If your employer offers a 401(k) plan, signing up is one of the smartest moves you can make for retirement. And these days, it's not uncommon to find a 401(k) plan that offers a Roth savings option. In fact, nearly 90% of 401(k)s now have a Roth feature.

High earners interested in the Roth option in their employer's retirement plan may be wondering if they qualify to make contributions. The IRS imposes income limits for Roth IRA contributions, but there's no income limit for Roth 401(k) contributions.

Here are a few things to consider when you're thinking about opening a Roth 401(k) account.

Roth 401(k) income limits

The good thing about Roth 401(k)s is that there are no income limits -- you can fund a Roth 401(k) even if you're bringing home a $1 million salary.

That's not the case with a Roth IRA. Single filers can't contribute directly to a Roth IRA if their incomes exceed $161,000 (2024) or $165,000 (2025). Married couples making in excess of $240,000 (2024) or $246,000 (2025) won't be able to contribute anything directly to a Roth IRA. But households ineligible for Roth IRA contributions could contribute to a Roth 401(k).

It's important to note that there's no income limit on deducting contributions to a traditional 401(k) account. That means high earners may be better off contributing to the traditional 401(k) and taking the tax deduction now at their high marginal tax rate than saving in a Roth account. Then again, nobody has a crystal ball.

Other benefits of a Roth 401(k)

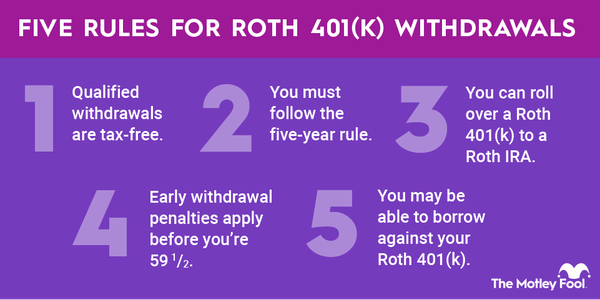

Although traditional 401(k)s give you a tax break for contributing money, the flip side is that your withdrawals in retirement are taxed as ordinary income -- meaning the highest rate you're liable for. This can be challenging from a financial planning standpoint since you'll need to account for taxes when determining how much of your plan balance to withdraw year after year. Roth 401(k)s, on the other hand, allow for tax-free withdrawals, which means that once you're retired, that money is yours free and clear.

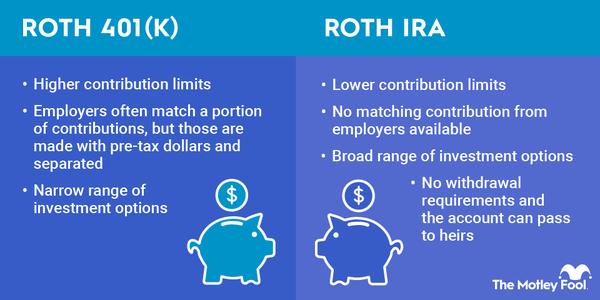

Additionally, by saving in a 401(k), you'll have access to a much higher contribution limit than with an IRA. For 2024, you can put in up to $23,000 if you're younger than 50 and up to $30,500 if you're 50 or older.

For 2025, the limit is $23,500, or $31,000 if you're 50-59 or 64 or older. Workers ages 60-63 are eligible for even higher catch-up contributions in 2025, bringing the maximum contribution to $34,250.

However, you could be subject to lower contribution limits if you're deemed a highly compensated employee.

The result? You get a prime opportunity to amass some serious wealth. Best of all, the entire sum is yours to use in retirement without having to worry about the IRS snagging its share. In effect, you can save more in a Roth account than in a traditional account since you don't have to worry about tax expenses when you withdraw.

If your 401(k) plan comes with a Roth savings option, it pays to consider it, especially if you expect your tax rate to be higher in retirement than it is today. That said, if you're earning enough to be concerned about income limits, a traditional account might save you more money in the long run.

You can also funnel some funds into a Roth IRA either directly or through the backdoor Roth IRA strategy since you likely won't qualify for a traditional IRA deduction. That way you'll have funds in both traditional retirement savings accounts and a Roth account and have maximum control over your income taxes in retirement.