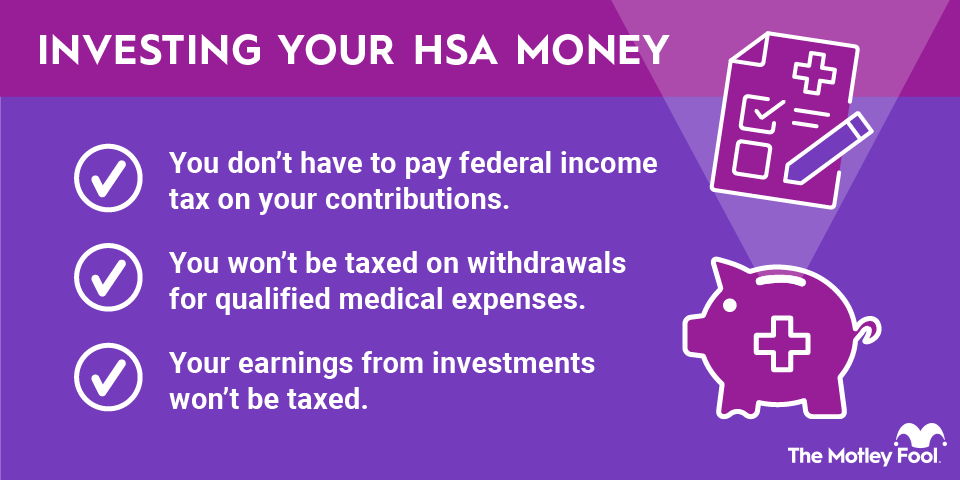

How does an HSA affect taxes when I contribute?

Because you can make HSA contributions with pretax funds, you can deduct the amount you've contributed from your taxable income in the year you contribute. This means that any money you contribute reduces your taxable income, which in turn saves you money on your IRS bill. It also means your take-home pay declines by a smaller amount than what you actually contributed.

For example, if you have $50,000 in taxable income and make a $3,600 deductible contribution to an HSA, you will be taxed on only $46,400 in income due to your contribution.

The specific amount you save due to your HSA contribution will depend on the size of your contribution and your tax rate. Those who are taxed at a higher rate and those who make larger contributions will realize more savings.