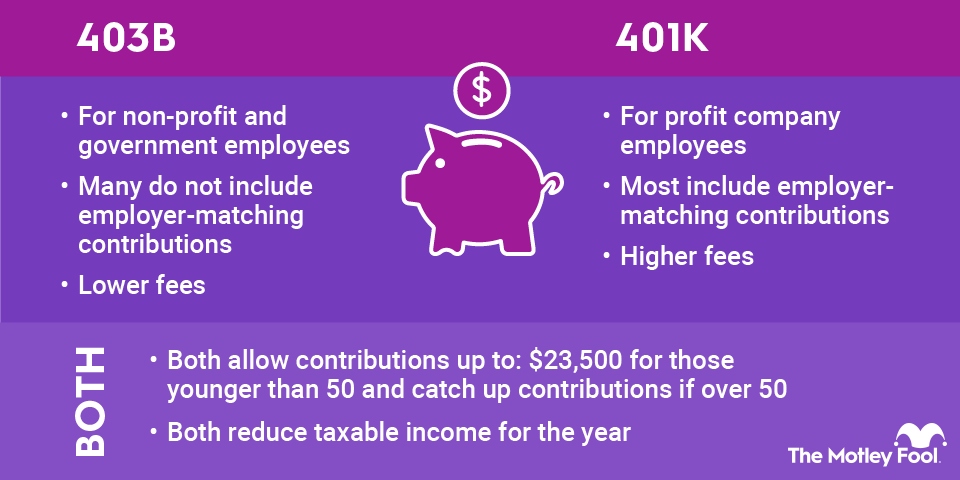

Weigh all the key differences listed above to decide which plan is right for you. Remember that your annual contribution limit applies to money you put in both accounts, so if you are contributing to a 401(k) and a 403(b) at the same time, you're allowed only up to $24,500 in combined contributions to both, or $32,000 if you're 50 or older, in 2026. If you're between the ages of 60 and 63, your maximum contribution is $35,750 in 2026. If you run into any questions about your plan, reach out to your plan administrator for more information.

Related Retirement Topics