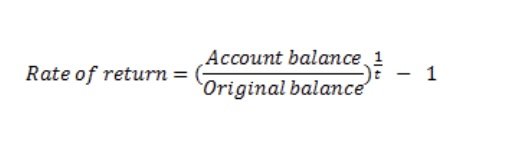

How to Calculate an Annual Return With Stock Prices

How to Calculate and Account for Stock Issuances

How to Calculate Capital Expenditure Depreciation Expense

How to Calculate Compounding on a Lump Sum at a Given Interest Rate

How to Calculate Disbursements of Cash

How to Calculate Discretionary Cash Flow

How to Calculate Ending Stockholders' Equity

How to Calculate Fair Value Adjustments to Stockholders' Equity With Available-for-Sale Securities

How to Calculate Hedge Fund Returns

How to Calculate IRA Early Distribution Penalty

How to Calculate IRR With Initial Outlay and Single Cash Flow

How to Calculate Maturity Risk Premiums

How to Calculate My Schedule K-1 Taxable Income for Another State

How to Calculate Net Asset Value for a Hedge Fund

How to Calculate Price-Weighted Average for Stocks

How to Calculate Rate of Return on Common Stock Equity

How to Calculate the Effective Interest Rate Including Discount Points