Aspect | HSA | FSA |

|---|---|---|

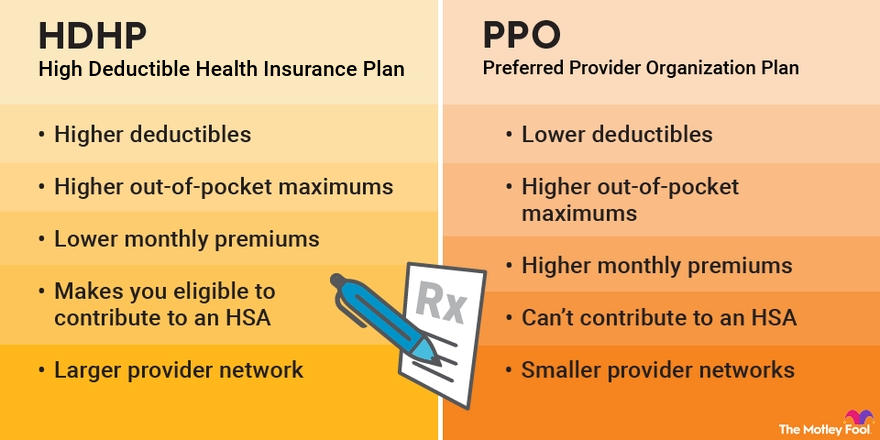

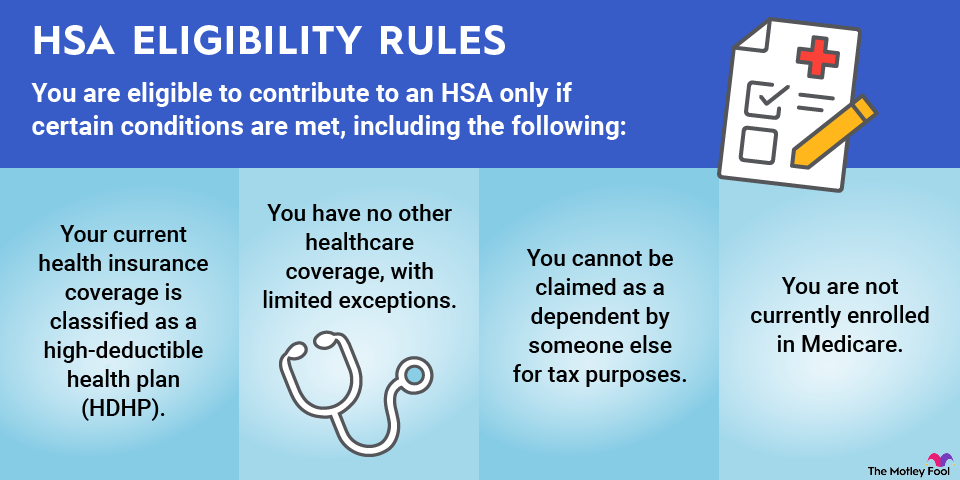

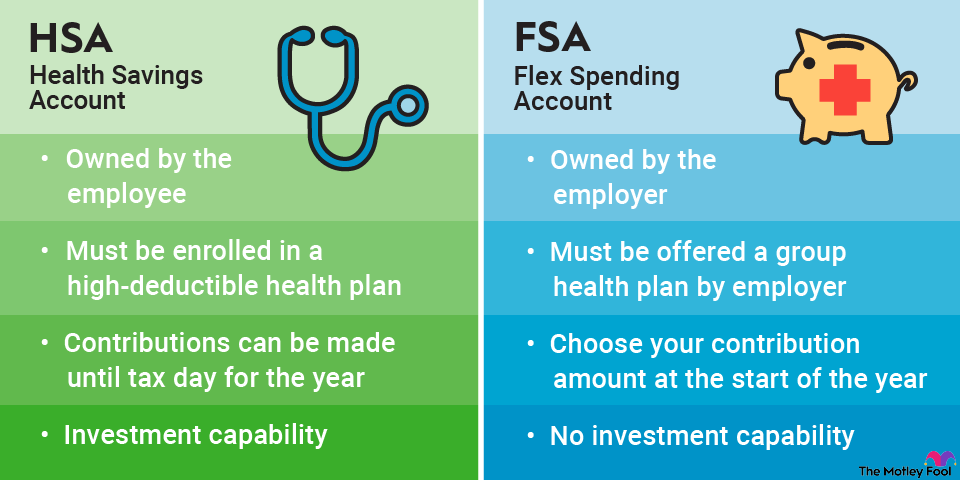

Eligibility rules | Employers may offer an HSA, but individuals can open their own.

You must have a qualifying HDHP to be eligible to make HSA contributions. | Only employers offer FSAs.

Any employee can contribute to an FSA if their employer offers one. |

Annual contribution limits | $4,300 for self-only coverage in 2025 ($4,400 in 2026).

$8,550 for family coverage in 2025 ($8,750 in 2026).

$1,000 additional catch-up contribution for those older than 55 in 2025 and 2026. | $3,300 per plan for a healthcare FSA in 2025 ($3,400 in 2026). If both spouses have FSAs, each can contribute this amount.

$5,000 total per family for dependent-care FSAs in 2025 ($2,500 if married filing separately) and $7,500 total per family in 2026. This $7,500 limit still applies if both spouses have FSAs. |

Contribution rules | Contributions are made with pre-tax dollars.

Employers or employees can contribute.

You have flexibility in how much to contribute during the year, and contributions can be made until the tax deadline. | Contributions are made with pre-tax dollars.

Employers or employees can contribute.

You must determine how much to contribute at the start of the year and the amount cannot change. |

Account ownership | Employees own HSAs and can take them with them when leaving a job. | Employers own accounts and leaving a job means losing access to the account unless you elect COBRA continuation if eligible. |

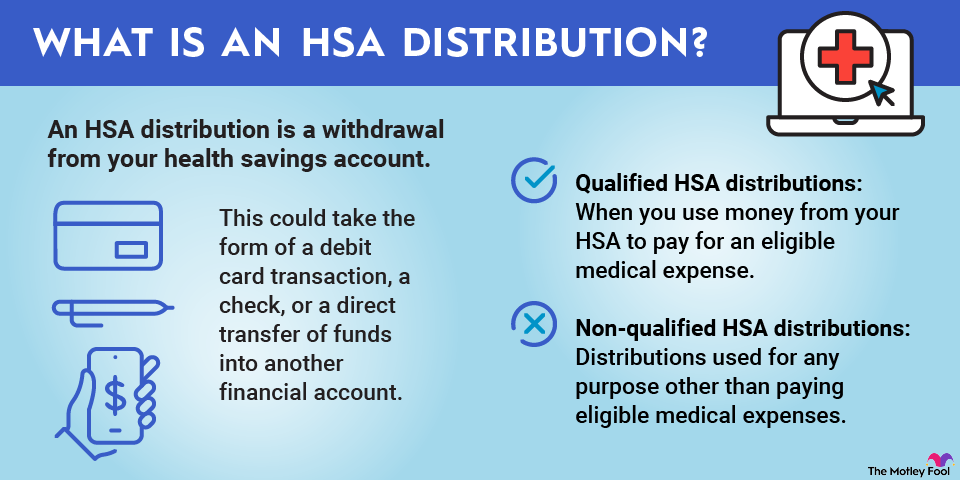

Withdrawal rules | You can access funds only after contributing.

Money can be withdrawn for any purpose, but withdrawals are subject to a 20% penalty plus income taxes if made for anything other than qualifying medical services.

After age 65, you can withdraw money for any purpose penalty-free but will be taxed at your ordinary income tax rate. | You have immediate access to the amount you elected to contribute to the FSA for the year, even if you haven't yet funded your account.

Money can be used only for qualifying medical expenses. |

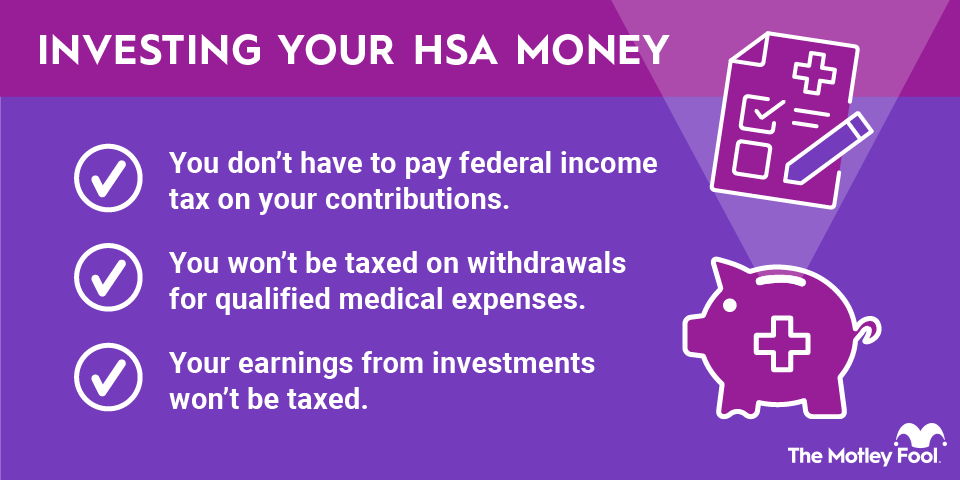

Investing rules | HSA money can be invested and grow tax-free. | FSA money cannot be invested. |

Carryover rules | Money in your HSA can remain invested and does not have to be used in the year the contributions were made. | Money may be lost if not used in the year the contributions are made.

Some plans allow you to carry over $660 in 2025 ($680 in 2026) if the money remains unused.

Some plans allow a 2 1/2-month grace period to use the money after the end of the year. |

Pros and Cons | HSA | FSA |

|---|---|---|

Pros | Contributions can be invested.

Account funds are not "use it or lose it" -- money remains in your account until you choose to withdraw it.

You have flexibility to decide how much to contribute during the course of the year.

Money can be withdrawn for any purpose without penalty after age 65. | You don't need a qualifying HDHP to contribute.

You can put away pre-tax money not just for healthcare but also for dependent care.

You'll get immediate access to the funds you elect to contribute for the year. |

Cons | You're eligible for an HSA only if you have a qualifying HDHP.

You can access funds only after they've been contributed. | If you don't use your FSA contribution within the year it is made (or within any applicable grace period), you could lose the contributed funds.

FSA money can be used only for medical expenses.

Money in an FSA cannot be invested. |