Defined contribution plans are employer-sponsored retirement plans where employees, and sometimes employers, make regular contributions to the plan, but the payout in retirement depends on how the employee invests the money. The government imposes restrictions on how much you can contribute to a defined contribution plan and when you can withdraw your funds.

Here's a closer look at how defined contribution plans work and which common retirement plans fall into this category.

Is a 401(k) a defined contribution plan?

The best-known defined contribution plan is the 401(k). Employees can contribute up to $23,500 in 2025, or $31,000 for ages 50 to 59 and 64 or older. Those ages 60 to 63 may contribute up to $34,750 in 2025. Contrbution limits rise to $24,500 in 2026, or $32,500 for ages 50 to 59 and 64 or older. The contribution limit for ages 60 to 63 increases to $35,750 in 2026.

Employers may also match some of their employees' contributions. You determine how to invest your 401(k) funds by choosing from a list of mutual funds your employer selects.

Most 401(k) contributions reduce your taxable income for the year, but then you must pay taxes on your distributions in retirement. But if you have a Roth 401(k), you pay taxes on your initial contributions and your money grows tax-free afterward.

You usually can't withdraw your 401(k) funds when you're under age 59 1/2, unless you have a qualified reason, like a large medical expense. Otherwise, you'll pay a 10% early withdrawal penalty. Some plans allow 401(k) loans -- you withdraw a sum and pay it back with interest over time -- but it's up to each employer to decide whether to offer this.

If you decide to leave the company, you may take your 401(k) with you, rolling it over into your new employer-sponsored retirement plan or into an IRA you open on your own.

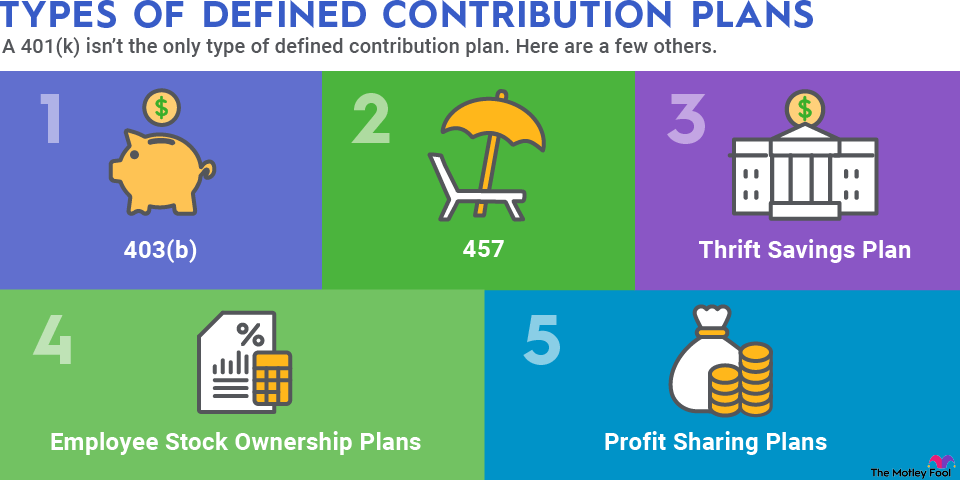

What are the types of defined contribution plans?

A 401(k) isn't the only type of defined contribution plan. Here are a few others you may have heard of:

- 403(b): A 403(b) is similar to a 401(k), but it's available only to public school employees, certain ministers, and employees of nonprofit organizations.

- 457: This is a special type of retirement plan reserved for state and local government employees and some nonprofit workers.

- Thrift Savings Plan: These are available exclusively to employees of the federal government and members of the uniformed services, including military members, police officers, and firefighters.

- Employee stock ownership plans: These plans give employees an ownership interest in their company and also provide tax benefits.

- Profit sharing plans: A profit sharing plan regularly gives employees a portion of their company's profits.

Defined contribution plan example

So how does a defined contribution plan work in practice? Each one has its own rules, so it's always best to check with your plan administrator before you begin making contributions. But in general, defined contribution plans work like this:

- You set up an account (or your employer will do it for you). Then you decide how much of each paycheck you'd like to contribute to the plan. It could be a set dollar amount or a percentage of your salary, and you can change your contribution rate at any time. Your employer automatically withholds this amount from your paycheck and places it in your defined contribution plan account.

- If your employer matches a portion of your contributions, or if it has a profit sharing plan or something similar, it will make its own employer contribution to your retirement account. These plans may have vesting schedules, which determine when you get to keep employer-contributed funds if you leave the company. Quitting before you're fully vested could cost you some or all of your employer match.

- Your employer will give you investment options to choose from, but you decide which one is best for your retirement goals. This is an important decision, as it affects how much investment earnings you'll end up with, and therefore how much you must personally contribute to fund your retirement.

- Once that's done, you continue putting money in the account, updating your employee contribution percentage and your investment options as necessary. Then, when you're ready to retire, you withdraw your funds gradually to cover your living expenses.

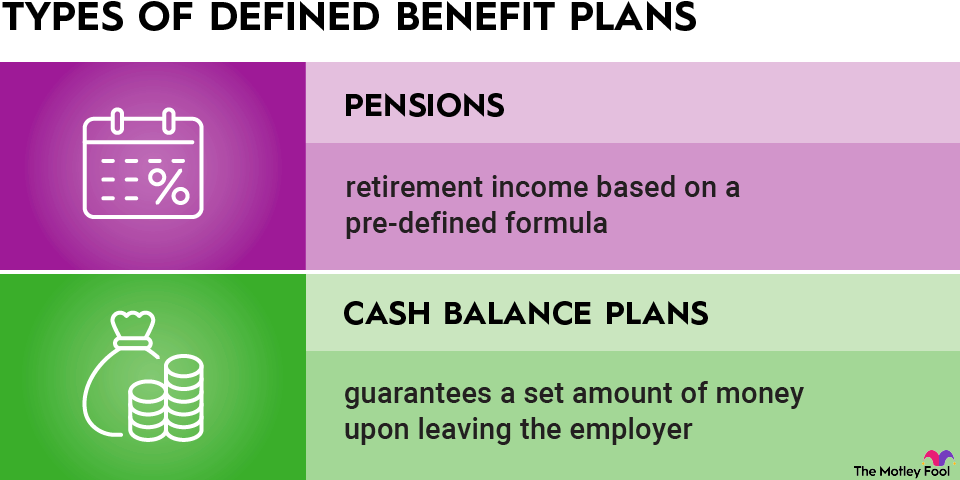

Defined contribution plan vs. defined benefit plan

Defined benefit plans are plans that provide a guaranteed payout in retirement. The most common type of defined benefit plan is a pension, but these are becoming less common because they're more expensive and complicated for employers.

Essentially, there's a formula that dictates how much you'll receive from your pension in retirement based on how long you've worked for the company or your average income as an employee. The employer is responsible for funding that one way or another, even if that means making an additional cash contribution if its investments don't perform as expected.

Defined contribution plans shift most of the savings burden from the employer to the employee. That's not as desirable for you as a worker, but it might suit you better if you don't plan to stay with your employer long. You can take your defined contribution plan with you and change how you invest your funds, but a defined benefit plan will always be tied to your old employer.

You're much more likely to have a defined contribution plan than a defined benefit plan these days, but it helps to have an understanding of both types and how they work. Whichever type of qualified retirement plan you end up with, make sure you understand any rules associated with contributions or withdrawals, and talk to your company's HR department if you have any questions.