Investment options

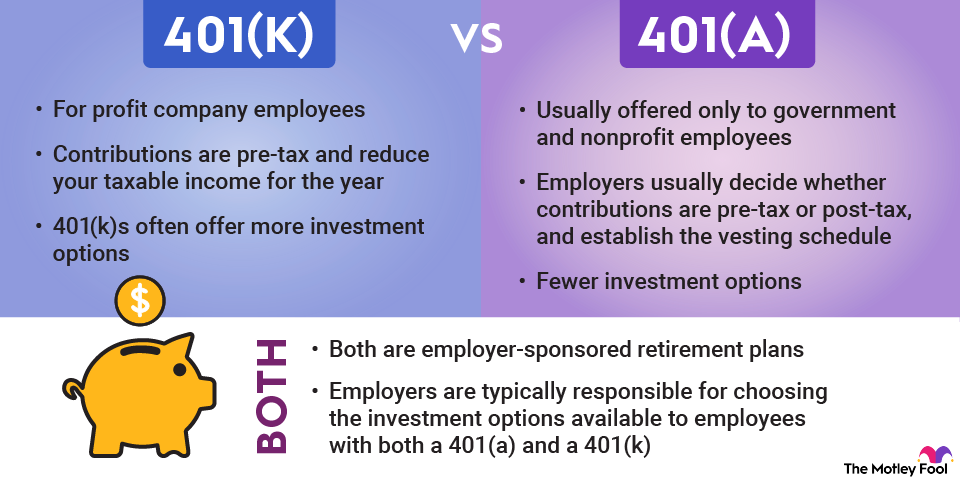

Employers are typically responsible for choosing the investment options available to employees with both a 401(a) and a 401(k). Typical 401(a) investment options include low-risk government bonds and mutual funds that focus on value-based stocks.

Employees who use a 401(a) often have even fewer investment options to choose from than 401(k) participants. However, since 401(a)s are often designed specifically for a select group of employees, a few choices may be all they need.

401(k)s often offer more investment options but are still known for offering far fewer options than IRAs do. 401(k) options usually include mutual funds, although some companies may offer a handful of exchange-traded funds (ETFs) and annuities as well. Employees who work for publicly traded companies may also be able to purchase company stock if they're interested.

Keep in mind

While it helps to understand the difference between 401(a)s and 401(k)s, you probably won't ever have to decide between the two accounts. Only government and nonprofit employees qualify for 401(a) plans, while employees of for-profit companies will typically have access to a 401(k).

Whichever type of retirement plan you end up with, make sure you review your investment options carefully and understand your plan's rules, particularly those regarding company matches and withdrawals, so you can make the most of your retirement account.

Related retirement topics