A health savings account (HSA) is a tax-advantaged investment account you can contribute to if you have a high-deductible health insurance plan. Employers often offer HSAs for employees, but you can also open your own if you qualify. HSA contributions are tax-deductible up to HSA annual limits, and money can be withdrawn tax-free to cover qualifying medical expenses.

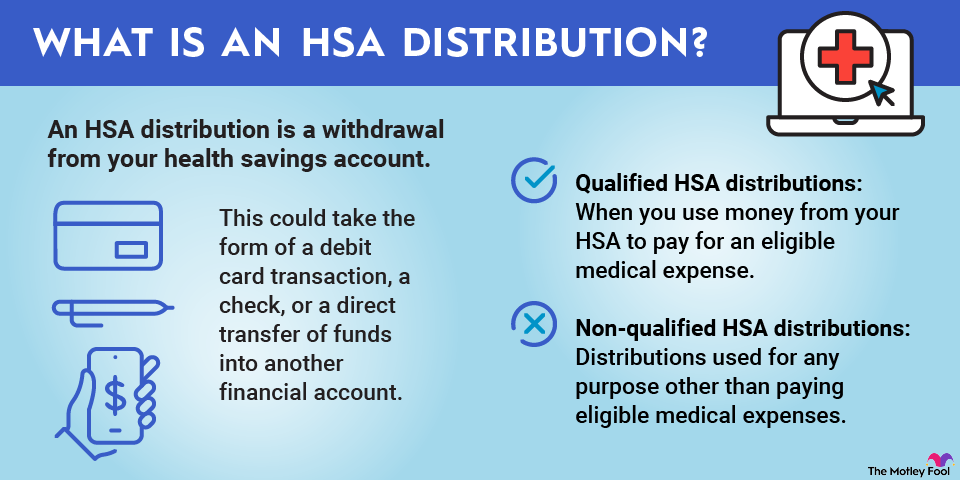

Money in an HSA can be invested and can be withdrawn for any purpose after age 65 without penalty. However, if the withdrawal isn't for a qualifying healthcare expense, you’ll be taxed at your ordinary income tax rate for distributions.

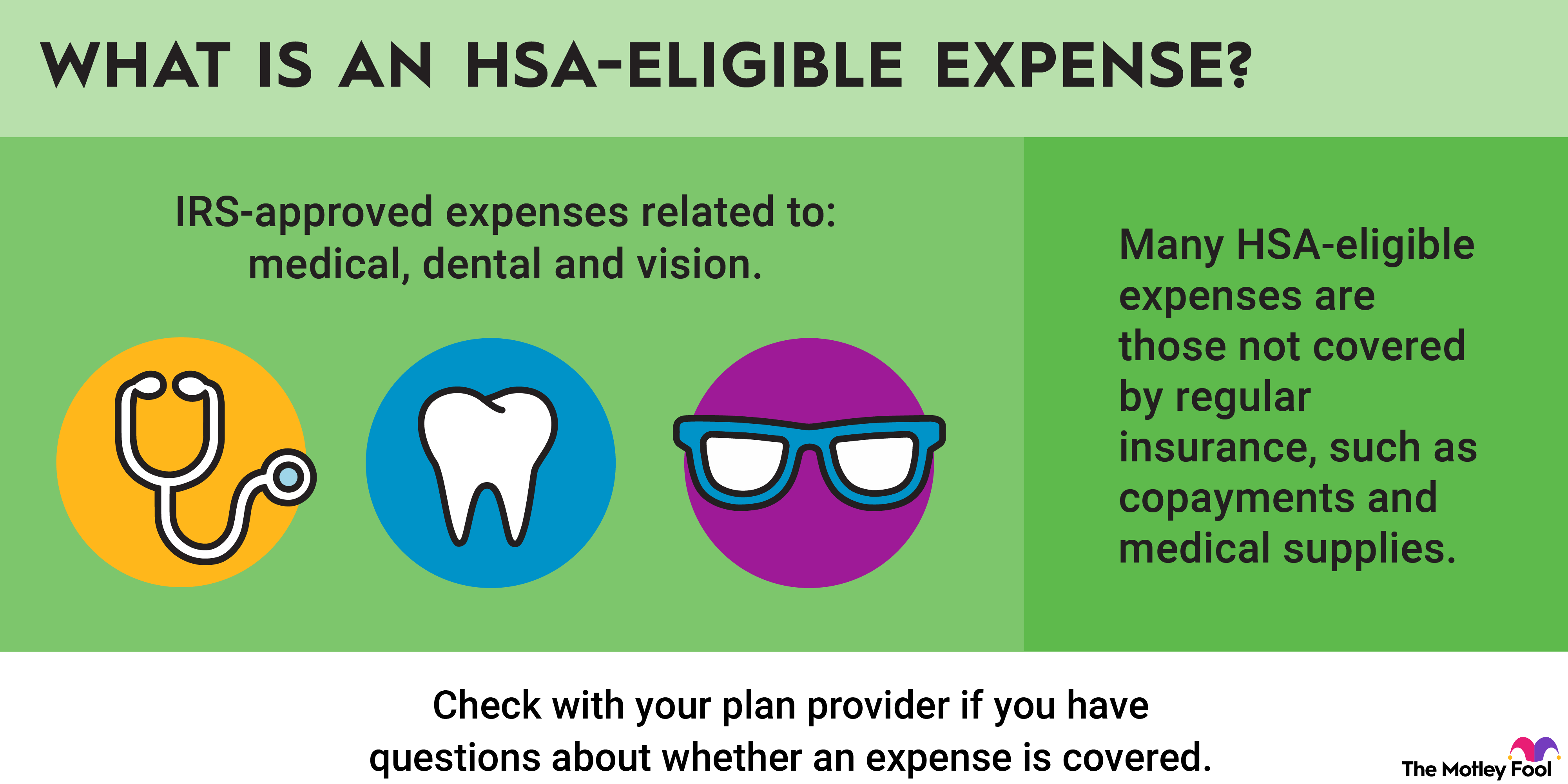

You can use your HSA money, tax-free, to cover qualifying medical expenses.

Understanding health savings accounts

Health savings accounts are intended to help people with high-deductible health insurance plans pay for medical expenses. They reduce out-of-pocket costs of medical care by allowing you to pay with pre-tax dollars. However, you can also invest your HSA money to save for retirement.

HSAs are unique for several key reasons:

- You’re eligible to contribute only if you have a qualifying high-deductible health plan.

- Your employer can open an HSA for you (and contribute money on your behalf), or you can open your own and make contributions to it.

- Money can be invested and can grow for as long as you’d like; there’s no requirement to withdraw funds at any point. With most other tax-advantaged accounts -- including 401(k)s and traditional IRAs -- you’re subject to required minimum distributions (RMDs) after age 73 (previously age 72).

- HSA funds can be withdrawn tax-free at any age to cover qualifying medical expenses. With 401(K)s and IRAs, money can’t be withdrawn before age 59 1/2 without a 10% penalty unless you qualify for a hardship distribution -- and you’re always taxed at your ordinary income tax rate on 401(k) or IRA distributions.

- Funds withdrawn for purposes other than covering HSA-eligible expenses are subject to a 20% penalty plus income taxes. This is double the penalty that applies for early 401(k) or IRA withdrawals. However, it applies only until age 65, after which you can withdraw funds from an HSA for any purpose. In this case, you’ll just pay ordinary income tax if the money isn’t used for healthcare.

How does an HSA work?

Health savings accounts can function as an important savings vehicle. They make it easier to afford medical care and can help you save for retirement. However, there are rules you have to follow -- including restrictions on eligibility as well as annual contribution limits.

The rules applicable to health savings accounts are very different from those that apply to flexible spending accounts (FSAs), although both enable you to pay for medical care with pre-tax funds.

Investing in a HSA

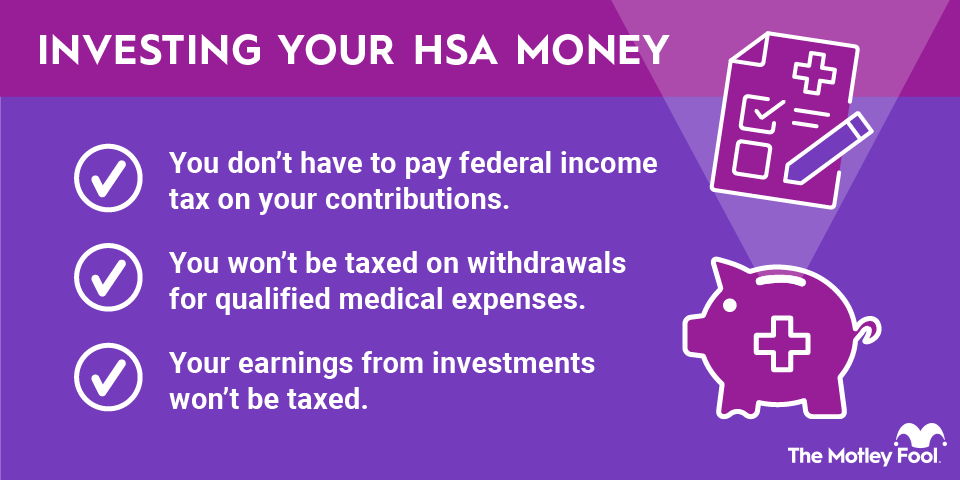

One of the biggest benefits of HSAs is that they can function as more than just a savings account for your healthcare. That's because you are generally allowed to invest the money in the account -- it does not have to remain in cash. This provides you with the opportunity to:

- Invest pre-tax money in the market.

- Increase your wealth through investments without paying taxes on your gains.

- Withdraw your money tax-free for medical purposes, including any gains you've made.

No other investment account allows you to put your pre-tax money into the stock market, earn a return on your investment, and never pay taxes on any of the money you make through investing. Because the IRS doesn’t take a cut, an HSA can be a wealth-building powerhouse of an account since all of the returns your investments earn are yours to keep.

Of course, if you use the money for non-medical purposes, you'll be taxed on withdrawals at your ordinary income tax rate. You’ll also owe a 20% penalty if you're younger than 65. Still, you have a chance to invest with pre-tax dollars and defer taxes on gains with this account even if you take this approach, much as you do with a 401(k).

Your investment options depend on where you hold your HSA account, but you’ll often have a selection of index funds similar to what a 401(k) offers. Often these funds allow you to gain broad exposure to the entire stock market or to specific types of companies, such as large, mid-sized, or small companies. You may also have access to bond funds, real estate funds, or emerging market funds.

Should you invest the money in your HSA?

If you plan to use the money in an HSA within two to five years of contributing it, though, you should generally opt to leave it in cash or a cash equivalent so you aren’t subject to stock market volatility.

However, if you want to leave your money to grow to cover healthcare costs later in life or as an additional retirement account, you should strongly consider investing the money so you can earn returns.

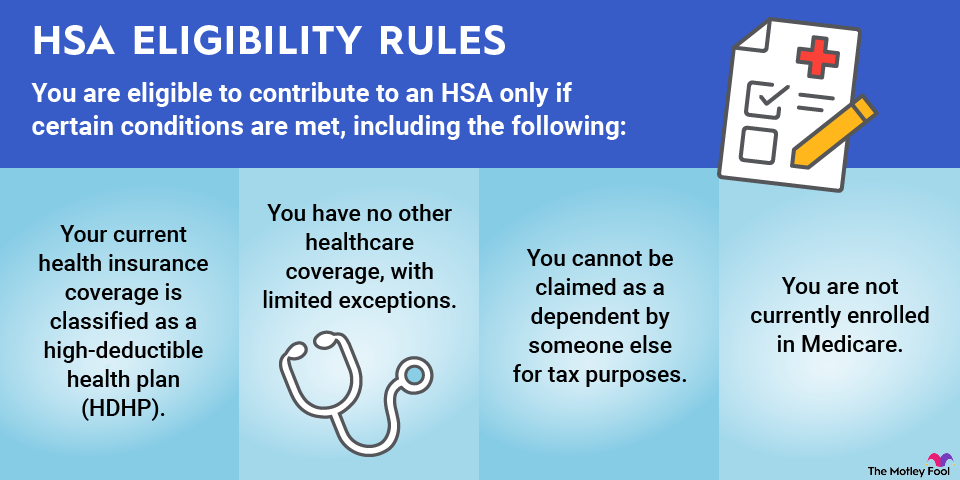

Who can contribute to an HSA?

As long as you have a qualifying high-deductible health plan, and you don’t have any other insurance with a deductible below the limits (such as Medicare coverage), you can contribute to an HSA. The definition of a high-deductible plan varies from year to year, but the plan must meet two requirements:

- Your deductible must equal or exceed a certain dollar amount.

- Your plan must have an out-of-pocket maximum below a specific threshold.

The chart below shows the minimum annual deductible and maximum annual out-of-pocket costs for a qualifying high-deductible health plan in 2025 and 2026. Eligibility is determined annually, so if your plan adheres to the restrictions in 2025 but not in 2026, you can contribute in 2025 but not in the following year.

Qualification | Self-Only Health Coverage | Family Health Coverage |

|---|---|---|

Annual deductible (minimum) | $1,650 for 2025; $1,700 for 2026 | $3,300 for 2025; $3,400 for 2026 |

Annual out-of-pocket costs (maximum) | $8,300 for 2025; $8,500 for 2026 | $16,600 for 2025; $17,000 for 2024 |

Annual contribution limits

You’re also limited in the amount you can contribute to an HSA each year, with the limits based on whether you have self-only (individual) or family coverage. Contribution limits change annually, and those age 55 and older are eligible to make an additional $1,000 catch-up contribution.

The annual contribution limits for 2025 are:

- $4,300 for self-only coverage or $5,300 for self-only coverage if you're 55 or older and eligible for catch-up contributions.

- $8,550 for family coverage or $9,550 for family coverage with catch-up contributions.

The annual contribution limits for 2026 are:

- $4,400 for self-only coverage or $5,400 for self-only coverage if you're 55 or older and eligible for catch-up contributions.

- $8,750 for family coverage or $9,750 for family coverage with catch-up contributions.

If your employer makes a contribution on your behalf, it is included in these annual limits -- so if your employer contributes $1,000 and you have self-only coverage, you'll be allowed to contribute only the remaining $3,300 if you're younger than 55 and have self-only coverage in 2025.

It's also worth noting that HSA contributions can be made until the tax deadline for any given year. That means you could fund your HSA for 2025 until April 15, 2026.

HSAs vs. FSAs

Many Americans mistakenly believe that an HSA is essentially the same thing as a Flexible Spending Account, or FSA. But they are very different types of tax-advantaged ways to save for medical expenses. The key differences for an HSA vs. FSA are:

- You can invest HSA funds, but investing FSA money isn’t allowed.

- FSAs are open to anyone whose employer offers them and are not restricted to people with high-deductible health plans. You can open an FSA for healthcare, as well as dependent care.

- Money contributed to an FSA generally must be used in the year the money is contributed, while HSA funds can grow and be withdrawn at any time (or not at all).

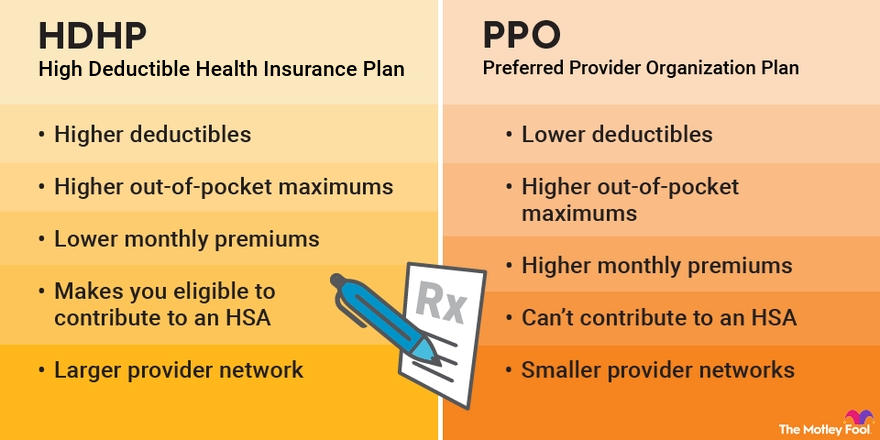

Related: HSA vs. PPO Plans

An HSA offers you a unique triple tax advantage that simply doesn't exist in other tax-deferred investment vehicles.

How to open and fund an HSA

If you have a qualifying high-deductible health plan, your employer may offer an HSA. If this is the case, it's usually an attractive option -- especially if your employer makes any HSA contributions on your behalf.

Alternatively, there are several reputable financial institutions that offer HSAs. For example:

- Lively offers HSAs with an FDIC-insured savings account option and the ability to invest your account funds through TD Ameritrade's platform, which lets you choose virtually any stocks, bonds, ETFs, or mutual funds you want.

- HSA Bank also offers HSAs with the option to invest through TD Ameritade’s platform or use a guided self-directed investment program that helps you put your money into low-fee mutual funds.

Although you can have multiple HSAs, the contribution limits apply in aggregate, so you’ll need to make sure to keep tabs on the total amount invested in all of your accounts each year. You’ll also need to file a separate Form 8889 for each HSA. Because it can be complicated to do that, it often makes sense to stick to just maintaining one HSA -- either one your employer opens or your own.

The choice comes down to the best option for your goals. If your employer will contribute on your behalf to a specific HSA, the choice is generally easy. If not, it's a good idea to compare the features of the plan your employer offers directly (if any) with a few other options. For example, if you'd like to buy individual stocks in your HSA, you'll need to find an institution that allows that.

The bottom line on HSAs

HSAs give you the opportunity to set aside money so you can pay for medical care with pre-tax dollars. But because you can invest and increase these funds as well as hold them in cash, HSAs offer much more than just a way to save on medical care. If used as a long-term investment vehicle, your HSA account could help you save on healthcare costs in retirement while reducing your tax bill in the meantime.