Expenses are treated the same way. For example, the COGS associated with an item is only recorded when that item is sold, regardless of whether payment has been received, not when it’s produced. COGS also includes non-cash expenses such as depreciation, while operating expenses include non-cash expenses such as stock-based compensation.

A piece of the puzzle

Net income is a useful and essential profitability metric, but it’s not the only one. For example, it does not represent the amount of cash a company generates.

For a full understanding of a company’s profitability, pairing net income with free cash flow is your best bet. Net income is found on the income statement; free cash flow is found on the cash flow statement. Free cash flow measures the amount of cash that a company generates through operating activities in a given period.

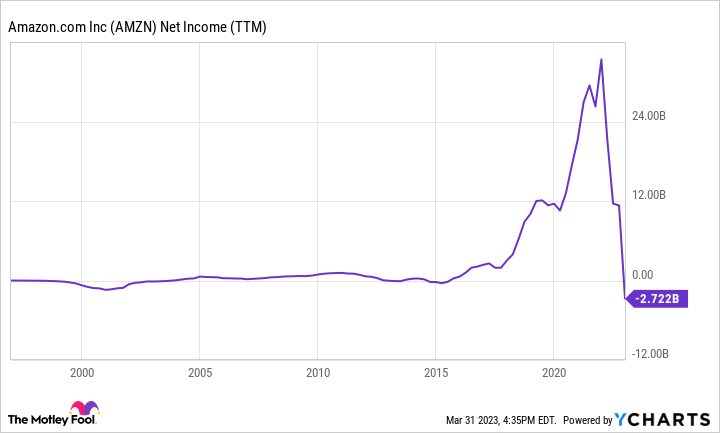

Another thing to note about net income is that it can sometimes be a poor representation of profitability. One example: Generally accepted accounting principles, or GAAP, require that unrealized gains and losses on equity investments must be recognized in the calculation of net income. If a company owns a substantial stock portfolio, swings in the value of the portfolio influence net income and can distort the company’s profitability.

Related Investing Topics