A qualified retirement plan is a specific type of retirement plan that confers tax advantages to employers and employees. Qualified retirement plans must meet criteria set forth by the Internal Revenue Code and the requirements established by the Employee Retirement Income Security Act (ERISA).

A retirement plan must meet many requirements to be considered a qualified plan. Most of those requirements must be fulfilled by employers rather than employees. What's important to workers is that contributions to qualified plans come with tax benefits that make saving for retirement easier.

What is a qualified retirement plan?

Qualified retirement plans, encompassing both a defined benefit plan and a defined contribution plan, meet specific ERISA requirements and IRS criteria and confer tax advantages. In order to be considered qualified, a plan must:

- Be maintained for the benefit of plan participants.

- Satisfy minimum participation requirements, including not setting a minimum age for participation that is over age 21.

- Provide a plan document describing which employees are covered by the retirement plan and what benefits they are eligible to receive for participating in it.

- Meet a non-discrimination test applicable to any matching contributions that the plan offers. This test must ensure that highly-compensated employees do not benefit disproportionately from the plan.

- Limit any elective deferrals to the maximum limit set by the IRS each year.

- Satisfy specific vesting schedule requirements which, among other things, ensure that employees are 100% vested by the time they reach normal retirement age under the plan's definition.

The IRS maintains a full list of common requirements applicable to qualified plans. Again, most employees cannot control whether their employers meet these mandates. Employees can receive the tax benefits of participation in a qualified plan simply by signing up for and contributing to a plan that their employer offers.

A qualified retirement plan can help you save money on taxes by paying them later in life, when people often have a lower income and tax rate.

What are the tax benefits of a qualified retirement plan?

A qualified plan confers tax advantages for both employers and employees.

Employers can make tax-deductible contributions. Any contributions that they make on behalf of workers are not subject to payroll taxes. Small businesses that establish qualified retirement plans may be entitled to tax credits to defray startup costs.

Employees can elect to contribute to qualified plans on a pre-tax basis via withholdings from their salaries. Money invested in a qualified plan can grow tax-free.

Plan administrators are allowed, though not obligated, to issue loans to employees who contribute to qualified plans. These loans enable employees to borrow cash from their own retirement funds. Early withdrawals (those made before the plan beneficiary reaches age 59 ½) from qualified plans are typically, with some narrow exceptions, subject to tax penalties.

It's important to note that there are other types of retirement plans that provide similar tax benefits to qualified plans, such as traditional and Roth Individual Retirement Accounts (IRAs).

Because these plans are used to save for retirement by individuals, rather than established by employers in accordance with IRS and ERISA rules, they are not considered qualified. However, a traditional IRA and Roth IRA do come with tax advantages including tax-free growth and other favorable tax treatments. Contributions to traditional IRAs are tax-deductible and withdrawals from Roth IRAs are tax-free.

Examples of Qualified Retirement Plans

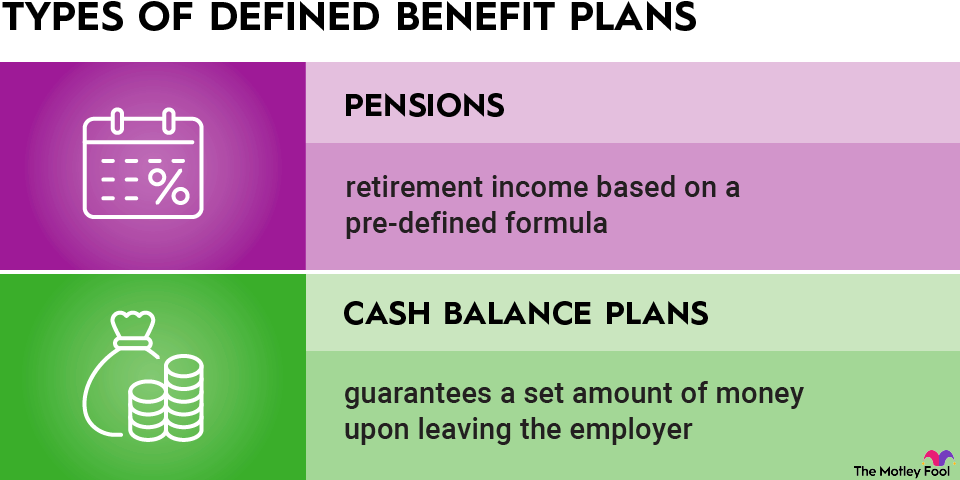

Qualified retirement plans can be broadly divided into two categories:

- Defined benefit plan: With this type of plan, employers promise workers a certain amount of retirement income, which is defined based on a pre-established formula that takes an employee’s wages and tenure into account.

- Defined contribution plan: Under this type of plan, employees and employers are eligible to make tax-advantaged contributions to a worker's retirement account, but there's no guarantee that the plan will provide any specific amount of retirement income. The amount of money that the employee ultimately receives in retirement depends on the amount contributed and the performance of the investments held by the account.

Common examples of qualified retirement plans include but are not limited to:

- 401(k) plans

- 403(b) plans

- Savings Incentive Match Plan for Employees (SIMPLE) IRAs

- Simplified Employee Pension (SEP) IRAs

- Salary Reduction Simplified Employee Pension (SARSEP) Plans

- Profit-sharing plans

In order for these or other accounts to be considered qualified, it's critical that they comply with ERISA requirements as well as the IRS mandates set forth in Section 401(a) of the Internal Revenue Code. While most 401(k) plans, for example, are qualified, a particular plan might not be if the employer does not keep its plan documents updated to reflect changes to the law or does not correctly apply the plan's definition of compensation for employee deferrals.

Self-employed individuals may also establish qualified plans. These retirement plans are usually referred to as Keogh plans or H.R. 10 plans. Because establishing a qualified plan can be complicated, it's more common for businesses with employees to establish them than for self-employed individuals to use them.

Employers are also allowed to set up non-qualified retirement plan. Non-qualified plans, such as executive bonus plans, do not provide the same tax benefits as qualified plans. Employees are required to include contributions to non-qualified plans in their gross incomes for tax purposes.

How do you know if you have a qualified retirement plan?

Most employer-sponsored retirement plans are qualified retirement plans. Chances are good that your plan is qualified if it was set up by your employer, especially if you aren't a highly-compensated employee or a leader at your organization and if you don't work for the government or a religious organization.

The easiest way to find out if you have a qualified retirement plan is to talk with your plan administrator or other member of your organization who set up the plan. In most cases, an employer’s contributions to your qualified plan will be listed by your employer in Box 12 on your W-2 form.