EastGroup Properties (EGP +1.18%) is a warehouse REIT focused on high-growth markets in the Sun Belt region. The company primarily owns clusters of smaller facilities (20,000-100,000 square feet) near major transportation infrastructure. It owned about 65 million square feet of warehouse space in early 2026.

EastGroup has built almost half of its portfolio from the ground up. It has invested $3.4 billion to develop 275 properties with 32.3 million square feet since 1996. It builds in park-like settings. This strategy delivers higher returns with lower risk.

The REIT also acquires properties near its existing locations. It focuses on value-add opportunities such as vacant properties or those with expansion potential.

How to invest in industrial REITs

Here's a step-by-step guide on how to invest in industrial REITs:

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Understanding industrial REITs

Industrial companies use various types of real estate to develop, manufacture, and produce goods. They require specialized real estate to support the movement and storage of products and goods. Properties in the sector include:

- Light manufacturing facilities.

- Food manufacturing facilities.

- Temperature-controlled warehouses (e.g., cold-storage facilities).

- Growing facilities and other properties for medical-use cannabis.

- Flex/office space, meaning a combination of office and industrial space, like a warehouse or light manufacturing.

- Logistics properties such as warehouses and fulfillment centers.

Industrial REITs lease these properties to tenants under long-term contracts, some as long as 25 years. They'll often rent an entire industrial building to one tenant under a triple net lease structure, making the tenant responsible for covering building insurance, real estate taxes, and maintenance. The agreements supply the REIT with steady cash flow.

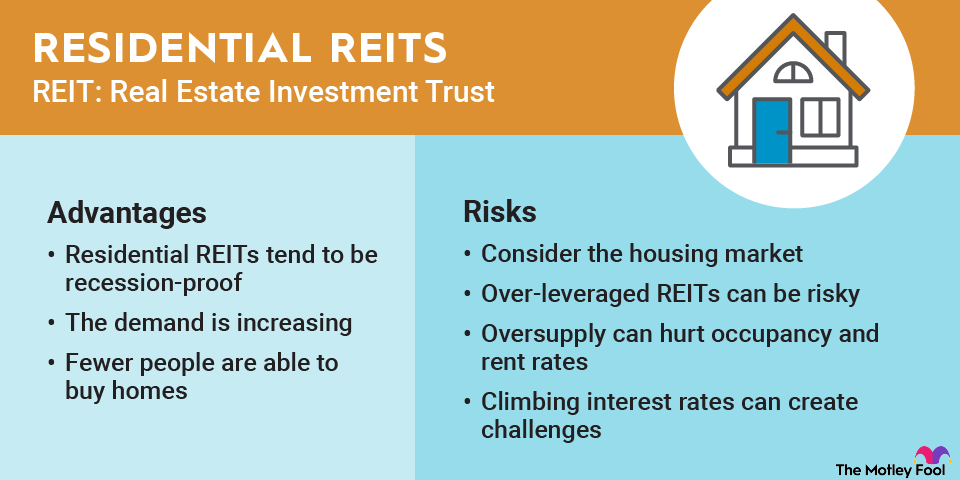

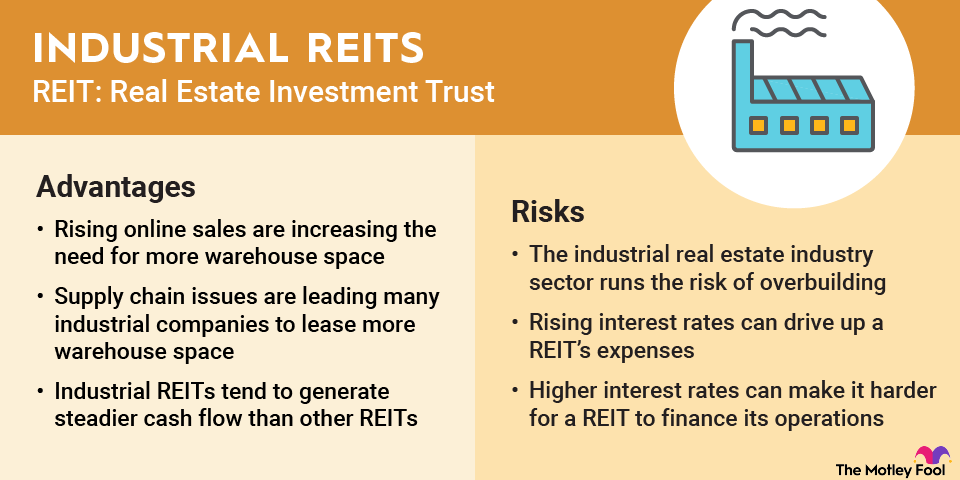

Advantages of investing in industrial REITs

Industrial REITs have a lot to offer investors, including:

- Upside to the growth of e-commerce: Rising online sales are increasing the need for more warehouse space, which these REITs provide.

- Cashing in on supply chain issues: Supply chain disruptions since the COVID-19 pandemic are leading many companies to lease more warehouse space to store additional inventory.

- Capitalizing on the onshoring of manufacturing: Tariffs and other catalysts are leading many companies to bring manufacturing back to the U.S. because of supply chain issues and other factors, providing new growth opportunities for industrial REITs.

- Stable cash flows: Industrial REITs typically sign long-term triple net leases (NNN). These leases produce stable cash flow, often making the sector relatively recession-resistant.

- Passive income: Most industrial REITs pay dividends, providing investors with a steady stream of income.

- Diversification: Investing in industrial REITs can help increase your portfolio's diversification.

Risks of investing in industrial REITs

The industrial real estate industry isn't without risk. Notable risk factors to consider include:

- Overbuilding: Many industrial REITs develop new properties on speculation or without securing a tenant before starting construction. Problems arise if developers build too much speculative capacity in certain markets, which can cause occupancy levels and rental rates to decline.

- Tenant troubles: Tenants can experience financial trouble, affecting their ability to pay rent. That can affect a REIT's financial results until it finds replacement tenants for those properties.

- Interest rates: Rising interest rates can increase a REIT's interest expenses, affecting its cash flows. It can also make it more expensive to fund new developments and acquisitions.

Key metrics to evaluate industrial REITs

Investors need to analyze several key metrics before buying shares of an industrial REIT, including:

- Occupancy rate: Occupancy should be high (above 90%) and stable or growing.

- Funds from operations (FFO) growth rate: An industrial REIT should ideally be growing its FFO per share by at least a mid-single-digit rate.

- Dividend payout ratio: The REIT should have a dividend payout ratio below 75% of its FFO.

- Leverage ratio: An industrial REIT should have a sub-6.0 times leverage ratio.

Industrial REITs vs. Retail REITs

Industrial REITs are crucial to the retail sector. They enable retailers to store excess inventory and support their e-commerce operations. However, there are some key differences between these two REIT types.

Industrial REITs own support properties such as manufacturing facilities, cold storage facilities, warehouses, and distribution centers. Most of these properties aren't open to the public. Retail REITs, on the other hand, own physical stores leased to retailers, including shopping malls, strip malls, and freestanding retail properties. These properties enable consumers to buy physical goods and services directly from retailers.