How to trade futures

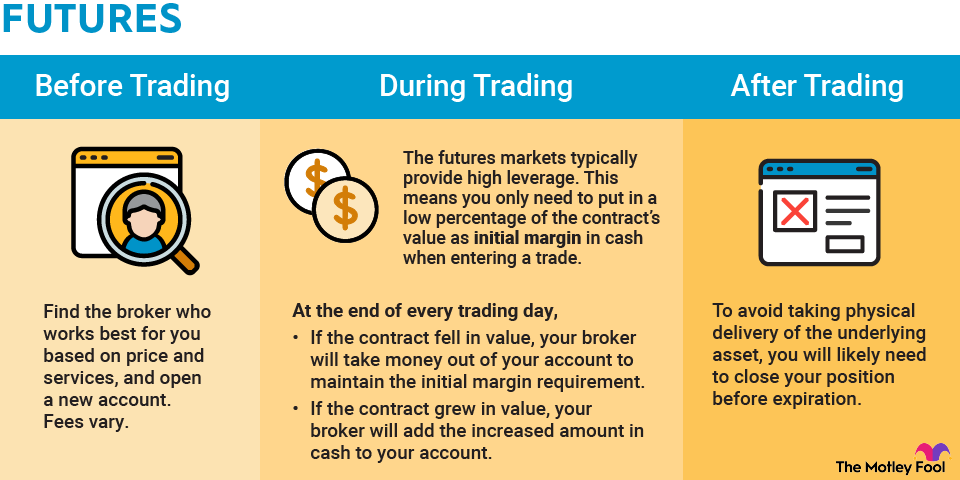

Getting started trading futures requires you to open a new account with a broker that supports the markets you want to trade. Many online stock brokers also offer futures trading.

To gain access to futures markets, though, they may ask more in-depth questions than when you opened a standard stock brokerage account. Questions may include how much money you need to start futures trading, details about your investing experience, income, and net worth, all designed to help the broker determine the amount of leverage they're willing to allow. Futures contracts can be bought with very high leverage if the broker deems it appropriate.

Fees vary from broker to broker for buying and selling futures. Be sure to ask around to find the broker that works best for you based on price and services.

Once your account is open, you can select the futures contract you'd like to buy or sell. For example, if you want to bet on the price of gold climbing by the end of the year, you could buy the December gold futures contract.

Your broker will determine your initial margin for the contract, which is usually a percentage of the contracted value you need to provide in cash. If the value of the contract is $180,000 and the initial margin is 10%, you'll need to provide $18,000 in cash.

At the end of every trading day, your position is marked to market. That means the broker determines the value of the position and adds or deducts that amount in cash to your account. If the $180,000 contract fell to $179,000, you'd see $1,000 come out of your account.

If the equity in your position falls below the broker's margin requirements, you'll be required to bring more cash to the account to meet the maintenance margin.

To avoid taking physical delivery of the underlying asset, you will likely need to close your position before expiration. Some brokers have mechanisms in place to do this automatically if you want to hold your position right up until it expires.

Once you've made your first futures trade, you can rinse and repeat, hopefully with great success.