When it comes to retirement savings, the $1 million mark has long been a major milestone for most people. How far that takes you in retirement is a different story, but there's something about hitting the seven-figure mark that feels like a bit of financial freedom.

The good news is that reaching $1 million doesn't require luck or getting in early on the next big thing. It can be accomplished with time and consistency. If you're currently around the $100,000 mark, here are three things you can do to potentially 10x it to $1 million.

Image source: Getty Images.

1. Start as early as possible

This might seem like "well, of course" type of advice, but I've noticed that people often underestimate just how powerful time can be in investing, thanks to compound earnings. It's the gift that keeps on giving and one of the keys to building wealth in the stock market.

To see it in action, let's imagine you invest $100,000 in a stock or exchange-traded fund (ETF) that averages 10% annual returns. Below is how much your investment would grow to over different amounts of time:

| Years Invested | Investment Value |

|---|---|

| 10 | $259,300 |

| 15 | $417,700 |

| 20 | $672,000 |

| 25 | $1.08 million |

| 30 | $1.74 million |

Calculations by author via investor.gov. Investment values are rounded down to the nearest hundred.

In this scenario, the difference between giving yourself 20 years versus 15 years is over $254,000. The difference between 30 and 25 years is around $660,000. The more time you give yourself, the more it pays off.

2. Invest in dividend stocks

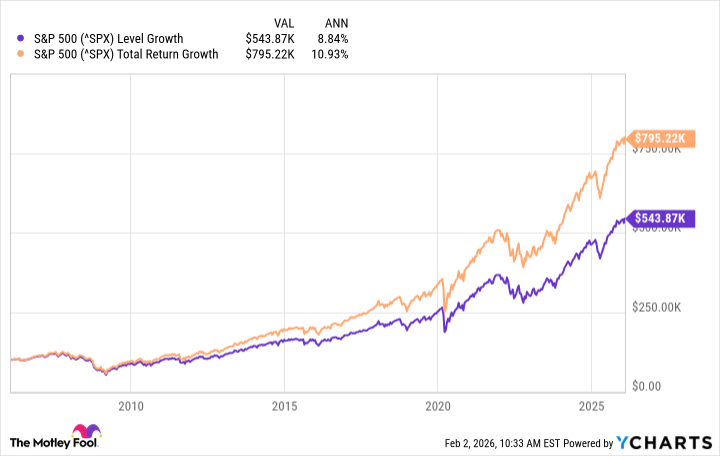

Since stock price movements get a lot of attention, many people don't realize how much dividends can contribute to a stock's total gains. Over the past 20 years, the S&P 500 has averaged 8.8% annual returns. When you include dividends, the average goes up to 10.9%.

If a one-time $100,000 investment were made back then, the 2.1% difference would equal more than a $250,000 difference in investment value.

Even investing in a dividend ETF like the Schwab U.S. Dividend Equity ETF can be lucrative. It has a 3.5% average dividend yield over the past decade. Maintaining that would mean $100,000 invested would pay out $3,500 annually to help compound your investment.

3. Use a dividend reinvestment plan

Receiving dividends in cash is cool, but the real magic happens when you use a dividend reinvestment plan (DRIP). When you elect into a DRIP, your broker automatically reinvests the dividends you're paid back into the stock or ETF that paid them.

Continuing our above example, instead of receiving $3,500 in cash, it's better to have it reinvested to buy more SCHD shares. That's then $3,500 worth of SCHD shares that are now going to earn dividends and hopefully increase in price. If the yield remains 3.5%, that's an extra $122.50 made from reinvesting. It's a lucrative cycle.