Deciding on a simplified employee pension (SEP) IRA vs. a Roth IRA might not be an easy decision. The SEP IRA gives business owners a powerful retirement savings account where they can stash a lot of cash for their future. A Roth IRA is an extremely flexible option for retirement savings available to most people.

Both have their advantages and disadvantages. Coming up with a good retirement strategy requires investors to weigh the pros and cons.

What is a SEP IRA?

What is a SEP IRA?

A SEP IRA is a retirement account developed to make it easier for small business owners to provide retirement savings plans for themselves and their employees.

SEP stands for Simplified Employee Pension; IRA is an abbreviation for Individual Retirement Account.

Just like any other IRA, a SEP IRA is fully owned and controlled by the beneficiary of the account (the employee). But unlike a typical IRA, the employer is responsible for 100% of contributions to the account.

Taxable Income

Employers can contribute up to 25% of an employee's compensation, up to a maximum of $69,000 in 2024, and $70,000 in 2025. However, every employee must receive the same percentage of their compensation as a contribution to their SEP IRA. If a business owner contributes 25% of their compensation to max out their own SEP IRA contribution limit, they must also contribute 25% of all their employees' salaries.

In the past, contributions to a SEP IRA were always tax-deferred. If the account is funded with pre-tax money, that means employees won't have to pay income tax on the contributions their employer makes. Additionally, there's no tax on the investments while they remain in the account. However, withdrawals from a SEP IRA are subject to regular income tax since they're considered taxable income.

However, the Secure Act 2.0 allows the option of Roth SEP IRAs. A Roth SEP IRA is funded with post-tax money, but retirement withdrawals are tax-free.

Aside from contribution limits and taxation, there are a few other SEP IRA rules you should know.

An employer may be able to exclude an employee from SEP IRA contributions if they're younger than 21 years old or haven't worked for the company in any capacity in three of the last five years. If an employee meets those criteria, though, the employer is required to make contributions to their account.

Like most retirement accounts, early withdrawals taken before age 59 1/2 from a SEP IRA are subject to a 10% penalty. Additionally, SEP IRAs funded with pre-tax money are subject to required minimum distributions starting at age 73.

The SEP IRA is a simple retirement plan for small businesses. A better option for individual business owners with no employees may be a Solo 401(k). There are several advantages to a Solo 401(k) vs a SEP IRA.

What is a Roth IRA?

What is a Roth IRA?

A Roth IRA is a retirement savings account available to most individuals with earned income.

The big difference between a Roth IRA and a traditional IRA is how they're taxed. Unlike a traditional IRA or SEP IRA, contributions to a Roth IRA are not exempt from income tax. Individuals still pay taxes on any amount they put into a Roth IRA, but their investments inside the account still grow without incurring any taxes. In exchange for paying taxes on contributions, Roth IRA withdrawals are completely tax-free.

An additional benefit of a Roth IRA is that you can withdraw contributions at any point in time without paying any penalties. Even if you haven't reached the age of 59 1/2, as is required for other retirement accounts, you can take out any amount you contributed directly to the Roth IRA at any time. You can take a penalty-free withdrawal of any amount converted from a traditional IRA, SEP IRA, 401(k), or other retirement account to a Roth IRA five years after the conversion. This advantage makes it an extremely flexible retirement savings account.

Related investing topics

Individuals can contribute as much as $7,000 in 2024 and 2025 to a Roth IRA. The contribution limits for people 50 or older are $8,000 for both years. However, households with an adjusted gross income above the Roth IRA income limits could have a lower contribution limit or lose the ability to contribute anything at all.

Luckily, there's a workaround. It's called the backdoor Roth IRA. Individuals make a contribution to a traditional IRA and immediately convert that amount to a Roth IRA. There are some important caveats to be aware of, but it's not as complicated as it might sound.

The biggest disadvantage of a Roth IRA is the relatively low contribution limit. While $7,000 may be plenty for some, it pales in comparison to the contribution limits for a 401(k) or SEP IRA. For individuals looking to save a lot for retirement, they'll need more than a Roth IRA.

SEP IRA vs. Roth IRA: Key differences

SEP IRA vs. Roth IRA: Key differences

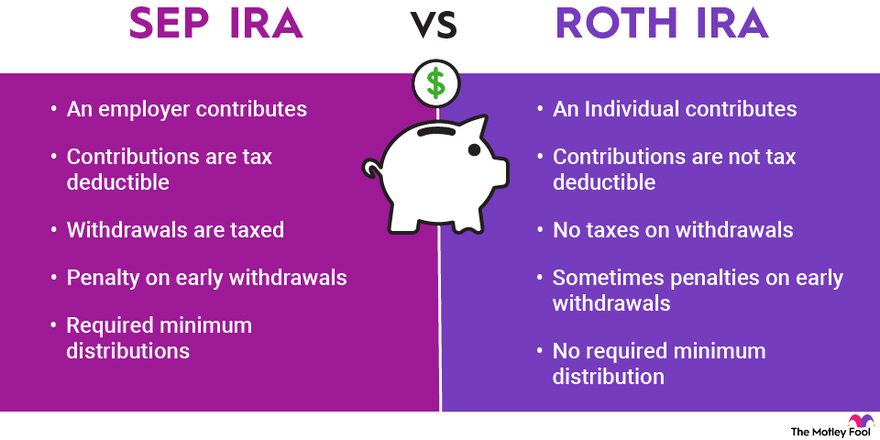

| SEP IRA | Roth IRA | |

|---|---|---|

| Who contributes? | Employer | Individual |

| Tax deduction for contributions | Yes | No |

| Taxation on withdrawals | Yes | No |

| Eligibility | Employers discretion until 21 years old and worked three of the last five years. | Income must fall below limits set each year by the IRS. |

| Contribution limit | The lesser of 25% of compensation, or $69,000 (2024) and $70,000 (2025). | $7,000, plus $1,000 catch-up contribution for each year if 50 or older in both 2024 and 2025. |

| Penalty on early withdrawals | Yes | Sometimes |

| Required minimum distributions | Yes (unless you have a Roth SEP IRA) | No |

Is a SEP IRA better than a Roth IRA?

Is a SEP IRA better than a Roth IRA?

A SEP IRA can be better for some individuals than a Roth IRA.

In particular, a SEP IRA is best for self-employed business owners with just a few employees looking to maximize their retirement savings. The high contribution limit allows them to save a lot of money and defer taxes on those contributions, saving them money upfront. That said, the cost of maximizing a SEP IRA contribution for oneself is that the business owner must then maximize the SEP IRA contribution for each eligible employee. (Solo entrepreneurs can avoid this problem, but a Solo 401(k) may still be a better option.)

A Roth IRA is a simple choice for practically anyone with earned income. It makes tax planning in retirement so much simpler since withdrawals don't count toward taxable income. What's more, Roth IRAs offer more flexible early withdrawal rules. The big downside is contribution limits are significantly lower than a SEP IRA.

If you want to maximize your retirement savings, a SEP IRA is a better option. If you want to remain flexible with your savings and simplify your taxes, a Roth IRA is for you.

Importantly, you don't necessarily have to choose between a SEP IRA and a Roth IRA. You're allowed to contribute to both in the same year.

SEP IRA vs. Roth IRA FAQs

Which is better, SEP IRA or Roth IRA?

Whether a SEP IRA or Roth IRA is better depends on your personal situation. For one, a SEP IRA is only available to you if you’re a business owner or your employer includes it as a benefit, and if your employer offers it, you have no control over contributions. Second, a SEP IRA is great for minimizing taxes today and saving a lot of money for retirement. If you have a lot of self-employment income, it might make sense to use a SEP IRA for retirement. A Roth IRA is great for remaining flexible with your savings and minimizing taxes in retirement. If you have a modest income and want to put away a bit for retirement, a Roth IRA could be a better option.

Why is a Roth IRA better than a SEP IRA?

A Roth IRA could be better than a SEP IRA for two reasons. First, it allows owners to withdraw contributions and conversions without penalty before age 59 1/2. Second, withdrawals are tax-free, helping keep taxes low in retirement.

What are the disadvantages of SEP IRA?

There are a few drawbacks to a SEP IRA. First, business owners must contribute the same percentage of compensation for each eligible employee, which means business owners can't contribute a lot to their accounts without also contributing a lot to employee accounts.

Second, there's no employee contribution portion of a SEP IRA like there is with a 401(k), which may limit how much you can contribute. Finally, withdrawals before age 59 1/2 are subject to a 10% tax penalty on top of regular income tax.

Should I have a Roth IRA and a SEP IRA?

You can have both a Roth IRA and SEP IRA. The benefits of having both are diversifying the tax treatment of your retirement savings. However, high-income households may be unable to get money into a Roth IRA in a tax-efficient manner if they also have money in a SEP IRA. A 401(k) or Solo 401(k) may be a better option to combine with a Roth IRA for high-income households.